Comcast 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

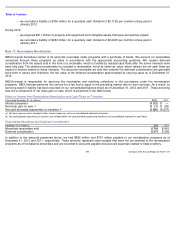

action. We are not the primary beneficiary of, and accordingly do not consolidate, Station Venture. The carrying value of our equity

method investment in Station Venture was zero as of December 31, 2012. Because the assets of Station LP serve as collateral for

Station Venture’

s $816 million senior secured note, we recorded a liability in other noncurrent liabilities in our allocation of purchase

price in the NBCUniversal transaction, which represented the fair value of the net assets that collateralize the note. As of

December 31, 2012, the liability recorded on our consolidated balance sheet was $482 million. In February 2013, we closed our

agreement with GE, GECC and LIN TV under which NBCUniversal purchased the Station Venture senior secured note from GECC

for $602 million, representing the agreed upon fair value of the assets of Station LP. As of the closing date of the transaction, the

$482 million liability was effectively settled, Station Venture and Station LP became wholly owned subsidiaries of NBCUniversal, we

now consolidate Station Venture and the Station Venture senior secured note was eliminated in consolidation. Due to the related

party nature of this transaction, the excess of the purchase price of the note over the recorded amount of the liability is treated as a

capital transaction.

Contingencies

Antitrust Cases

We are defendants in two purported class actions originally filed in December 2003 in the United States District Courts for the District

of Massachusetts and the Eastern District of Pennsylvania. The potential class in the Massachusetts case, which has been

transferred to the Eastern District of Pennsylvania, is our customer base in the “Boston Cluster”

area, and the potential class in the

Pennsylvania case is our customer base in the “Philadelphia and Chicago Clusters,”

as those terms are defined in the complaints. In

each case, the plaintiffs allege that certain customer exchange transactions with other cable providers resulted in unlawful horizontal

market restraints in those areas and seek damages under antitrust statutes, including treble damages.

Classes of Chicago Cluster and Philadelphia Cluster customers were certified in October 2007 and January 2010, respectively. We

appealed the class certification in the Philadelphia Cluster case to the Third Circuit Court of Appeals, which affirmed the class

certification in August 2011 and denied our petition for a rehearing en banc in September 2011. In March 2010, we moved for

summary judgment dismissing all of the plaintiffs’

claims in the Philadelphia Cluster. In April 2012, the District Court issued a

decision dismissing some of the plaintiffs’ claims, but allowing two claims to proceed to trial. The plaintiffs’

claims concerning the

other two clusters are stayed pending determination of the Philadelphia Cluster claims. In June 2012, the U.S. Supreme Court

granted our petition to review the Third Circuit Court of Appeals’

ruling, and oral arguments were held in November 2012. In

September 2012, the trial court stayed all trial and pretrial proceedings pending resolution of the Supreme Court appeal.

We also are among the defendants in a purported class action filed in the United States District Court for the Central District of

California in September 2007. The potential class is comprised of all persons residing in the United States who have subscribed to

an expanded basic level of video service provided by one of the defendants. The plaintiffs allege that the defendants who produce

video programming have entered into agreements with the defendants who distribute video programming via cable and satellite

(including us), which preclude the distributor defendants from reselling channels to customers on an “unbundled”

basis in violation of

federal antitrust laws. The plaintiffs seek treble damages and injunctive relief requiring each distributor defendant to resell certain

channels to its customers on an “unbundled”

basis. In October 2009, the Central District of California issued an order dismissing the

plaintiffs’ complaint with prejudice. In March 2012, a panel of the Ninth Circuit Court of Appeals affirmed the District Court’

s order. In

April 2012, the plaintiffs filed a petition for a rehearing, which the Ninth Circuit denied in May 2012. In August 2012, the plaintiffs filed

a petition for writ of certiorari with the U.S. Supreme Court, which was denied in November 2012.

113

Comcast 2012 Annual Report on Form 10

-

K