Chrysler 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356

|

|

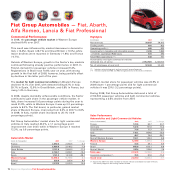

Report on Operations Fiat Group Automobiles 71

In Western Europe, deliveries for Fiat Group Automobiles fell

8.8% to 1,237,900 units. In Italy, deliveries for the Sector

declined 16%, whereas there were significant increases in

France (+30.7%) and Germany (+14.4%), with performance

being counter to the trend in demand. In Spain (-38.7%) and

Great Britain (-8.1%), the Sector posted marked declines in line

with the downward trends in those markets.

In Poland, volumes increased 6.5% over 2007.

Despite the general contraction in volumes, the Sector’s

products performed well: the Lancia Delta and Alfa MiTo, new

models introduced during the year, achieved increasing

success; the Panda and 500 continued to hold the top two

positions in the A segment and the Punto was one of the most

sold models in Western Europe.

Outside of the European Union, Fiat Group Automobiles

strengthened its presence in well-established markets, such as

Brazil, Argentina and Turkey, while also pursuing development

opportunities in other emerging markets in collaboration with

strong local partners.

In Brazil, where the Sector delivered a total of 665,600

automobiles and light commercial vehicles, sales increased

8.6% for the year, confirming the Sector’s leading position in

this market.

Economic recovery continued in Argentina, where the

passenger vehicle market rose 6.6% over 2007, and Fiat Group

Automobiles achieved an 11.9% market share (up 0.8

percentage points). Deliveries of automobiles and light

commercial vehicles increased 15.9% to 65,600 units.

In Turkey, the automobile industry experienced declines in line

with the overall economic trend. In 2008, the market for

automobiles and light commercial vehicles was down 16.9%

over 2007 to 494,000 units. Tofas (a local joint venture in which

Fiat Group Automobiles holds a 37.9% interest) saw a 21%

decline in sales with its market share slipping to 12.4%, down

0.7 percentage points year on year.

Light commercial vehicles performed positively in 2008,

reflecting, in part, the contribution of the new Fiorino launched

in late 2007. A total of 408,700 light commercial vehicles were

delivered (+5.3%), with deliveries in Western Europe increasing

1.1% to 241,000 units. In Italy, deliveries for the Sector declined

3%, whereas growth in France (+31.2%) and Germany (+7.1%)

either surpassed or ran counter to the overall trend in demand.

In Spain (-31.1%) and Great Britain (-18.3%), the Sector posted

performance in line with the overall significant declines in

those markets.

During 2008, the Sector continued its strategy of targeted

alliances to strengthen its position in international markets.

In June, as part of the collaboration between Fiat Group and

OJSC-Sollers (formerly Severstal-Auto), an agreement was

signed for the establishment of a 50/50 joint venture between

Fiat Group Automobiles and its Russian partner for the

manufacture and distribution of Fiat brand vehicles (both cars

and light commercial vehicles) in the Russian Federation. The

joint venture’s activities are to include management of the Fiat

Linea assembly plant in the Tatarstan region. In November, a

new letter of intent was signed for further expansion of the

strategic collaboration between FGA and Sollers.

At the end of September, following the signing of a

memorandum of understanding in April, Fiat Group

Automobiles and the Serbian government announced a

definitive agreement for the creation of a joint venture to

produce cars at the Zastava plant in Kragujevac. The company

will be held 67% by FGA and 33% by the Serbian government.

Once fully operational (in 2010), the plant will have a production

capacity of some 200,000 vehicles per year, with potential for a

further 100,000 units per year. Initial investment in the project

will be approximately €700 million, which includes over €200

million in contributions from the Serbian government.