Lenovo 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

86

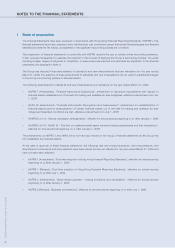

NOTES TO THE FINANCIAL STATEMENTS (Continued)

2 Significant accounting policies (continued)

(h) Financial assets

The Group classifies its financial assets in the following categories: at fair value through profit or loss, loans and

receivables, and available-for-sale. The classification depends on the purpose for which the financial assets were

acquired. Management determines the classification of its financial assets at initial recognition and evaluates this

designation at every reporting date.

(i) Financial assets at fair value through profit or loss

This category has two sub-categories: financial assets held for trading, and those designated at fair value through

profit or loss at inception. A financial asset is classified in this category if acquired principally for the purpose of

selling in the short term or if so designated by management. Derivatives are also categorized as held for trading

unless they are designated as hedges. Assets in this category are classified as current assets if they are either held

for trading or are expected to be realized within 12 months of the balance sheet date.

(ii) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted

in an active market. They arise when the Group provides money, goods or services directly to a debtor with no

intention of trading the receivable. They are included in current assets, except for maturities greater than 12 months

after the balance sheet date. These are classified as non-current assets. Loans and receivables comprise trade and

other receivables in the balance sheet (Note 2(k)).

(iii) Available-for-sale financial assets

Available-for-sale financial assets are non-derivatives that are either designated in this category or not classified in

any of the other categories. They are included in non-current assets unless management intends to dispose of the

asset within 12 months of the balance sheet date.

Regular purchases and sales of financial assets are recognized on trade-date, the date on which the Group commits to

purchase or sell the asset. Investments are initially recognized at fair value plus transaction costs for all financial assets

not carried at fair value through profit or loss. Financial assets carried at fair value through profit or loss are initially

recognized at fair value and transaction costs are expensed in the income statement. Financial assets are derecognized

when the rights to receive cash flows from the investments have expired or have been transferred and the Group has

transferred substantially all risks and rewards of ownership. Available-for-sale financial assets and financial assets at fair

value through profit or loss are subsequently carried at fair value. Loans and receivables are carried at amortized cost

using the effective interest method.

Realized and unrealized gains and losses arising from changes in the fair value of the “financial assets at fair value

through profit or loss” category are presented in the income statement in the period in which they arise. Dividend income

from financial assets at fair value through profit or loss is recognized in the income statement as part of other income

when the Group’s right to receive payments is established.