Comcast 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

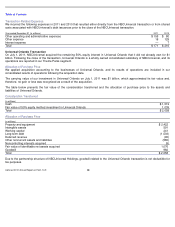

SpectrumCo

SpectrumCo, LLC (“SpectrumCo”)

is a joint venture in which we, along with Time Warner Cable and Bright House Networks, are

partners. We account for this joint venture as an equity method investment based on its governance structure, notwithstanding our

majority interest. SpectrumCo was the successful bidder for 137 advanced wireless services (“AWS”)

spectrum licenses for $2.4

billion in the FCC’

s AWS spectrum auction that concluded in September 2006. Our portion of the total cost to purchase the licenses

was $1.3 billion.

In August 2012, SpectrumCo closed its agreement to sell its AWS spectrum licenses to Verizon Wireless for $3.6 billion. Our portion

of SpectrumCo’

s gain on sale of its AWS spectrum licenses was $876 million, which is included in equity in net income (losses) of

investees, net in our consolidated statement of income in 2012. Following the close of the transaction, SpectrumCo distributed to us

$2.3 billion, which represents our portion of the sale proceeds. These proceeds are reflected as a return of capital from investees in

our consolidated statement of cash flows.

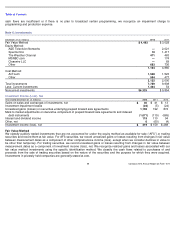

MSNBC.com

In July 2012, NBCUniversal acquired the remaining 50% equity interest in MSNBC Interactive News, LLC and other related entities

(“MSNBC.com”)

that it did not already own. The total purchase price was $195 million, which was net of $100 million of cash and

cash equivalents held at MSNBC.com that were acquired in the transaction, which were not previously attributable to NBCUniversal.

Following the close of the transaction, MSNBC.com is a wholly owned consolidated subsidiary of NBCUniversal.

Cost Method

We use the cost method to account for investments not accounted for under the fair value method and in which we do not have the

ability to exercise significant influence over the investee’s operating and financial policies.

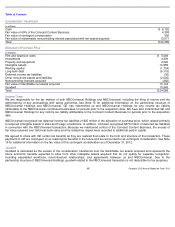

AirTouch Communications, Inc.

We hold two series of preferred stock of AirTouch Communications, Inc. (“AirTouch”),

a subsidiary of Vodafone, which are

redeemable in April 2020. As of both December 31, 2012 and 2011, the estimated fair value of the AirTouch preferred stock was

$1.8 billion.

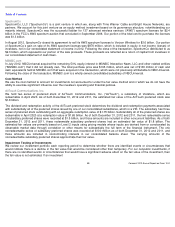

The dividend and redemption activity of the AirTouch preferred stock determines the dividend and redemption payments associated

with substantially all of the preferred shares issued by one of our consolidated subsidiaries, which is a VIE. The subsidiary has three

series of preferred stock outstanding with an aggregate redemption value of $1.75 billion. Substantially all of the preferred shares are

redeemable in April 2020 at a redemption value of $1.65 billion. As of both December 31, 2012 and 2011, the two redeemable series

of subsidiary preferred shares were recorded at $1.5 billion, and those amounts are included in other noncurrent liabilities. As of both

December 31, 2012 and 2011, these redeemable subsidiary preferred shares had an estimated fair value of $1.8 billion. The

estimated fair values are primarily based on Level 2 inputs using pricing models whose inputs are derived from or corroborated by

observable market data through correlation or other means for substantially the full term of the financial instrument. The one

nonredeemable series of subsidiary preferred shares was recorded at $100 million as of both December 31, 2012 and 2011, and

those amounts are included in noncontrolling interests in our consolidated balance sheet. The carrying amounts of the

nonredeemable subsidiary preferred shares approximate their fair value.

Impairment Testing of Investments

We review our investment portfolio each reporting period to determine whether there are identified events or circumstances that

would indicate there is a decline in the fair value that would be considered other than temporary. For our nonpublic investments, if

there are no identified events or circumstances that would have a significant adverse effect on the fair value of the investment, then

the fair value is not estimated. If an investment

93

Comcast 2012 Annual Report on Form 10-

K