Comcast 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301

|

|

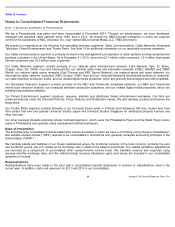

Table of Contents

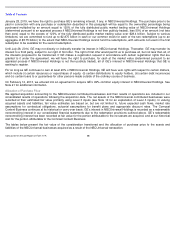

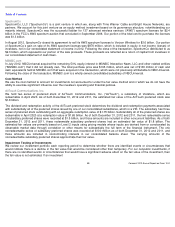

January 28, 2019, we have the right to purchase GE’

s remaining interest, if any, in NBCUniversal Holdings. The purchase price to be

paid in connection with any purchase or redemption described in this paragraph will be equal to the ownership percentage being

purchased multiplied by an amount equal to 120% of the fully distributed public market trading value of NBCUniversal Holdings

(determined pursuant to an appraisal process if NBCUniversal Holdings is not then publicly traded), less 50% of an amount (not less

than zero) equal to the excess of 120% of the fully distributed public market trading value over $28.4 billion. Subject to various

limitations, we are committed to fund up to $2.875 billion in cash or our common stock for each of the two redemptions (up to an

aggregate of $5.75 billion) to the extent that NBCUniversal Holdings cannot fund the redemptions, with amounts not used in the first

redemption to be available for the second redemption.

Until July 28, 2014, GE may not directly or indirectly transfer its interest in NBCUniversal Holdings. Thereafter, GE may transfer its

interest to a third party, subject to our right of first offer. The right of first offer would permit us to purchase all, but not less than all, of

the interests proposed to be transferred. If GE makes a registration request in accordance with certain registration rights that are

granted to it under the agreement, we will have the right to purchase, for cash at the market value (determined pursuant to an

appraisal process if NBCUniversal Holdings is not then publicly traded), all of GE’

s interest in NBCUniversal Holdings that GE is

seeking to register.

For so long as GE continues to own at least 20% of NBCUniversal Holdings, GE will have veto rights with respect to certain matters,

which include (i) certain issuances or repurchases of equity, (ii) certain distributions to equity holders, (iii) certain debt incurrences

and (iv) certain loans to or guarantees for other persons made outside of the ordinary course of business.

On February 12, 2013, we entered into an agreement to acquire GE’

s 49% common equity interest in NBCUniversal Holdings. See

Note 21 for additional information.

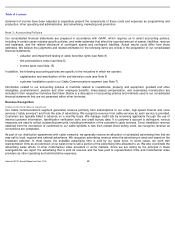

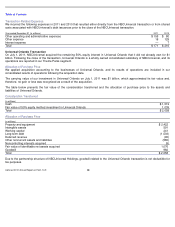

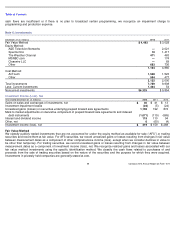

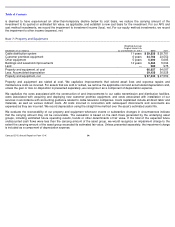

Allocation of Purchase Price

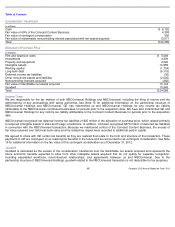

We applied acquisition accounting to the NBCUniversal contributed businesses and their results of operations are included in our

consolidated results of operations following the acquisition date. The net assets of the NBCUniversal contributed businesses were

recorded at their estimated fair value primarily using Level 3 inputs (see Note 10 for an explanation of Level 3 inputs). In valuing

acquired assets and liabilities, fair value estimates are based on, but are not limited to, future expected cash flows, market rate

assumptions for contractual obligations, actuarial assumptions for benefit plans and appropriate discount rates. The Comcast

Content Business continues at its historical or carry-over basis. GE’

s interest in NBCUniversal Holdings is recorded as a redeemable

noncontrolling interest in our consolidated financial statements due to the redemption provisions outlined above. GE’

s redeemable

noncontrolling interest has been recorded at fair value for the portion attributable to the net assets we acquired, and at our historical

cost for the portion attributable to the Comcast Content Business.

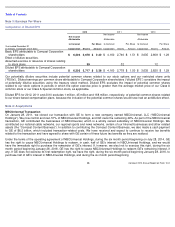

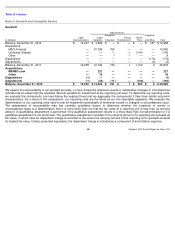

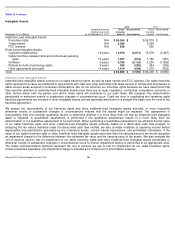

The tables below present the fair value of the consideration transferred and the allocation of purchase price to the assets and

liabilities of the NBCUniversal businesses acquired as a result of the NBCUniversal transaction.

Comcast 2012 Annual Report on Form 10-K

86