Chrysler 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat Group Consolidated Financial Statements at 31 December 2008 119

attention is placed on the eco-sustainability of those types

of products. As a result, therefore, despite the fact that the

automotive sector is one of the markets most affected by the

present crisis in the immediate term, it is considered highly

probable that the life cycle of these products can be

lengthened to extend over the period of time involved in a

slower economic recovery, in this way allowing the Group

to achieve sufficient earnings flows to cover the investments,

albeit over a longer timescale.

– Around 60% of capitalised goodwill relates to the CNH

business and around 28% to Ferrari. The Group has carried

out additional analyses to test the recoverability of the

goodwill allocated to the former business in the event

of a further deterioration of the construction equipment

market, and considerations in this respect are discussed in

Note 14; at 31 December 2008 this goodwill had a carrying

amount of €397 million. As concerns Ferrari, the exclusivity

of the business, its historical profitability and its future

earnings prospects indicate that the carrying amount will

continue to be recoverable, even in the event of economic

and market conditions which remain difficult and may

deteriorate further.

Residual values of assets leased out under operating

lease arrangements or sold with a buy-back

commitment

The Group reports assets rented or leased to customers

under operating leases as tangible assets. Furthermore, new

vehicle “sales” with a buy-back commitment are not

recognised as sales at the time of delivery but are accounted

for as operating leases if it is probable that the vehicle will be

bought back. The Group recognises income from such

operating leases over the term of the lease. Depreciation

expense for assets subject to operating leases is recognised

on a straight-line basis over the term of the lease in amounts

necessary to reduce the cost of the assets to its estimated

residual value at the end of the lease term. The estimated

residual value of the leased assets is calculated at the lease

inception date on the basis of published industry information

and historical experience.

Realisation of the residual values is dependant on the Group’s

future ability to market the assets under the then-prevailing

market conditions. The Group continually evaluates whether

events and circumstances have occurred which impact the

estimated residual values of the assets on operating leases.

More specifically the Group recognised further write-downs at

the end of 2008, in addition to those usually made on the basis

of historical trends in residual values, to take account of the

sudden deterioration in the used vehicle market over the past

few months. It cannot be excluded that additional write-downs

may be needed if market conditions should deteriorate yet

again.

Sales allowance

At the later time of sale or the time an incentive is announced

to dealers, the Group records the estimated impact of sales

allowances in the form of dealer and customer incentives as a

reduction of revenue. There may be numerous types of

incentives available at any particular time. The determination

of sales allowances requires management estimates based on

different factors.

Product warranties

The Group makes provisions for estimated expenses related to

product warranties at the time products are sold. Management

establishes these estimates based on historical information on

the nature, frequency and average cost of warranty claims. The

Group seeks to improve vehicle quality and minimise warranty

expenses arising from claims.

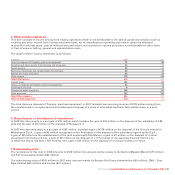

Pension and other post-retirement benefits

Group companies sponsor pension and other post-retirement

benefits in various countries. In the US, the United Kingdom,

Germany and Italy, the Group has major defined benefit plans.

Management uses several statistical and judgmental factors

that attempt to anticipate future events in calculating the

expense, the liability and the assets related to these plans.

These factors include assumptions about the discount rate,

expected return on plan assets, rate of future compensation

increases and health care cost trend rates. In addition, the

Group’s actuarial consultants also use subjective factors such

as withdrawal and mortality rates in making relevant estimates.

More specifically, in 2008 discount rate curves experienced a

high level of volatility, with significant upwards changes

occurring as the consequence of the financial crisis and the

related effect on the yields of high quality corporate bonds.

Then, however, at the end of the year, these curves underwent

a reversal and began to fall. After consulting with its actuaries,

the Group has selected discount rates which it considers to be

of a balanced nature given the context. It cannot be excluded,