Lenovo 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTORS’ REPORT (Continued)

2008/09 Annual Report Lenovo Group Limited

66

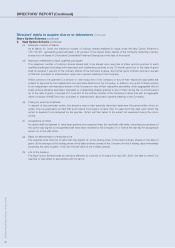

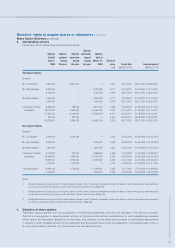

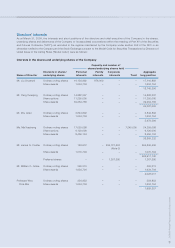

Directors’ interests (continued)

Interests in the shares and underlying shares of the Company (continued)

Capacity and number of

shares/underlying shares held

Interests in shares/ Personal Family Corporate Aggregate

Name of Director underlying shares interests interests interests Trust long position

Mr. Ting Lee Sen Ordinary voting shares 354,800 – – – 354,800

Share awards 1,634,704 – – – 1,634,704

1,989,504

Mr. John W. Barter III Ordinary voting shares 309,708 – – – 309,708

Share awards 1,634,704 – – – 1,634,704

1,944,412

Dr. Tian Suning Ordinary voting shares 17,085 – – – 17,085

Share awards 460,087 – – – 460,087

477,172

Notes:

1. Share options represent underlying shares convertible into ordinary voting shares. Particulars of directors’ interests in the share options of the

Company are set out under the section “Share Option Schemes”.

2. Share awards represent underlying shares convertible into ordinary voting shares. Details of share awards are set out under the section

“Compensation Policy” in Corporate Governance section.

3. Mr. James G. Coulter has a deemed corporate interest in these underlying shares derived from the preferred shares and warrants convertible

into ordinary voting shares by virtue of his shareholding in TPG Advisors IV, Inc., Tarrant Capital Advisors, Inc., TPG Advisors III, Inc. and T3

Advisors II, Inc..

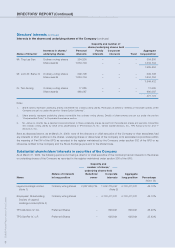

Save as disclosed above, as at March 31, 2009, none of the directors or chief executive of the Company or their associates had

any interests or short positions in the shares, underlying shares or debentures of the Company or its associated corporations (within

the meaning of Part XV of the SFO) as recorded in the register maintained by the Company under section 352 of the SFO or as

otherwise notified to the Company and the Stock Exchange pursuant to the Model Code.

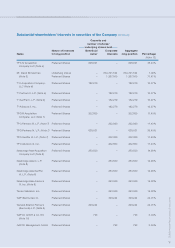

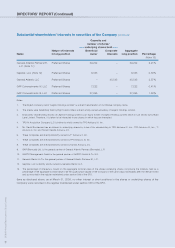

Substantial shareholders’ interests in securities of the Company

As at March 31, 2009, the following persons (not being a director or chief executive of the Company) had an interests in the shares

or underlying shares of the Company as recorded in the register maintained under section 336 of the SFO:

Capacity and

number of shares/

underlying shares held

Nature of interests Beneficial Corporate Aggregate

Name in long position owner interests long position Percentage

(Note 13)

Legend Holdings Limited Ordinary voting shares 2,667,636,724 1,502,775,247 4,170,411,971 45.13%

(Note 1) (Note 2)

Employees’ Shareholding Ordinary voting shares – 4,170,411,971 4,170,411,971 45.13%

Society of Legend

Holdings Limited (Note 3)

TPG Advisors IV, Inc. Preferred Shares – 628,921 628,921 35.43%

TPG GenPar IV, L.P. Preferred Shares – 628,921 628,921 35.43%