Lenovo 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CORPORATE GOVERNANCE

2008/09 Annual Report Lenovo Group Limited

44

Long-Term Incentive Program

The Company operates a Long-Term Incentive Program (“LTI Program”) which was approved by the Company on

May 26, 2005. The purpose of the LTI Program is to attract, retain, reward and motivate executive and non-executive

directors, senior management and selected top-performing employees of the Company and its subsidiaries.

Under the LTI Program, the Company maintains three types of equity-based compensation vehicles: (i) share

appreciation rights, (ii) restricted share units, and (iii) performance-based share units. These vehicles are described in

more detail below.

(i) Share Appreciation Rights (“SARs”)

SARs entitle the holder to receive the appreciation in value of the Company’s share price above a predetermined

level. SARs are typically subject to a vesting schedule of up to four years.

(ii) Restricted Share Units (“RSUs”)

RSUs are equivalent to the value of one ordinary share of the Company. Once vested, RSUs are converted to an

ordinary share, or its cash equivalent. RSUs are typically subject to a vesting schedule of up to four years. Dividends

are typically not paid on RSUs.

(iii) Performance Based Share Units

The Company has three performance based share unit plans, the 2005 Performance Share Unit (PSU) plan, the

2007 Performance RSU plan and the 2008 Performance RSU Plan. The 2005 PSU plan was discontinued in 2006

however, the Company continues to honor grants previously awarded. All outstanding awards vested completely

on May 1, 2008.

The Performance RSU plans have been discontinued; however, the Company continues to honor grants previously

awarded. All outstanding awards will vest completely by June 1, 2012.

The Company reserves the right, at its discretion, to pay any awards under the LTI Program in cash or ordinary shares.

The Company has created and funded a trust to pay shares to eligible recipients. In the case of SARs, awards are due

after exercise by the recipient. In the case of RSUs, awards are due after the employee satisfies any vesting conditions.

The number of units that are awarded under the plan is set and reviewed annually, reflecting competitive market

positioning, market practices, especially those among Lenovo’s competitors, as well as the Company’s performance

and an individual’s actual and expected contribution to the business. In certain circumstances, awards under the LTI

Program may be made to support the attraction of new hires. Award levels and mix may vary.

During the year, eligible executive directors and senior management received an annual award comprised of SARs and

RSUs.

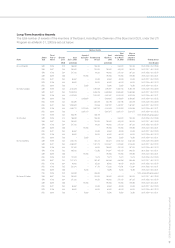

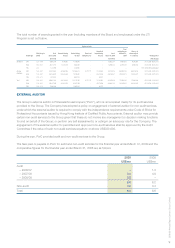

Awards outstanding for executive and non-executive directors as of March 31, 2009 under the LTI Program are

presented below.

Share Option Scheme

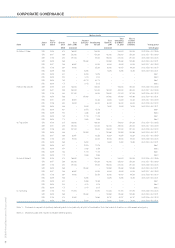

The Company operates two share option schemes, the “New Option Scheme” and the “Old Option Scheme”. Details

of the programs are set out in the Directors’ Report on pages 57 and 58. Options outstanding for executive and non-

executive directors as of March 31, 2009 under these schemes are presented in the Directors’ Report on page 59.

No options were granted under these schemes during the year.

Retirement Benefits

The Company operates a number of retirement schemes for its employees, including executive directors and senior

management. These schemes are reviewed regularly and intended to deliver benefit levels that are consistent with local

market practices. Details of the programs are set out in the Directors’ Report on pages 69 to 71.