Chrysler 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat Group Consolidated Financial Statements at 31 December 2008 113

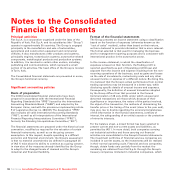

Current financial assets and held-to-maturity securities are

recognised on the basis of the settlement date and, on initial

recognition, are measured at acquisition cost, including

transaction costs.

Subsequent to initial recognition, available-for-sale and held

for trading financial assets are measured at fair value. When

market prices are not available, the fair value of available-for-

sale financial assets is measured using appropriate valuation

techniques e.g. discounted cash flow analysis based on market

information available at the balance sheet date.

Gains and losses on available-for-sale financial assets are

recognised directly in equity until the financial asset

is disposed or is determined to be impaired; when the asset is

disposed of, the cumulative gains or losses, including those

previously recognised in equity, are reclassified into the

income statement for the period; when the asset is impaired,

accumulated losses are recognised in the income statement.

Gains and losses arising from changes in fair value of held for

trading financial instruments are included in the income

statement for the period.

Loans and receivables which are not held by the Group for

trading (originated loans and receivables), held-to-maturity

securities and all financial assets for which published price

quotations in an active market are not available and whose fair

value cannot be determined reliably, are measured, to the

extent that they have a fixed term, at amortised cost, using the

effective interest method. When the financial assets do not

have a fixed term, they are measured at acquisition cost.

Receivables with maturities of over one year which bear no

interest or an interest rate significantly lower than market rates

are discounted using market rates.

Assessments are made regularly as to whether there is any

objective evidence that a financial asset or group of assets may

be impaired. If any such evidence exists, an impairment loss

is included in the income statement for the period.

Except for derivative instruments, financial liabilities are

measured at amortised cost using the effective interest

method.

Financial assets and liabilities hedged by derivative

instruments are measured in accordance with hedge

accounting principles applicable to fair value hedges: gains

and losses arising from remeasurement at fair value, due to

changes in relevant hedged risk, are recognised in the income

statement and are offset by the effective portion of the loss or

gain arising from remeasurement at fair value of the hedging

instrument.

Derivative financial instruments

Derivative financial instruments are used for hedging

purposes, in order to reduce currency, interest rate and market

price risks. In accordance with IAS 39, derivative financial

instruments qualify for hedge accounting only when at the

inception of the hedge there is formal designation and

documentation of the hedging relationship, the hedge is

expected to be highly effective, its effectiveness can be reliably

measured and it is highly effective throughout the financial

reporting periods for which the hedge is designated.

All derivative financial instruments are measured in

accordance with IAS 39 at fair value.

When derivative financial instruments qualify for hedge

accounting, the following accounting treatment applies:

Fair value hedge – Where a derivative financial instrument is

designated as a hedge of the exposure to changes in fair value

of a recognised asset or liability that is attributable to a

particular risk and could affect the income statement, the gain

or loss from remeasuring the hedging instrument at fair value

is recognised in the income statement. The gain or loss on the

hedged item attributable to the hedged risk adjusts the

carrying amount of the hedged item and is recognised in the

income statement.

Cash flow hedge – Where a derivative financial instrument is

designated as a hedge of the exposure to variability in future

cash flows of a recognised asset or liability or a highly

probable forecasted transaction and could affect income

statement, the effective portion of any gain or loss on the

derivative financial instrument is recognised directly in equity.

The cumulative gain or loss is removed from equity and

recognised in the income statement at the same time as the

economic effect arising from the hedged item affects income.

The gain or loss associated with a hedge or part of a hedge

that has become ineffective is recognised in the income

statement immediately. When a hedging instrument or hedge