Comcast 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

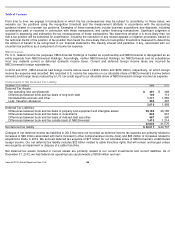

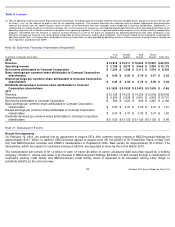

ous state net operating loss carryforwards that expire in periods through 2032. As of December 31, 2012, we also had foreign net

operating loss carryforwards of $311 million that are related to the foreign operations of NBCUniversal, the majority of which expire in

periods through 2021. The determination of the realization of the state and foreign net operating loss carryforwards is dependent on

our subsidiaries’

taxable income or loss, apportionment percentages, and state and foreign laws that can change from year to year

and impact the amount of such carryforwards. We recognize a valuation allowance if we determine it is more likely than not that

some portion, or all, of a deferred tax asset will not be realized. As of December 31, 2012 and 2011, our valuation allowance was

related primarily to state and foreign net operating loss carryforwards. In 2012, 2011 and 2010, income tax expense attributable to

share-based compensation of $164 million, $38 million and $3 million, respectively, was allocated to shareholders’ equity.

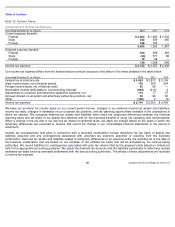

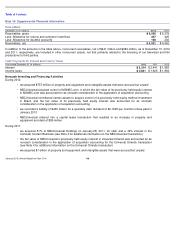

Uncertain Tax Positions

Our uncertain tax positions as of December 31, 2012 totaled $1.6 billion, which excludes the federal benefits on state tax positions

that were recorded as deferred income taxes, including $32 million related to tax positions of NBCUniversal for which we have been

indemnified by GE. If we were to recognize the tax benefit for our uncertain tax positions in the future, $1.2 billion would impact our

effective tax rate and the remaining amount would increase our deferred income tax liability. The amount and timing of the

recognition of any such tax benefit is dependent on the completion of our tax examinations and the expiration of statutes of limitation.

A majority of the amount of our uncertain tax positions relates to positions taken in years before 2007.

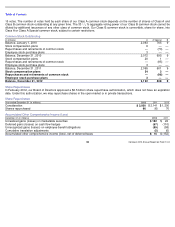

Reconciliation of Unrecognized Tax Benefits

As of December 31, 2012 and 2011, our accrued interest associated with tax positions was $721 million and $698 million,

respectively. As of December 31, 2012 and 2011, $11 million and $10 million, respectively, of these amounts were related to tax

positions of NBCUniversal for which we have been indemnified by GE.

The IRS is examining our 2009 through 2012 tax returns. The IRS completed its examination of our income tax returns for the years

2000 through 2008 and proposed adjustments that relate primarily to certain financing transactions, which we disputed. We

effectively settled the dispute related to these transactions in February 2013. This settlement will not have a material impact on our

effective tax rate.

Various states are examining our tax returns through 2010. The tax years of our state tax returns currently under examination vary

by state. The majority of the periods under examination relate to tax years 2000 and forward, with a select few dating back to 1993.

It is reasonably possible that certain statutes of limitation for the years 2000-

2006 will expire within the next 12 months that could

result in a decrease to our uncertain tax positions related to those periods.

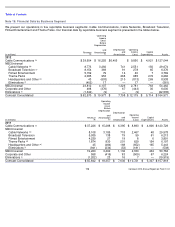

(in millions)

2012

2011

2010

Balance, January 1

$

1,435

$

1,251

$

1,185

Additions based on tax positions related to the current year

154

87

69

Additions based on tax positions related to the prior years

79

75

59

Additions from acquired subsidiaries

—

57

—

Reductions for tax positions of prior years

(60

)

(22

)

(28

)

Reductions due to expiration of statute of limitations

(3

)

(5

)

(24

)

Settlements with taxing authorities

(32

)

(8

)

(10

)

Balance, December 31

$

1,573

$

1,435

$

1,251

109

Comcast 2012 Annual Report on Form 10-

K