Lenovo 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

101

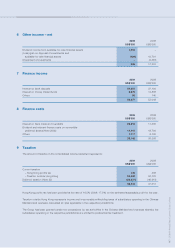

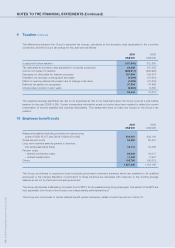

4 Critical accounting estimates and judgments (continued)

(b) Income taxes (continued)

Deferred tax assets are mainly recognized for temporary differences such as warranty provision, accrued sales rebates,

bonus accruals, and other accrued expenses, and unused tax losses carried forward to the extent it is probable that

future taxable profits will be available against which deductible temporary differences and the unused tax losses can

be utilized, based on all available evidence. Recognition primarily involves judgment regarding the future financial

performance of the particular legal entity or tax group in which the deferred tax asset has been recognized. A variety of

other factors are also evaluated in considering whether there is convincing evidence that it is probable that some portion

or all of the deferred tax assets will ultimately be realized, such as the existence of taxable temporary differences, group

relief, tax planning strategies and the periods in which estimated tax losses can be utilized. The carrying amount of

deferred tax assets and related financial models and budgets are reviewed at each balance sheet date and to the extent

that there is insufficient convincing evidence that sufficient taxable profits will be available within the utilization periods

to allow utilization of the carry forward tax losses, the asset balance will be reduced and the difference charged to the

income statement.

Where the final tax outcome of these matters is different from the amounts that were initially recorded, such differences

will impact the income tax and deferred tax provisions and deferred tax assets in the period in which such determination

is made.

(c) Warranty provision

Warranty provision is based on the estimated cost of product warranties when revenue is recognized. Factors that

affect the Group’s warranty liability include the number of sold units currently under warranty, historical and anticipated

rates of warranty claims on those units, and cost per claim to satisfy our warranty obligation. The estimation basis is

reviewed on an on-going basis and revised where appropriate. Certain of these costs are reimbursable from the suppliers

in accordance with the terms of relevant arrangement with the suppliers. These amounts are recognized as a separate

asset, to the extent of the amount of the provision made, when it is virtually certain that reimbursement will be received

if the Group settles the obligation.

(d) Future billing adjustments

Estimates that further impact revenue recognition relate primarily to allowance for future volume discounts and price

rebates, and customer sales returns. Both estimates are relatively predictable based on historical experience. The

primary factors affecting the Group’s accrual for estimated customer returns include estimated return rates as well as the

number of units shipped that still have a right of return as of the balance sheet date.

(e) Retirement benefits

Pension and other post-retirement benefit costs and obligations are dependent on various assumptions. The Group’s

major assumptions primarily relate to discount rate, expected return on assets, and salary growth. In determining the

discount rate, the Group references market yields at the balance sheet date on high quality corporate bonds. The

currency and term of the bonds are consistent with the currency and estimated term of the benefit obligations being

valued. The expected return on plan assets is based on market expectations for returns over the life of the related assets

and obligations. The salary growth assumptions reflect the Group’s long-term actual experience and future and near-

term outlook. Actual results that differ from the assumptions are generally recognized in the year they occur.

(f) Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives)

is determined by using valuation techniques. The Group uses its judgment to select a variety of methods and make

assumptions that are mainly based on market conditions existing at each balance sheet date. The Group has used

discounted cash flow analysis for various available-for-sale financial assets that are not traded in active markets.