Comcast 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

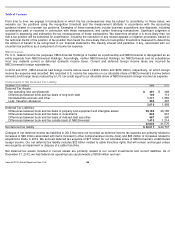

From time to time, we engage in transactions in which the tax consequences may be subject to uncertainty. In these cases, we

evaluate our tax positions using the recognition threshold and the measurement attribute in accordance with the accounting

guidance related to uncertain tax positions. Examples of these transactions include business acquisitions and disposals, including

consideration paid or received in connection with these transactions, and certain financing transactions. Significant judgment is

required in assessing and estimating the tax consequences of these transactions. We determine whether it is more likely than not

that a tax position will be sustained on examination, including the resolution of any related appeals or litigation processes, based on

the technical merits of the position. A tax position that meets the more-likely-than-

not recognition threshold is measured to determine

the amount of benefit to be recognized in our financial statements. We classify interest and penalties, if any, associated with our

uncertain tax positions as a component of income tax expense.

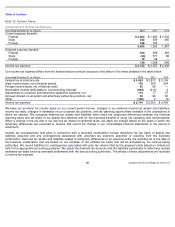

NBCUniversal

For U.S. federal income tax purposes, NBCUniversal Holdings is treated as a partnership and NBCUniversal is disregarded as an

entity separate from NBCUniversal Holdings. Accordingly, neither NBCUniversal Holdings nor NBCUniversal and its subsidiaries

incur any material current or deferred domestic income taxes. Current and deferred foreign income taxes are incurred by

NBCUniversal’s foreign subsidiaries.

In 2012 and 2011, NBCUniversal had foreign income before taxes of $434 million and $476 million, respectively, on which foreign

income tax expense was recorded. We recorded U.S. income tax expense on our allocable share of NBCUniversal’

s income before

domestic and foreign taxes reduced by a U.S. tax credit equal to our allocable share of NBCUniversal’s foreign income tax expense.

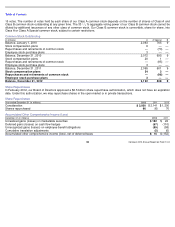

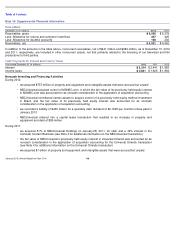

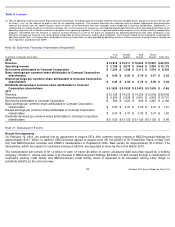

Components of Net Deferred Tax Liability

Changes in net deferred income tax liabilities in 2012 that were not recorded as deferred income tax expense are primarily related to

increases of $99 million associated with items included in other comprehensive income (loss) and $66 million of increases related to

acquisitions made in 2012. We accrued deferred tax expense of $77 million for our allocable share of NBCUniversal’

s undistributed

foreign income. Our net deferred tax liability includes $23 billion related to cable franchise rights that will remain unchanged unless

we recognize an impairment or dispose of a cable franchise.

Net deferred tax assets included in current assets are primarily related to our current investments and current liabilities. As of

December 31, 2012, we had federal net operating loss carryforwards of $158 million and vari-

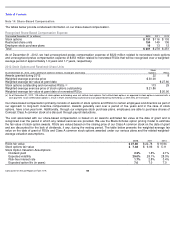

December 31 (in millions)

2012

2011

Deferred Tax Assets:

Net operating loss carryforwards

$

491

$

468

Differences between book and tax basis of long

-

term debt

109

114

Nondeductible accruals and other

1,771

1,583

Less: Valuation allowance

355

297

2,016

1,868

Deferred Tax Liabilities:

Differences between book and tax basis of property and equipment and intangible assets

29,185

29,185

Differences between book and tax basis of investments

848

616

Differences between book and tax basis of indexed debt securities

587

560

Differences between book and tax outside basis of NBCUniversal

1,413

1,214

32,033

31,575

Net deferred tax liability

$

30,017

$

29,707

Comcast 2012 Annual Report on Form 10

-

K

108