Lenovo 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

82

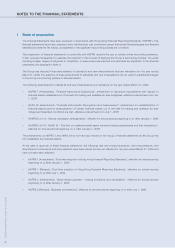

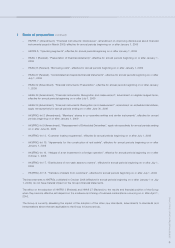

NOTES TO THE FINANCIAL STATEMENTS (Continued)

2 Significant accounting policies

The significant accounting policies adopted in the preparation of these financial statements are set out below:

(a) Basis of consolidation

(i) The consolidated financial statements include the financial statements of the Company and all of its subsidiaries

made up to March 31.

Subsidiaries are all entities (including special purpose entities) over which the Group has the power to govern the

financial and operating policies generally accompanying a shareholding of more than one half of the voting rights.

The existence and effect of potential voting rights that are currently exercisable or convertible are considered when

assessing whether the Group controls another entity.

Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are de-

consolidated from the date that control ceases.

The purchase method of accounting is used to account for the acquisition of subsidiaries by the Group. The cost of

an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities incurred or

assumed at the date of exchange, plus costs directly attributable to the acquisition. Identifiable assets acquired and

liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the

acquisition date, irrespective of the extent of any minority interest. The excess of the cost of acquisition over the

fair value of the Group’s share of the identifiable net assets acquired is recorded as goodwill (Note 2(f)(i)). If the cost

of acquisition is less than the fair value of the net assets of the subsidiary acquired, the difference is recognized

directly in the income statement.

(ii) Inter-company transactions, balances and unrealized gains on transactions between group companies are

eliminated. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of the

asset transferred.

(iii) In the Company’s balance sheet, the investments in subsidiaries are stated at cost less provision for impairment

losses. The results of subsidiaries are accounted for by the Company on the basis of dividends received and

receivable.

(b) Associated companies

(i) An associated company is an entity, not being a subsidiary or a joint venture, in which an equity interest is held for

the long-term and significant influence, but not control, is exercised in its management, generally accompanying a

shareholding of between 20% and 50% of the voting rights.

(ii) The results and assets and liabilities of associated companies are incorporated into the consolidated financial

statements using the equity method of accounting. Under the equity method, investments in associated companies

are carried in the consolidated balance sheet at cost as adjusted for post-acquisition changes in the Group’s

share of the profit or loss and of changes in equity of the associated companies, less any identified impairment

loss. When the Group’s share of losses in an associated company equals or exceeds its interest in the associated

company including any other unsecured receivables, the Group does not recognize further losses, unless it has

incurred obligations or made payments on behalf of the associated company.

(iii) Unrealized gains on transactions between the Group and its associated companies are eliminated to the extent of

the Group’s interest in the associated companies; unrealized losses are eliminated unless the transaction provides

evidence of an impairment of the assets transferred.