Chrysler 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat Group Consolidated Financial Statements at 31 December 2008122

entity or by other parties, should receive the same accounting

treatment. The Group will apply this amendment

retrospectively from 1 January 2009; no significant effects are

expected to arise on its adoption.

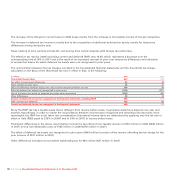

On 22 May 2008 the IASB issued a series of amendments to

IFRS (“Improvements”). Details are provided in the following

paragraphs of those identified by the IASB as resulting in

accounting changes for presentation, recognition and

measurement purposes, leaving out amendments regarding

changes in terminology or editorial changes which are likely

to have minimal effects on accounting and improvements that

relates to matters not applicable to the Group.

IFRS 5 –

Non-Current Assets Held for Sale and Discontinued

Operations

: this amendment, to be applied prospectively from

1 January 2010, requires an entity that is committed to a sale

plan involving loss of control of a subsidiary to classify all the

assets and liability of that subsidiary as held for sale,

regardless of whether the entity will retain a non-controlling

interest in its former subsidiary after the sale.

IAS 1 –

Presentation of Financial Statements (revised in

2007)

: this amendment, to be applied prospectively from

1 January 2009, requires an entity to classify assets and

liabilities arising from derivative financial instruments that are

not classified as held for trading between current and non-

current assets and liabilities. The adoption of this standard will

have no effect on the measurement of items in the financial

statements.

IAS 16 –

Property, Plant and Equipment

: this amendment,

effective retrospectively from 1 January 2009, requires an

entity that in the course of its ordinary activities routinely sells

items of property, plant and equipment that it has held for

rental to others, to transfer such assets to inventories when

they cease to be rented and become held for sale. As a

consequence, the proceeds from the sale of such assets shall

be recognised as revenue. Cash payments to manufacture or

acquire assets held for rental to others or subsequently held

for sale are cash flows from operating activities (and not from

investing activities). The adoption of this standard will have no

effect on the measurement of items in the financial statements.

IAS 19 –

Employee Benefits

: this amendment, effective

prospectively from 1 January 2009 to changes in benefits that

occur after that date, clarifies the definition of positive/negative

past service costs and states that in the case of a curtailment,

only the effect of the reduction for future service shall be

recognised immediately in the income statement, while the

effect arising from past service periods shall be considered

a negative past service cost. The Board also revised the

definition of short-term employee benefits and other long-term

employee benefits and the definition of a return on plan assets,

stating that this amount should be net of any costs for

administering the plan (other than those included in the

measurement of the defined benefit obligation).

IAS 20 –

Government Grants and Disclosure of Government

Assistance

: this amendment, applicable prospectively from

1 January 2009, states that the benefit of a government loan at a

below-market rate of interest shall be treated as a government

grant and then accounted for in accordance with IAS 20.

IAS 23 –

Borrowing Costs

: this amendment, applicable from

1 January 2009, revises the definition of borrowing costs.

IAS 28 –

Investments in Associates

: this amendment shall be

applied from 1 January 2009, with prospective application also

permitted, requires that for investments accounted for using

the equity method a recognised impairment loss should not be

allocated to any asset (and in particular goodwill) that forms

part of the carrying amount of the investment in the associate,

but to the carrying amount of the investment overall. Accordingly

any reversal of that impairment loss is recognised in full.

IAS 36 –

Impairment of Assets

: this amendment, effective

from 1 January 2009, requires additional disclosures to be

made in the case in which an entity determines the recoverable

amount of a cash-generating unit using discounted cash flows.

IAS 38 –

Intangible Assets

: this amendment, effective

retrospectively from 1 January 2009, requires expenditure on

advertising and promotional activities to be recognised in the

income statement. Further, it states that in the case expenditure

is incurred to provide future economic benefits to an entity, but

no intangible assets is recognised, in the case of the supply of