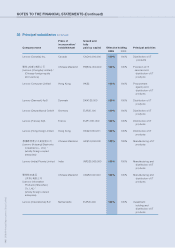

Lenovo 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

142

NOTES TO THE FINANCIAL STATEMENTS (Continued)

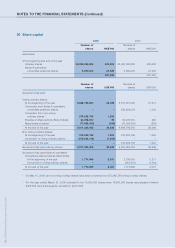

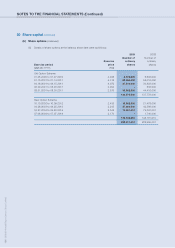

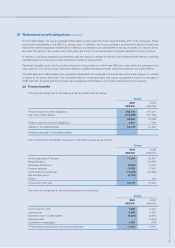

36 Notes to the consolidated cash flow statement

(a) Reconciliation of (loss)/profit before taxation to net cash generated from operations

2009 2008

US$’000 US$’000

(Loss)/profit before taxation (187,945) 512,850

Share of profits of associated companies (351) (124)

Finance income (59,977) (52,048)

Depreciation of property, plant and equipment

and amortization of prepaid lease payments 143,269 88,025

Amortization of intangible assets

and share-based compensation 137,843 180,641

(Gain)/loss on disposal of property,

plant and equipment (276) 8,299

Loss on disposal of intangible assets – 7,210

Impairment of assets – 2,530

Dividend income (1,053) –

Loss/(gain) on disposal of investments 124 (19,791)

Decrease/(increase) in inventories 26,028 (152,473)

Decrease/(increase) in trade receivables,

notes receivable, deposits, prepayments

and other receivables 616,431 (463,631)

(Decrease)/increase in trade payables,

notes payable, provisions, accruals

and other payables (692,274) 981,950

Finance costs 38,142 38,366

Net cash generated from operations 19,961 1,131,804

(b) Changes in bank borrowings

2009 2008

US$’000 US$’000

Proceeds from borrowings 297,061 932,355

Repayment of borrowings (172,568) (503,672)

124,493 428,683

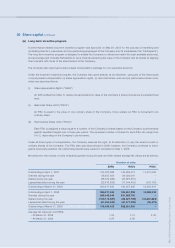

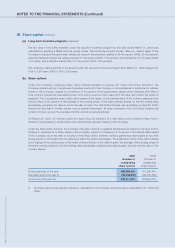

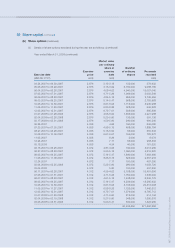

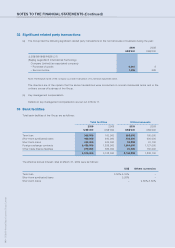

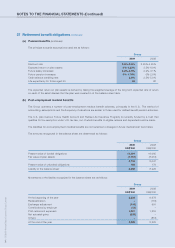

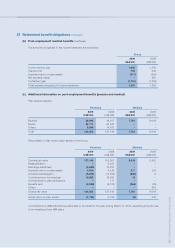

37 Retirement benefit obligations

Group

2009 2008

US$’000 US$’000

Pension obligation included in other non-current liabilities (Note 29)

Pension benefits 59,115 77,264

Post-employment medical benefits 8,885 8,226

68,000 85,490

Expensed in income statement

Pension benefits 11,032 6,931

Post-employment medical benefits 1,021 1,253

12,053 8,184

Net actuarial gains recognized in equity 7,025 –

On the acquisition of the personal computer business of IBM, the Group assumed a cash balance pension liability for

substantially all former IBM employees in Japan, and final salary defined benefit obligations for selected employees in other

countries.