Chrysler 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Report on Operations Corporate Governance60

the Parent Company ensures a system of efficient exchange of

information and conducts the necessary coordination with the

activities of its subsidiaries, the majority of which are

organised into Sectors. The second relates to detailed

operating policies and procedures at Sector level, based on

guidelines provided by the Parent Company, and implemented

by the individual legal entities.

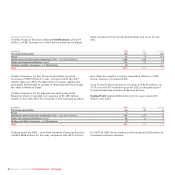

In parallel, assessment and monitoring of the system of

internal control over financial reporting has been implemented

consistent with the model established in the COSO Framework

and follows a ‘top-down, risk-based’ approach, which is in line

with international best practice. As part of that process, tests

are carried out by management, which are accompanied by

quality reviews of the design and functioning of those controls,

and tests are also conducted independently by Internal Audit.

The ‘top-down, risk-based’ approach adopted by the Fiat Group

enables management to conduct its own assessments focusing

on areas of greatest risk and/or materiality in relation to the

financial reporting system.

Documents and financial information regarding the Company

continue to be disclosed, including via the internet, in accordance

with the provisions of the Disclosure Controls & Procedures

adopted in the past in conformity with the US regulation.

Board of Statutory Auditors

As required by Article 17 of the By-laws, the Board of Statutory

Auditors is comprised of three regular auditors and three

alternates, all of whom must be entered in the Register of

Auditors and have at least three years’ experience as a

statutory account auditor. They may also hold other positions as

director or regular auditor within the legal and regulatory limit.

The Board of Statutory Auditors, following resignation of the

regular member Cesare Ferrero and alternate member Giorgio

Giorgi on 15 May 2008, is currently composed of: Carlo

Pasteris, Chairman; Giuseppe Camosci and Piero Locatelli,

regular auditors; and, Roberto Lonzar, alternate auditor.

The Board of Statutory Auditors’ current term of office expires

on the date of the forthcoming General Meeting of

Shareholders called to approve the 2008 Financial Statements.

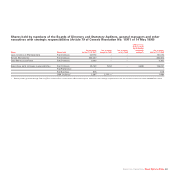

Below is a list of the most significant positions held by the

members of the Board of Statutory Auditors. In compliance

with legal and regulatory requirements, more complete

information is provided in the Report of the Board of Statutory

Auditors on the 2008 Financial Statements. Carlo Pasteris is

Chairman of the Board of Statutory Auditors of Toro

Assicurazioni S.p.A., Augusta Assicurazioni S.p.A., Augusta Vita

S.p.A., De Agostini S.p.A., B&D Holding S.a.p.A. and a director

of Ferrero S.p.A.; Giuseppe Camosci is Chairman of the Board

of Statutory Auditors of Samsung Electronics Italia S.p.A., and

a regular auditor of Trussardi S.p.A., Finos S.p.A., Locafit S.p.A.

and WestLB (Italia) Finanziaria S.p.A.; Piero Locatelli is a

regular auditor of Giovanni Agnelli & C. S.a.p.A.

Pursuant to Legislative Decree 58/98 and in accordance with

Article 17 of the Company’s By-laws, appropriately constituted

minority groups have the right to appoint one regular auditor,

who shall serve as Chairman, and one alternate auditor. In

accordance with the By-laws, an equity interest no lower than

that required by law for the submission of lists of candidates

for the appointment of the Company’s Board of Directors is

required for the submission of a list of candidates to the Board

of Statutory Auditors. In accordance with the communication

issued by Consob and with reference to the Company’s market

capitalisation in the last quarter of 2008, the required minimum

percentage is currently 1% of ordinary shares. The lists

presented, together with the documentation required by law

and the Company’s By-laws, must be deposited at the

Company’s registered office at least fifteen days prior to the

date set for the Meeting on first call, or, in specific cases, up to

five days after that date. The Board of Statutory Auditors was

elected by Shareholders on 3 May 2006 using the voting list

system. In particular, the regular auditors Giuseppe Camosci

and Piero Locatelli, who was substituted for Cesare Ferrero on

15 May 2008, were drawn from the list presented by the

majority shareholder IFIL Investments S.p.A. and Carlo

Pasteris, who was appointed Chairman of the Board of

Statutory Auditors, was drawn from the minority list receiving

the highest number of votes. That minority list was presented

jointly by the Generali Group and Mediobanca, which at the

time were holders of 2.7% and 1.8% of the Fiat ordinary shares,

respectively. Upon accepting his candidacy, Carlo Pasteris

resigned from his position as common representative for the

holders of savings shares. Additional information provided to

Shareholders on candidates and lists presented are still

available in the Investor Relations section of the Group website

(www.fiatgroup.com).