Comcast 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

stantial portion of our cash flows to meet our debt repayment obligations, to fund our capital expenditures, to invest in business

opportunities, to return capital to shareholders and to fund the acquisition of GE’s 49% common equity interest in NBCUniversal.

As of December 31, 2012, we held $11 billion of cash and cash equivalents, of which $5.9 billion was attributable to NBCUniversal.

We also maintain significant availability under our lines of credit and our commercial paper programs to meet our short-

term liquidity

requirements. In June 2012, Comcast and Comcast Cable Communications, LLC entered into a new $6.25 billion revolving credit

facility due June 2017 with a syndicate of banks, which may be used for general corporate purposes. The new credit facility replaced

our prior $6.8 billion credit facility that was terminated in connection with the execution of the new credit facility. The interest rate on

the new credit facility consists of a base rate plus a borrowing margin that is determined based on Comcast’

s credit rating. As of

December 31, 2012, the borrowing margin for borrowings based on the London Interbank Offered Rate (“LIBOR”)

was 1.125%. The

terms of the new credit facility’

s financial covenants and guarantees are substantially the same as those under the prior credit facility.

As of December 31, 2012, amounts available under the new credit facility and NBCUniversal

’

s credit facility, net of amounts

outstanding under our commercial paper programs and undrawn letters of credit, was $5.8 billion and $1.4 billion, respectively.

We and our Cable Communications subsidiaries that have provided guarantees are subject to the covenants and restrictions set

forth in the indentures governing Comcast’s public debt securities and in the credit agreements governing Comcast’

s and Comcast

Cable Communications’

credit facilities (see Note 22 to our consolidated financial statements). NBCUniversal is subject to the

covenants and restrictions set forth in the indentures governing its public debt securities and in the credit agreement governing its

credit facility. We test for compliance with the covenants for each of our credit facilities on an ongoing basis. The only financial

covenant in each of our credit facilities pertains to leverage, which is the ratio of debt to operating income before depreciation and

amortization. As of December 31, 2012, we and NBCUniversal each met this financial covenant by a significant margin. Neither we

nor NBCUniversal expect to have to reduce debt or improve operating results in order to continue to comply with this financial

covenant.

Receivables Monetization

NBCUniversal monetizes certain of its accounts receivable under programs with a syndicate of banks. The effects of NBCUniversal’

s

monetization transactions are a component of net cash provided by operating activities in our consolidated statement of cash flows.

See Note 17 to our consolidated financial statements for additional information.

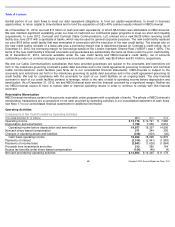

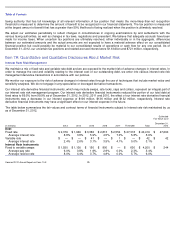

Operating Activities

Components of Net Cash Provided by Operating Activities

Year ended December 31 (in millions)

2012

2011

2010

Operating income

$

12,179

$

10,721

$

7,980

Depreciation and amortization

7,798

7,636

6,616

Operating income before depreciation and amortization

19,977

18,357

14,596

Noncash share-based compensation

371

344

300

Changes in operating assets and liabilities

(418

)

(603

)

(20

)

Cash basis operating income

19,930

18,098

14,876

Payments of interest

(2,314

)

(2,441

)

(1,983

)

Payments of income taxes

(2,841

)

(1,626

)

(1,864

)

Proceeds from investments and other

213

360

154

Excess tax benefits under share

-

based compensation

(134

)

(46

)

(4

)

Net cash provided by operating activities

$

14,854

$

14,345

$

11,179

63

Comcast 2012 Annual Report on Form 10-

K