Chrysler 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat Group Consolidated Financial Statements at 31 December 2008118

year which differ from estimates, and which therefore might

require adjustments, even significant, to be made to the

carrying amount of the items in question, which at the present

moment can clearly neither be estimated nor predicted.

The main items affected by these situations of uncertainty are

the allowances for doubtful accounts receivable and

inventories, non-current assets (tangible and intangible assets),

the residual values of vehicles leased out under operating

lease arrangements or sold with buy-back clauses, pension

funds and other post-employment benefits, and deferred tax

assets.

The following are the critical judgements and the key

assumptions concerning the future, that management has

made in the process of applying the Group accounting policies

and that have the most significant effect on the amounts

recognised in the Consolidated financial statements or that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year.

Allowance for doubtful accounts

The allowance for doubtful accounts reflects management

estimate of losses inherent in wholesale and retail credit

portfolio. The Group reserves for the expected credit losses

based on past experience with similar receivables, current and

historical past due amounts, dealer termination rates, write-

offs and collections, the careful monitoring of portfolio credit

quality and current and projected economic and market

conditions. Should the present economic and financial crisis

persist or even worsen, this could lead to a further

deterioration in the financial situation of the Group’s debtors

compared to that already taken into consideration in

calculating the allowances recognised in the financial

statements.

Allowance for obsolete and slow-moving inventory

The allowance for obsolete and slow-moving inventory reflects

management’s estimate of the loss in value expected by the

Group, and has been determined on the basis of past

experience and historical and expected future trends in the

used vehicle market. The present economic and financial crisis

could cause a further deterioration in conditions in the used

vehicle market compared to that already taken into

consideration in calculating the allowances recognised in the

financial statements.

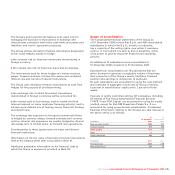

Recoverability of non-current assets (including goodwill)

Non-current assets include property, plant and equipment,

investment property, intangible assets (including goodwill),

investments and other financial assets. Management reviews

the carrying value of non-current assets held and used and

that of assets to be disposed of when events and

circumstances warrant such a review. Management performs

this review using estimates of future cash flows from the use

or disposal of the asset and suitable discount rate in order to

calculate present value. If the carrying amount of a non-

current asset is considered impaired, the Group records an

impairment charge for the amount by which the carrying

amount of the asset exceeds its estimated recoverable amount

from use or disposal determined by reference to its most

recent Group plans.

In view of the present economic and financial crisis, the Fiat

Group has the following considerations in respect of its future

prospects:

In the current situation, when preparing figures for the

Consolidated financial statements for the year ended 31

December 2008 and more specifically for carrying out

impairment testing of tangible and intangible assets, the

various Sectors of the Group have taken into consideration

their expected performance for 2009, with assumptions and

results consistent with the statements made in the section

Significant events subsequent to the year end and outlook.

In addition, for the plans of subsequent years they have made

prudent revisions to their respective 2007-2010 plans to take

account of an economic and financial situation and market

conditions which have undergone profound change as the

result of the present crisis. No requirement to recognise

significant impairment losses arose following the revision

of the planned data in this way.

Further, should the plan assumptions deteriorate further the

following is noted:

– The Group’s tangible assets and intangible assets with

a finite useful life (which essentially regard development

expenditure) relate to recent models or products having

a high technological content in line with the latest

environmental laws and regulations, which consequently

renders them competitive in the present economic situation,

especially in the more mature economies in which particular