Comcast 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

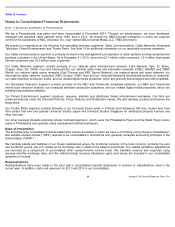

We use the notional amount of each instrument to calculate the interest to be paid or received. The notional amounts do not

represent our exposure to credit loss. The estimated fair value approximates the amount of payments to be made or proceeds to be

received to settle the outstanding contracts, including accrued interest. We estimate interest rates on variable rate debt and swaps

using the average implied forward LIBOR through the year of maturity based on the yield curve in effect on December 31, 2012, plus

the applicable borrowing margin on December 31, 2012.

Certain of our financial contracts include credit-ratings-

based triggers that could affect our liquidity. In the ordinary course of

business, some of our swaps could be subject to termination provisions if we do not maintain investment grade credit ratings. As of

December 31, 2012 and 2011, the estimated fair value of those swaps was an asset of $13 million and $19 million, respectively. The

amount to be paid or received upon termination, if any, would be based on the fair value of the outstanding contracts at that

time. See Note 2 to our consolidated financial statements for additional information on our accounting policies for derivative financial

instruments.

Foreign Exchange Risk Management

NBCUniversal has significant operations in a number of countries outside the United States, and certain of NBCUniversal’

s

operations are conducted in foreign currencies. The value of these currencies fluctuates relative to the U.S. dollar. These changes

could adversely affect the U.S. dollar value of our non-

U.S. revenue and operating costs and expenses and reduce international

demand for our content, all of which could negatively affect our business, financial condition and results of operations in a given

period or in specific territories.

As part of our overall strategy to manage the level of exposure to the risk of foreign exchange rate fluctuations, we enter into

derivative financial instruments related to a significant portion of our foreign currency exposures. We enter into foreign currency

forward contracts that change in value as foreign exchange rates change to protect the U.S. dollar equivalent value of our foreign

currency assets, liabilities, commitments, and forecasted foreign currency revenue and expenses. In accordance with our policy, we

hedge forecasted foreign currency transactions for periods generally not to exceed one year. In certain circumstances we enter into

foreign exchange contracts with initial maturities in excess of one year. As of December 31, 2012 and 2011, we had foreign

exchange contracts with a total notional value of $820 million and $767 million, respectively. As of December 31, 2012 and 2011, the

aggregate estimated fair value of these foreign exchange contracts was not material.

We have analyzed our foreign currency exposures related to NBCUniversal’

s operations as of December 31, 2012, including our

hedging contracts, to identify assets and liabilities denominated in a currency other than their relevant functional currency. For these

assets and liabilities, we then evaluated the effect of a 10% shift in currency exchange rates between those currencies and the U.S.

dollar. The analysis of such shift in exchange rates indicated that there would be an immaterial effect on our 2012 income.

We are also exposed to the market risks associated with fluctuations in foreign exchange rates as they relate to our foreign currency

denominated debt obligations. Cross-currency swaps are used to effectively convert fixed-

rate foreign currency denominated debt to

fixed-

rate U.S. dollar denominated debt, in order to hedge the risk that the cash flows related to annual interest payments and the

payment of principal at maturity may be adversely affected by fluctuations in currency exchange rates. The gains and losses on the

cross-

currency swaps offset changes in the U.S. dollar equivalent value of the related exposures. As of December 31, 2012 and

2011, the fair value of our cross-currency swaps on our £

625 million principal amount of 5.50% senior notes due 2029 was an asset

of $30 million and a liability of $69 million, respectively.

71

Comcast 2012 Annual Report on Form 10-

K