Comcast 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

All of our postretirement benefit plans are unfunded and substantially all of our postretirement benefit obligations are recorded to

noncurrent liabilities. The expense we recognize related to our postretirement benefit plans is determined using certain assumptions,

including the discount rate.

Pension Plans

We and NBCUniversal sponsor various defined benefit plans for which future benefits have been frozen. The expense we recognize

related to our defined benefit plans is determined using certain assumptions, including the discount rate and the expected long-

term

rate of return on plan assets. We cease to recognize service costs associated with our defined benefit plans following the date on

which future benefits are frozen. We recognize the funded or unfunded status of our defined benefit plans as an asset or liability in

our consolidated balance sheet and recognize changes in the funded status in the year in which the changes occur through

accumulated other comprehensive income (loss). In the event of a defined benefit plan termination, we expect to fully fund and settle

the plan within 180 days of approval by the Internal Revenue Service (“IRS”)

and the Pension Benefit Guaranty Corporation

(“PBGC”).

NBCUniversal has a qualified and a nonqualified defined benefit plan that each provide a lifetime income benefit based on an

individual’

s length of service and related compensation. In October 2012, NBCUniversal provided notice to its plan participants of an

amendment to both the qualified and nonqualified NBCUniversal defined benefit plans that froze future benefits effective

December 31, 2012. In 2012, NBCUniversal has funded its qualified plan with sufficient contributions to meet its funding

requirements through 2013. The nonqualified NBCUniversal plan is unfunded. NBCUniversal is also obligated to reimburse GE for

future benefit payments to those participants who were vested in the supplemental pension plan sponsored by GE at the time of the

close of the NBCUniversal transaction.

We also sponsor a qualified pension plan and a nonqualified pension plan that together provide benefits to former AT&T Broadband

employees. On December 30, 2011 we provided notice to plan participants of our intent to terminate the qualified pension plan

effective February 29, 2012. On August 27, 2012, we filed a Standard Termination Notice with the PBGC and on October 26, 2012

the related PBGC review concluded with no objections. We expect to receive approval from the IRS and subsequently fully fund and

settle the plan in 2013. We currently anticipate the contributions required from us to fully fund and settle the plan will be less than

$100 million.

Other Employee Benefits

Deferred Compensation Plans

We maintain unfunded, nonqualified deferred compensation plans for certain members of management and nonemployee directors

(each, a “participant”).

The amount of compensation deferred by each participant is based on participant elections. Participant

accounts, except for those in the NBCUniversal plan, are credited with income primarily based on a fixed annual rate. Participants in

the NBCUniversal plan designate one or more valuation funds, independently established funds or indices that are used to determine

the amount of earnings to be credited or debited to the participant’

s account. Participants are eligible to receive distributions of the

amounts credited to their account based on elected deferral periods that are consistent with the plans and applicable tax law.

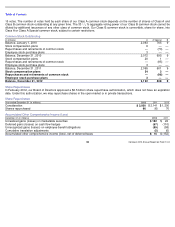

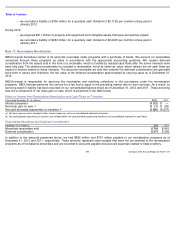

The table below presents the benefit obligation and expenses for our deferred compensation plans.

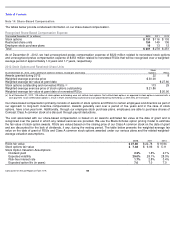

Year ended December 31 (in millions)

2012

2011

2010

Benefit obligation

$

1,247

$

1,059

$

935

Interest expense

$

107

$

99

$

88

103

Comcast 2012 Annual Report on Form 10-

K