Chrysler 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Letter from the Chairman

and the Chief Executive Officer

Letter from the Chairman and the Chief Executive Officer

6

Dear Shareholders,

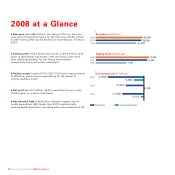

Characterising the Group’s 2008 results is no easy task.

If we were only to consider trading profit, 2008 was clearly a

record year - the best in our history.

But it was also a year of two halves: the outstanding

performance of all our businesses in the first nine months was

followed by widespread declines in the fourth quarter as a

result of the dramatic change in the economic environment.

Yet our focus remains - as it constantly has in recent years -

firmly on the future.

The challenging global economic situation we were faced with,

particularly in the closing months of the year, is destined to

continue to have a profound impact on Fiat’s markets.

In fact, 2008 was a year of trials.

The crisis which was initially believed to be confined to the

financial system and the U.S. spilled over into the real

economy on a global scale, triggering significant and

widespread deterioration of trading conditions in most sectors

and regions where we operate.

There is significant uncertainty linked to the future

performance of the economy which nobody currently is fully

able to evaluate, not even the most authoritative international

institutions.

This uncertainty has been further compounded by a severe

credit crunch, both to consumers and to businesses.

For the Fiat Group, the prospects ahead will require additional

commitment and sacrifice from us, as they will from you, our

Shareholders. It is for this reason that the Board of Directors

has decided not to propose a dividend for 2008, other than the

mandatory dividend payable on savings shares.

We believe that this decision, even though 2008 profit was

sufficient to enable distribution of a dividend, is indispensable

in guaranteeing that, going forward, the Fiat Group maintains a

strong capital structure and a level of liquidity adequate to

meet its future commitments and challenges.

During 2008, we worked intensively on renewing the product

range, improving industrial processes, strengthening the image

of our brands and accelerating the Group’s international

expansion, including through targeted alliances.

Earlier this year, a letter of intent was signed with Chrysler and

Cerberus Capital Management for the creation of a global

strategic alliance. The agreement would not require cash

investment by the Fiat Group or commitment to provide

funding to Chrysler in the future. Rather, it is based on an

underlying rationale of mutual benefit, with Fiat receiving an

equity interest in Chrysler and gaining access to new markets

and the U.S. automaker gaining access to competitive

platforms for fuel-efficient vehicles, engines, transmissions and

components where we are already well established. We are

confident that such an agreement would provide an

opportunity for our Group to create medium and long-term

value.

Looking forward to 2009, we believe that difficult trading

conditions will continue at least through the first half of the

year and that it will only be possible to fully assess the effect

of actions to underpin demand for the automotive sector in

Italy, and other major European markets, as the year unfolds.

However, we expect quarter-by-quarter performance will be

uneven, with the first three months being particularly difficult.

Improvements should be visible in the remaining three

quarters, as the benefits of restructuring initiatives begin to be

felt.

As we look forward, we are convinced that the industrial profile

of our businesses, which has been carefully re-engineered in

recent years, means we are well-placed for the next phase of

development.

Fiat Group Automobiles has a strong presence in the smaller

car segments and has invested significantly in being able to

offer a range of low environmental impact models.

We expect current market trends, likely to be further

accentuated by present circumstances, will continue toward

demand for increasingly smaller, more environmentally-

friendly and economical cars.

At Case and New Holland, we have been working with

determination to ensure an extensive product offering and

stronger global presence.

For Iveco, we have sought to balance an over-dependence on

our domestic Western European market with an increased

presence in Eastern Europe, Latin America and China.

FPT Powertrain Technologies has been committed to research

and technological innovation enabling it to compete with the

world’s best powertrain makers in terms of performance and

respect for the environment.

There was the same level of energy and focus in the

components sector, with its fundamental role as a contributor

to the overall competitiveness of the Group being further

strengthened.