Chrysler 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Consolidated and Statutory

Financial Statements

at 31 December 2008

103rd financial year

Table of contents

-

Page 1

Annual Report Consolidated and Statutory Financial Statements at 31 December 2008 103rd financial year -

Page 2

... Agenda 1. Motion for approval of the Statutory Financial Statements at 31 December 2008 and allocation of net profit for the year. 2. Election of the Board of Directors and determination of the number of members and their compensation; related resolutions. 3. Election of the Statutory Auditors and... -

Page 3

Force without wisdom falls of its own weight. Horace -

Page 4

-

Page 5

... Group Automobiles Maserati Ferrari Agricultural and Construction Equipment Trucks and Commercial Vehicles FPT Powertrain Technologies Components Metallurgical Products Production Systems Financial Review - Fiat S.p.A. Motion for Approval of the Statutory Financial Statements and Allocation of 2008... -

Page 6

...15 May 2008, Cesare Ferraro and Giorgio Giorgi resigned their respective positions as Regular Auditor and Alternate Auditor. On the same date, Piero Locatelli was appointed as Regular Auditor (1) Member of the Nominating and Corporate Governance Committee (2) Member of the Internal Control Committee... -

Page 7

...of our brands and accelerating the Group's international expansion, including through targeted alliances. Earlier this year, a letter of intent was signed with Chrysler and Cerberus Capital Management for the creation of a global strategic alliance. The agreement would not require cash investment by... -

Page 8

... be the first movers in restoring order to a disoriented market and ensure that, in the restructuring process which the car industry will undoubtedly undergo, Fiat is one of the major players. Our principal objective is to preserve our brands, businesses and management culture. We are ready because... -

Page 9

True passion confers strength by giving courage. Voltaire -

Page 10

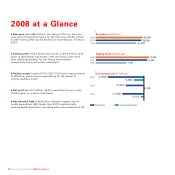

Report on Operations 10 2008 at a Glance 16 Shareholders 18 The Fiat Group and its Brands 20 Highlights by Sector 21 Main Risks and Uncertainties to which Fiat S.p.A. and the Group are exposed 25 Corporate Social Responsibility 26 Research and Innovation 32 Human Resources 36 Financial Review - Fiat... -

Page 11

...). I 2006 (11,836) (1,773) I Net Industrial Debt of â,¬5.9 billion reflected a higher level of capital expenditure (36% higher than 2007) combined with working capital absorption associated with volume declines in Q4. Fiat Group Industrial Activities 10 Report on Operations 2008 at a Glance -

Page 12

...: net industrial (debt)/cash Total shareholders' equity Equity attributable to shareholders of the parent company Number of employees at the end of the year (1) See Note 13 to the Consolidated Financial Statements for additional information on the calculation of basic and diluted earnings per share... -

Page 13

-

Page 14

...) to expand and upgrade Verrone plant prior to production of new transmission (C635) for medium-sized passenger vehicles. Upgrade of product range for both brands with 2008 versions of the Sedici, Ulysse, Idea, Ypsilon and Phedra. Launch of the telehandler line in North America for "load & carry... -

Page 15

... Class VII models and a new Class IX model, the industry's largest combine segment. Launch of the new TC5070 combine in Brazil. September Magneti Marelli and Unitech Machines Limited sign agreement to establish a joint venture in India for the production of automotive electronic systems. Fiat Group... -

Page 16

... for Fiat SpA and CNH Global NV from stable to negative, while confirming investment grade status for both companies with long and short-term ratings of "BBB-/A-3" and "BBB-" respectively. FASIFIAT, a health benefit plan for Fiat Group employees supplementing Italy's national health service begins... -

Page 17

... Relations section provides historical financial data and highlights, investor presentations, quarterly publications, official communications and real time trading information on Fiat shares. Shareholders can also contact the company at the following: For holders of Fiat shares: Toll-free number... -

Page 18

... shares in relation to which FMR has sole power to vote. IFIL Investments S.p.A. 30.5% 5.4% 5.0% 25.6% 6.2% 23.8% Capital Research & Management Co. FMR LLC Institutional Investors - EU Institutional Investors - outside EU Other Shareholders Earnings per share (figures in â,¬) 2008 2007 2006... -

Page 19

... Businesses: Automobiles The Group develops, produces and sells automobiles (Fiat, Abarth, Alfa Romeo and Lancia brands) and light commercial vehicles (Fiat Professional brand) through Fiat Group Automobiles. This Sector's main financial services activities in Europe have been grouped into Fiat... -

Page 20

...768 11,196 Trading millions) Trading Profit Profit(¤ (â,¬ millions) 838 813 2008 2007 2008 2007 Revenues Revenues (¤ (â,¬millions) millions) 2008 2007 2008 2007 13,793 13,375 Trading millions) Trading Profit Profit(¤ (â,¬ millions) 402 509 Report on Operations The Fiat Group and its Brands 19 -

Page 21

...(3) 2007 2008 R&D expense (4) 2007 2008 Number of employees 2007 Fiat Group Automobiles Maserati Ferrari Agricultural and Construction Equipment (CNH) Trucks and Commercial Vehicles (Iveco) FPT Powertrain Technologies Components (Magneti Marelli) Metallurgical Products (Teksid) Production Systems... -

Page 22

... established as well as the general condition of the economy, the financial markets and the industries in which the Group operates that, moreover, require significant levels of investment. The Fiat Group expects to be able to meet funding Report on Operations Main Risks and Uncertainties to which... -

Page 23

... of its industrial activities and financing offered to customers and dealers. Changes in interest rates can increase or reduce the cost of financing or interest margins of the financial services companies. Consistent with its risk management policies, the Fiat Group seeks to manage risks associated... -

Page 24

...which the Group operates The Group operates in markets which are highly competitive in terms of product quality, innovation, pricing, fuel efficiency, reliability, safety and customer assistance. The Group competes with other major multinational groups and domestic firms in Europe, North America and... -

Page 25

..., products - with requirements for emissions of polluting gases, fuels and safety becoming increasingly stricter - and Fiat S.p.A., as Parent Company of the Group, is exposed in substance to the same risks and uncertainties as those described above for the Group. 24 Report on Operations Main Risks... -

Page 26

... of the Group's products and services. The social performance indicators cover such key aspects as labour practices, labour/management relations, occupational health and safety, employee training and education, diversity and equal opportunity, human rights, society and product responsibility. The... -

Page 27

... in innovation, research and development. Now an internationally recognized centre of excellence, C.R.F.'s work constitutes a strategic lever for the Group's businesses, enhancing performance through development and transfer of innovative content which makes the Group's products both competitive and... -

Page 28

... to guarantee the Fiat Group has the technical know-how in secondary systems, electronics, telematics and preventive safety needed to improve mobility by making vehicles safer, more versatile and more eco-compatible. Major achievements in 2008 included: Report on Operations Research and Innovation... -

Page 29

... mobility. This R&D work is being carried out in concert with major automakers throughout Europe to create systems that are interoperable across the EU. Alongside these research and development activities, C.R.F. and Fiat Group Automobiles are members of the Car-2-Car Communication Consortium, whose... -

Page 30

... work will help increase the efficiency of vehicles currently in production, while over the next few years, medium- to long-term development will contribute to achieving the energy savings which will be required under new European regulations and reducing operating costs. panel which was presented... -

Page 31

... of information systems. At Elasis, as at C.R.F., work on engines and transmissions is carried out as part of Fiat Powertrain Technologies' development projects. In 2008, Elasis continued in its strategy of creating new links in the research/innovation value chain and of promoting local development... -

Page 32

... to automatically check the status of ECU-controlled indicator lamps and displays. Elasis also assisted Ferrari in developing a number of electronic control systems, including those for the Dual Clutch transmission, the traction system for the E-2WD Report on Operations Research and Innovation 31 -

Page 33

... CNH in North America and Latin America. Approximately 30,000 employees (classified internally as Professional) have specific professional qualifications, and 44% of them work outside Italy. Training Investment in training to support Group activities and individual professional development totalled... -

Page 34

... in relation to pay and employment conditions in those countries where the Group's activities are located. Social dialogue At the European level, the Fiat Group European Works Council (EWC), a representative body for Group employees in the European Union, took part in information and consultation... -

Page 35

... parts distribution activities of Fiat Group Automobiles (Germany) and down-size operations at Comau and at the Components Sector's Plastic Components and Modules business line (France). In North America, CNH's also rationalised its financial services activities. In Italy, a collective lay-off plan... -

Page 36

... in the quality-related component, which this year was applied equally to all Sectors and employee grades. Outside Italy, the main company-level collective agreements established during 2008 include the annual negotiation in France which resulted in salary increases, in line with inflation, of... -

Page 37

... quarter of 2008, the Group completed the purchase accounting for this acquisition, including conversion of the acquired company's financial statements to IFRS, and consolidated it on a line-by-line basis from 1 April 2008. I In the third quarter of 2008, as part of the shareholder restructuring of... -

Page 38

...the closing months of 2008. Revenues by Business (â,¬ millions) 2008 2007 % change Automobiles (Fiat Group Automobiles, Maserati, Ferrari) Agricultural and Construction Equipment (CNH - Case New Holland) Trucks and Commercial Vehicles (Iveco) Components and Production Systems (FPT, Magneti Marelli... -

Page 39

...to benefit from the agricultural equipment industry's strong performance. Worldwide tractor market share was up with gains in Latin America, Rest-of-World and in North America for high-powered models, while share was unchanged in Western Europe. In the fast growing 38 Report on Operations Financial... -

Page 40

... in Latin America, stable positions in North America and Western Europe and a slight decline in the Rest-of-World, due to supply constraints. Construction equipment unit retail sales decreased 11% worldwide in 2008. CNH global market share in the construction equipment was stable at 2007 levels. In... -

Page 41

... in Latin America, partly offset by a decrease in Service activities in Europe, in line with the reshaping of the Sector's activities. Other Businesses Other Businesses includes the contribution from the Group's publishing businesses, service companies and holding companies. Other Businesses had... -

Page 42

...Profit by Business (â,¬ millions) 2008 2007 Change Automobiles (Fiat Group Automobiles, Maserati, Ferrari) Agricultural and Construction Equipment (CNH - Case New Holland) Trucks and Commercial Vehicles (Iveco) Components and Production Systems (FPT, Magneti Marelli, Teksid, Comau) Other Businesses... -

Page 43

... adjustments, a decrease of â,¬70 million over the â,¬172 million loss recognised in 2007 primarily attributable to a reduction in costs related to stock option plans. I Magneti Marelli reported trading profit of â,¬174 million for 2008 (â,¬214 million for 2007). The decrease over 2007 was due to... -

Page 44

...) on the disposal of investments 2007 Restructuring costs 2008 2007 Other unusual income/(expense) 2008 2007 Operating profit/(loss) 2008 2007 Fiat Group Automobiles 691 Maserati 72 Ferrari 339 Agricultural and Construction Equipment (CNH) 1,122 Trucks and Commercial Vehicles (Iveco) 838 803 24... -

Page 45

... The financial component of costs for pension plans and other employee benefits totalled â,¬155 million, in line with 2007. Investment income for 2008 totalled â,¬162 million, down from the â,¬185 million figure for 2007, mainly due to start-up costs for joint venture companies. Profit before taxes... -

Page 46

...new financing provided by the financial services companies. Financing activities generated a total of â,¬3,127 million in cash, principally from an increase in bank loans, net of â,¬238 million in share repurchases (less shares sold in relation to the exercise of stock options) and dividend payments... -

Page 47

... of the value of vehicles sold under buy-back commitments by Fiat Group Automobiles. (2) Other current Payables included under the item Other Current Taxes Receivable/(Payable) & Other Current Receivables/(Payables) excludes the buy-back price payable to customers upon expiration of lease contracts... -

Page 48

... December 2007. At 31 December 2008, cash and cash equivalents included â,¬473 million (â,¬530 million at 31 December 2007) specifically allocated to debt servicing for securitisation vehicles, which are recognised under Asset-Backed Financing. Report on Operations Financial Review - Fiat Group 47 -

Page 49

... 2008 Following is a breakdown of the consolidated income statement, balance sheet and cash flow statement between the Group's Industrial Activities and Financial Services. The latter include the retail financing, leasing and rental companies of CNH - Case New Holland, Iveco, Fiat Group Automobiles... -

Page 50

Operating Performance by Activity 2008 Financial Services 2007 Financial Services (â,¬ millions) Consolidated Industrial Activities Consolidated Industrial Activities Net revenues Cost of sales Selling, general and administrative Research and development Other income/(expense) Trading profit ... -

Page 51

... and Construction Equipment (CNH - Case New Holland) Trucks and Commercial Vehicles (Iveco) Holding and Other Companies, and Eliminations Total 160 14 1,169 137 (3) 1,477 127 8 1,158 117 - 1,410 26.0 75.0 0.9 17.1 n.a. 4.8 Financial Services for Fiat Group Automobiles reported revenues of... -

Page 52

...2007 Financial Services Intangible assets Property, plant and equipment Investment property Investments and other financial assets Leased assets Defined benefit plan assets Deferred tax assets Total Non-current Assets Inventories Trade receivables Receivables from financing activities Current taxes... -

Page 53

... Other current securities Cash and cash equivalents Cash and cash equivalents included under Assets held for sale Net (Debt)/Cash (a) This item includes current financial receivables payable to Fiat Group companies by Fiat Group Automobiles Financial Services - FAFS (now FGA Capital). (b) Includes... -

Page 54

... in working capital, as previously reported. Dividend payments and share repurchases during the year (net of shares sold in relation to the exercise of stock options) resulted in cash outflows of â,¬546 million and â,¬238 million, respectively. Report on Operations Financial Review - Fiat Group 53 -

Page 55

...of non-current assets totalling â,¬297 million. (b) Cash from vehicles sold under buy-back commitments for the periods shown, net of amounts already recognised through the income statement, is included in a single line item under Operating Activities which also includes the change in working capital... -

Page 56

...net of shares sold in relation to the exercise of stock options) and dividend payments (â,¬546 million). Financial Services Cash and cash equivalents for Financial Services activities totalled â,¬1,079 million at 31 December 2008, down â,¬14 million over 31 December 2007. Changes in cash during the... -

Page 57

... of human and financial resources, purchasing of production materials, and marketing and communication. Furthermore, coordination of the Group includes specialised companies which provide centralized cash management, corporate and accounting, internal audit, and training services. Direction and... -

Page 58

... and strategic direction for the activities of the Board of Directors, while the Chief Executive Officer is responsible for the operational management of the Group. The Board established "Guidelines for Significant Transactions and Transactions with Related Parties" in which it reserves the right to... -

Page 59

...its executive directors and executives with strategic responsibilities, its controlling companies or subsidiaries, or any other party related to the Company. The results of these assessments are published in the Annual Report on Corporate Governance. At the meeting held on 23 July 2008, the Board of... -

Page 60

... order to safeguard the principle of independence of the firms engaged to audit the financial statements. The Group has also implemented and maintains up-to-date a system of reliable administrative and accounting procedures which guarantee a high standard of internal control over financial reporting... -

Page 61

...term of office expires on the date of the forthcoming General Meeting of Shareholders called to approve the 2008 Financial Statements. Below is a list of the most significant positions held by the members of the Board of Statutory Auditors. In compliance 60 Report on Operations Corporate Governance -

Page 62

... the Company's share capital, with any adjustment factor being determined by the AIAF. The exercise price must be paid in cash upon purchase of the underlying shares. Terms and conditions common to the plans established for Group managers between 2000 and 2002 are as follows: I in the event of... -

Page 63

... Board of Directors approved an eight-year plan consisting of 20 million stock options, authorised by Shareholders on 5 April 2007, which grants certain Group managers and the Chief Executive Officer of Fiat S.p.A. the right to acquire a determined number of Fiat S.p.A. ordinary shares at the price... -

Page 64

....12.2007 No. of shares bought in 2008 No. of shares sold in 2008 No. of shares held at 31.12.2008 Luca Cordero di Montezemolo Sergio Marchionne Gian Maria Gros-Pietro Executives with strategic responsibilities Fiat Ordinary Fiat Ordinary Fiat Ordinary Fiat Ordinary Fiat Preference Fiat Savings... -

Page 65

... are concluded at standard market terms for the nature of goods and/or services offered. Information on transactions with related parties, including specific disclosures required by the Consob Communication of 28 July 2006, is provided in Note 34 of the Consolidated Financial Statements and in Note... -

Page 66

...) and Cerberus Capital Management L.P., the private investment majority owner of Chrysler L.L.C., announced the signing of a non-binding term sheet for the establishment a global strategic alliance. On the basis of the term sheet, the alliance, to be a key element of Chrysler's viability plan, would... -

Page 67

... is of the view that the following conditions will materialize in 2009. I Global demand for our products will decline approximately ~20% compared to 2008. I I Group net industrial cash flow will be in excess of â,¬1 billion, with net industrial debt levels below the â,¬5 billion mark. While these... -

Page 68

-

Page 69

Lions have great strength, but it would be useless, if nature had not given them eyes. Montesquieu -

Page 70

...70 Fiat Group Automobiles - Fiat, Abarth, Alfa Romeo, Lancia & Fiat Professional 75 Maserati 76 Ferrari 77 Agricultural and Construction Equipment 80 Trucks and Commercial Vehicles 84 FPT Powertrain Technologies 87 Components 90 Metallurgical Products 91 Production Systems 92 Financial Review - Fiat... -

Page 71

... Group Automobiles' market share for light commercial vehicles in Italy reached 43.2%, a 1.1 percentage point improvement over 2007, while in Western Europe it reached 12.3%, up 0.6 percentage points. Highlights (â,¬ millions) 2008 2007 Net revenues Trading profit Operating profit (*) Investments... -

Page 72

...in which Fiat Group Automobiles holds a 37.9% interest) saw a 21% decline in sales with its market share slipping to 12.4%, down 0.7 percentage points year on year. Light commercial vehicles performed positively in 2008, reflecting, in part, the contribution of the new Fiorino launched in late 2007... -

Page 73

Innovation and Products Despite challenging market conditions, 2008 saw the launch of several key additions to the product range, particularly for Lancia and Alfa Romeo, and several of Fiat Group Automobiles' models received major international awards. The Fiat brand's 500 continued to garner ... -

Page 74

... the development of new information systems to provide faster, more effective support to the service network. Repair times for vehicles under warranty have also been reduced, and the process for developing repair equipment improved, resulting in the average cost per model being lowered. Fiat Group... -

Page 75

...issue of guarantees), a company wholly-owned by FGA and consolidated on a line-by-line basis. Consistent with company policy, Fidis S.p.A. reduced activities in the supplier financing segment, with managed loans dropping to â,¬505 million (â,¬963 million in 2007). 74 Report on Operations Fiat Group... -

Page 76

... R&D charged directly to the income statement. Innovation and Products In 2008, Maserati enhanced its market offer, expanding the GranTurismo range and releasing the new Quattroporte. The GranTurismo S, designed for the brand's sportier customers, was presented at the Geneva Motor Show in March. In... -

Page 77

... models in 2008. Joining the existing product line up was the new Ferrari California, launched with a highly innovative and effective marketing campaign which used the internet as its principal platform. The opening of new Ferrari Stores in major international cities also continued according to plan... -

Page 78

... equipment industry unit retail sales declined 20%. Declines in North America, Western Europe and in Rest-ofWorld were only partially offset by growth in Latin America. CNH global market share in the construction equipment market was stable at 2007 levels. In the strong Latin American markets, share... -

Page 79

...Combine®, in North America, a model which has industry-leading horsepower and maximizes productivity. 78 Report on Operations CNH Also the new 591 horsepower CR9090 Class IX Combine set a new Guinness world record in the UK on 26 September 2008, harvesting 551 tons of wheat in 8 hours, beating the... -

Page 80

.... finance leases, operating leases, credit cards, equipment rental programs and insurance products. Differentiated financial services are offered for both the Agricultural Equipment and Construction Equipment businesses. In North America, the activity is run by captive financial services companies... -

Page 81

... due to low-priced competition. Market share of 10.4% for the heavy segment, represented a decrease of one percentage point due, in part, to the unfavourable market mix. > 2.8 tonnes) Commercial Vehicle Market by product (GVW _ (units in thousands) 2008 2007 % change France Germany Great Britain... -

Page 82

... became a shareholder following the agreements signed in 2006 with SAIC Motor Corporation Ltd and Chongqing Heavy Vehicle Group Co.), sold some 22,300 heavy vehicles in 2008, representing a decline of 7.1% over the prior year. In 2008, Iveco focused on expanding the alliances established in 2007... -

Page 83

... six key elements: new generation vehicles, best-in-class fuel efficiency, high perceived quality of cabin environment, cost-effective solutions for frames, excellence in preventive security, evolution of telematic systems. Method innovation targeted four key areas: product development processes... -

Page 84

... minimize vehicle downtime. Iveco offers Financial Services in Europe and, through financial services companies in the Fiat Group Automobiles Sector, in Latin America and, since the beginning of 2008, China. In Europe, since 2005 the activity has been managed by Iveco Finance Holdings Limited (IFHL... -

Page 85

...the income statement. (****) Also includes Iveco personnel employed at powertrain product lines transferred to FPT (8,335 employees at year-end 2008 and 8,218 employees at year-end 2007). In March, FPT signed an agreement with Chrysler LLC to acquire 100% of the Tritec Motors plant located in Campo... -

Page 86

... in two major categories: "Engine Producer of the Year" and "Enterprise of the Year" . Innovation and Products Passenger & Commercial Vehicles In 2008, FPT continued to develop innovative powertrain systems (engines and transmissions combined) for Fiat Group Automobiles. For gasoline engines, work... -

Page 87

Development also continued during the year on various versions of the F1C engine to be fitted on vehicles produced by Mitsubishi Fuso Bus&Truck Corporation (the Daimler Truck Group) from the start of 2009. Production began on the four-cylinder 3.2-litre F32 Tier 3 engine with output up to 65 kW for ... -

Page 88

... into a number of important agreements to support growth in new strategic markets. In April, Magneti Marelli and Sumi Motherson Group established the joint venture Magneti Marelli Motherson India Holding B.V. for the production of automotive lighting and engine control systems in India. In May... -

Page 89

... radio/navigator for Fiat, PSA and SAIC. Instrument panel products were developed for new Volkswagen-Audi, Renault and Citroën models, while the business line also worked on a telematic-compatible high-resolution display for PSA and Maserati. The vehicle interiors products line developed new body... -

Page 90

..., Fiat 500, and for Ford, as well as hot-end systems for the Euro 5-compliant turbocharged 1.4-litre gasoline engine. Major new orders included a complete exhaust system for General Motors for production in several countries and an exhaust manifold for Volkswagen in Brazil. Motorsport During 2008... -

Page 91

... downturn in European markets. The market for heavy commercial vehicles, on the other hand, was slightly higher worldwide that in the prior year. The Sector's diversification in terms of customers and geographic areas, as well as the ongoing quest for efficiency in production processes and logistics... -

Page 92

...markets (13% in China). By customer, 41% of orders were received from Fiat Group companies and 59% from other automakers. At 31 December 2008, the order backlog for contract work totalled â,¬523 million, in line with 2007 on a comparable scope of operations. With regard to new orders for the Service... -

Page 93

...is a summary of Fiat S.p.A.'s income statement: (â,¬ millions) 2008 2007 Operating Performance For 2008, Fiat S.p.A., the Group's Parent Company, reported net profit of â,¬1,199 million, compared to net profit of â,¬2,069 million for the prior year. Income from investments - Dividends - Impairment... -

Page 94

...-cash expenses related to stock option plans and a reduction in the cost of services. In 2008, the Company had an average of 151 employees compared with an average of 143 in 2007. brands. This transaction, which forms part of the Group's programme of consolidating its strategic marketing and brand... -

Page 95

... favour of Fiat S.p.A., following which the Parent Company directly holds the controlling interest in all of the Group's industrial sectors. This simplification of the Group's structure will enable improved operating efficiency, financial optimization and streamlined dividend flows. The transaction... -

Page 96

...Fiat Netherlands Holding N.V. connected to fair value recognition of the stock-option related equity swaps on Fiat S.p.A. shares referred to above. At 31 December 2008, current financial liabilities consisted of a negative balance on the current account held with Fiat Finance S.p.A., amounts payable... -

Page 97

-

Page 98

... payable on shares outstanding at the coupon detachment date. 13 February 2009 On behalf of the Board of Directors /s/ LUCA CORDERO DI MONTEZEMOLO Luca Cordero di Montezemolo Chairman Report on Operations Motion for Approval of the Statutory Financial Statements and Allocation of 2008 Net Profit... -

Page 99

When two forces are joined together their efficacy is doubled. Isaac Newton -

Page 100

Fiat Group Consolidated Financial Statements at 31 December 2008 100 Consolidated Income Statement 101 Consolidated Balance Sheet 103 Consolidated Cash Flow Statement 104 Consolidated Statement of Changes in Shareholders' Equity 105 Consolidated Income Statement pursuant to Consob Resolution No. ... -

Page 101

...(3) (4) (5) 2008 2007 Net revenues Cost of sales Selling, general and administrative costs Research and development costs Other income (expenses) Trading profit Gains (losses) on the disposal of investments Restructuring costs Other unusual income (expenses) Operating profit/(loss) Financial income... -

Page 102

... Investment property Investments and other financial assets: - Investments accounted for using the equity method - Other investments and financial assets Leased assets Defined benefit plan assets Deferred tax assets Total Non-current assets Inventories Trade receivables Receivables from financing... -

Page 103

... 2008 At 31 December 2007 SHAREHOLDERS' EQUITY AND LIABILITIES Shareholders' equity: - Shareholders' equity of the Group - Minority interest Provisions: - Employee benefits - Other provisions Debt: - Asset-backed financing - Other debt Other financial liabilities Trade payables Current tax payables... -

Page 104

... assets (net of vehicles sold under buy-back commitments) - Investments Other non-cash items Dividends received Change in provisions Change in deferred taxes Change in items due to buy-back commitments Change in working capital Total D) Cash flows from (used in) investment activities: Investments in... -

Page 105

... Statement of Changes in Shareholders' Equity (â,¬ millions) Share capital Treasury shares Capital reserves Income (expenses) recognised Earning directly reserves in equity Minority interest Total Balances at 1 January 2007 Capital increase Dividends Increase in reserve for share based payments... -

Page 106

... Related parties (Note 34) Net revenues Cost of sales Selling, general and administrative costs Research and development costs Other income (expenses) Trading profit Gains (losses) on the disposal of investments Restructuring costs Other unusual income (expenses) Operating profit/(loss) Financial... -

Page 107

... Investment property Investments and other financial assets: - Investments accounted for using the equity method - Other investments and financial assets Leased assets Defined benefit plan assets Deferred tax assets Total Non-current assets Inventories Trade receivables Receivables from financing... -

Page 108

... assets (net of vehicles sold under buy-back commitments) - Investments Other non-cash items Dividends received Change in provisions Change in deferred taxes Change in items due to buy-back commitments Change in working capital Total D) Cash flows from (used in) investment activities: Investments in... -

Page 109

...as the investments will be realised in their normal operating cycle. Financial services companies, though, obtain funds only partially from the market: the remaining are obtained from Fiat S.p.A. through the Group's treasury companies (included in industrial companies), which Significant accounting... -

Page 110

...is presented using the indirect method. In connection with the requirements of the Consob Resolution No. 15519 of 27 July 2006 as to the format of the financial statements, specific supplementary Income Statement, Balance Sheet and Consolidated Cash Flow Statement formats have been added for related... -

Page 111

... contingent liabilities are recorded at fair value at the date of acquisition. Any excess of the cost of the business combination over the Group's interest in the fair value of those assets and liabilities is classified as goodwill and recorded in the financial statement as an intangible asset. If... -

Page 112

... are classified as operating leases. Operating lease expenditures are expensed on a straight-line basis over the lease terms. Cars Trucks and Buses Agricultural and Construction Equipment Engines Components and Production Systems 4-5 8 5 8 - 10 3-5 All other development costs are expensed as... -

Page 113

...vehicles leased to retail customers by the Group's leasing companies under operating lease agreements. They are stated at cost and depreciated at annual rates of between 20% and 33%. Financial instruments Presentation Financial instruments held by the Group are presented in the financial statements... -

Page 114

... assets are measured at fair value. When market prices are not available, the fair value of available-forsale financial assets is measured using appropriate valuation techniques e.g. discounted cash flow analysis based on market information available at the balance sheet date. Gains and losses on... -

Page 115

... deferred purchase price clauses (i.e. the payment of a minority portion of the purchase price is conditional upon the full collection of the receivables), require a first loss guarantee of the seller up to a limited amount or imply a continuing significant exposure to the receivables cash flow... -

Page 116

...allocated to costs by function in the income statement, except for interest cost on unfunded defined benefit plans which is reported as part of financial expenses. The post-employment benefit obligation recognised in the balance sheet represents the present value of the defined benefit obligation as... -

Page 117

... as operating leases when it is probable that the vehicle will be bought back. More specifically, vehicles sold with a buy-back commitment are accounted for as assets in Inventory if the sale originates from the Fiat Group Automobiles business (agreements with normally a short-term buy-back Cost of... -

Page 118

...shares issued by Group's subsidiaries. Taxes Income taxes include all taxes based upon the taxable profits of the Group. Taxes on income are recognised in the income statement except to the extent that they relate to items directly charged or credited to equity, in which case the related income tax... -

Page 119

... operating lease arrangements or sold with buy-back clauses, pension funds and other post-employment benefits, and deferred tax assets. The following are the critical judgements and the key assumptions concerning the future, that management has made in the process of applying the Group accounting... -

Page 120

... vehicle quality and minimise warranty expenses arising from claims. Residual values of assets leased out under operating lease arrangements or sold with a buy-back commitment The Group reports assets rented or leased to customers under operating leases as tangible assets. Furthermore, new vehicle... -

Page 121

... abovementioned plans. Accounting principles, amendments and interpretations adopted in 2008 On 30 November 2006, the IASB issued the IFRS 8 - Operating Segments that will become effective on 1 January 2009 and which will replace IAS 14 - Segment Reporting. The new standard requires the information... -

Page 122

...prospectively to borrowing costs relating to qualifying assets for which the commencement date for capitalisation is on or after the 1 January 2009. On 6 September 2007 the IASB issued a revised version of IAS 1 - Presentation of Financial Statements that is effective for annual periods beginning on... -

Page 123

... in the income statement, while the effect arising from past service periods shall be considered a negative past service cost. The Board also revised the definition of short-term employee benefits and other long-term employee benefits and the definition of a return on plan assets, stating that... -

Page 124

... the fact that a number of assets and liabilities may or must be measured on the basis of a current value rather than historical value. This amendment, made in order to reflect this, is effective prospectively from 1 January 2009. I Fiat Group Consolidated Financial Statements at 31 December 2008... -

Page 125

... receivables and receivables from financing activities, in particular dealer financing and finance leases in the European Union market for the Fiat Group Automobiles and Trucks and Commercial Vehicles Sectors, and in North America for the Agricultural and Construction Equipment Sector. Financial... -

Page 126

... hedged by interest rate swaps and, in limited cases, by forward rate agreements. Counterparties to these agreements are major and diverse financial institutions. Information on the fair value of derivative financial instruments held at the balance sheet date is provided in Note 21. Additional... -

Page 127

... Diesel Company. The combined balances of the Group's share in the principal income statement items of jointly controlled entities accounted for using the equity method are as follows: (â,¬ millions) 2008 2007 Net revenues Trading profit Operating profit/(loss) Profit before taxes Net profit/(loss... -

Page 128

... Financial Statements at 31 December 2007) was completed during the third quarter of 2008. Other information Certain reclassifications have been made to the balance sheet reported in the published Consolidated financial statements at 31 December 2007 in arriving at that presented in these financial... -

Page 129

... be analysed as follows: (â,¬ millions) 2008 2007 Sales of goods Rendering of services Contract revenues Rents on operating leases Rents on assets sold with a buy-back commitment Interest income from customers and other financial income of financial services companies Other Total Net revenues 54... -

Page 130

...and Fiat Group Automobiles (â,¬62 million). The restructuring costs of â,¬105 million in 2007 were incurred mainly by Sectors Fiat Group Automobiles (â,¬40 million), CNH - Case New Holland (â,¬30 million) and Comau (â,¬21 million). Fiat Group Consolidated Financial Statements at 31 December 2008 129 -

Page 131

... residual values of vehicles leased out under operating leases, those sold with buy-back clauses and those included in used stocks. In 2007, net expenses of â,¬166 million mainly referred to the rationalisation of a set of strategic Group suppliers, some of which were acquired in 2007. 9. Financial... -

Page 132

...) 2008 2007 Current taxes: - IRAP - Other taxes Total Current taxes Deferred taxes for the period: - IRAP - Other taxes Total Deferred taxes Taxes relating to prior periods Total Income taxes 168 755 923 (65) (415) (480) 23 466 188 624 812 4 (118) (114) 21 719 Fiat Group Consolidated Financial... -

Page 133

... in prior years (â,¬443 million) consists of the income offsetting the tax charge for the year (income of â,¬511 million in 2007). Other differences included unrecoverable withholding tax for â,¬50 million (â,¬27 million in 2007). 132 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 134

... financial instruments - Other Total Deferred tax assets Deferred tax liabilities arising from: - Accelerated depreciation - Deferred tax on gains on disposal - Capital investment grants - Employee benefits - Capitalisation of development costs - Other Total Deferred tax liabilities Theoretical tax... -

Page 135

...financial statements and their tax base. The decision to recognise deferred tax assets is taken by each company in the Group by assessing critically whether the conditions exist for the future recoverability of such assets on the basis of updated strategic plans, accompanied by the related tax plans... -

Page 136

... of the parent and the profit attributable to each class of shares, as well as, the weighted average number of outstanding shares for the two years presented: 2008 Ordinary shares Preference shares Saving shares Total Ordinary shares Preference shares Saving shares 2007 Total Profit attributable to... -

Page 137

... effects arose from stock option plans granted on Fiat S.p.A. on its ordinary shares at an exercise price above â,¬12.35 per share in 2008 and â,¬19.74 per share in 2007. Moreover, the net profit or loss attributable to the Group has been adjusted to take into account the dilutive effects that... -

Page 138

... 2007 Amortisation Impairment losses Divestitures Changes in the scope of consolidation Reclassified to Assets held for sale At 31 December 2008 Goodwill Trademarks and other intangible assets with indefinite useful lives - Development costs externally acquired - Development costs internally... -

Page 139

...2007 Goodwill Trademarks and other intangible assets with indefinite useful lives - Development costs externally acquired - Development costs internally generated Total Development costs... - - (7) 29 (4) (27) 30 389 307 38 7,048 138 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 140

... Trucks and Commercial Vehicles Metallurgical Products Fiat Group Automobiles FPT Powertrain Technologies Other Operating Segment Goodwill net carrying amount 1,699 786 133 112 56 18 10 1 - 2,815 1,626 786 138 87 56 18 10 - 3 2,724 Fiat Group Consolidated Financial Statements at 31 December 2008... -

Page 141

... and Case and New Holland Construction for construction equipment cash-generating unit while book value and total asset market multiples were utilised in determining the fair value of the Financial Services cash-generating unit. 140 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 142

... to which the cash-generating units belong. These cash flows are then discounted using rates that take account of current market assessments of the time value of money and the specific risks inherent in individual cash-generating units. Fiat Group Consolidated Financial Statements at 31 December... -

Page 143

... in 2007. Development costs recognised as assets are attributed to cash generating units and are tested for impairment together with the related tangible fixed assets, using the discounted cash flow method in determining their recoverable amount. 142 Fiat Group Consolidated Financial Statements at... -

Page 144

... At 31 December 2008 Land - Owned industrial buildings - Industrial buildings leased under finance leases Total Industrial buildings - Owned plant, machinery and equipment - Plant, machinery and equipment leased under finance leases Total Plant, machinery and equipment Assets sold with a buy-back... -

Page 145

... At 31 December 2007 Land - Owned industrial buildings - Industrial buildings leased under finance leases Total Industrial buildings - Owned plant, machinery and equipment - Plant, machinery and equipment leased under finance leases Total Plant, machinery and equipment Assets sold with a buy-back... -

Page 146

... Land - Owned industrial buildings - Industrial buildings leased under finance leases Total Industrial buildings - Owned plant, machinery and equipment - Plant, machinery and equipment leased under finance leases Total Plant, machinery and equipment Assets sold with a buy-back commitment - Owned... -

Page 147

... At 31 December 2007 Land - Owned industrial buildings - Industrial buildings leased under finance leases Total Industrial buildings - Owned plant, machinery and equipment - Plant, machinery and equipment leased under finance leases Total Plant, machinery and equipment Assets sold with a buy-back... -

Page 148

... Land - Owned industrial buildings - Industrial buildings leased under finance leases Total Industrial buildings - Owned plant, machinery and equipment - Plant, machinery and equipment leased under finance leases Total Plant, machinery and equipment Assets sold with a buy-back commitment - Owned... -

Page 149

... mainly relate to Fiat Group Automobiles, FPT Powertrain Technologies, Iveco, Magneti Marelli and CNH - Case New Holland and do not include capitalised borrowing costs. During 2008 the Group recognised impairment losses on Assets sold with a buy-back commitment from Trucks and Commercial Vehicles... -

Page 150

...) At 31 December 2008 At 31 December 2007 Investments accounted for using the equity method Investments at fair value with changes directly in equity Investments at cost Total Investments Non-current financial receivables Other securities Total Investments and other financial assets 1,899 18... -

Page 151

...374) 70 1,411 497 54 2,032 Revaluations and Write-downs consist of adjustments to the carrying value of investments accounted for using the equity method for the Group's share of the profit or loss for the year of the investee company for an amount of â,¬133 million in 2008 (â,¬210 million in 2007... -

Page 152

... the Board of Directors and is a party to a shareholder agreement. As a result the company is classified as an associate. In order to account for this investment using the equity method, reference was made to its most recent published financial statements being those of Interim Management Statement... -

Page 153

...2008, non-current financial receivables of â,¬47 million (â,¬51 million at 31 December 2007) were pledged as security for loans obtained. 17. Leased assets The Group leases out assets, mainly its own products, as part of its financial services business. This item changed as follows in 2008 and 2007... -

Page 154

... 2008 and 2007. The majority of amount due from customers for contract work relates to the Production Systems Sector and can be analysed as follows: (â,¬ millions) At 31 December 2008 At 31 December 2007 Aggregate amount of costs incurred and recognised profits (less recognised losses) to date... -

Page 155

...The carrying amount of Trade receivables is considered in line with their fair value at the date. At 31 December 2008, trade receivables of â,¬36 million were pledged as security for loans obtained (â,¬45 million at 31 December 2007). 154 Fiat Group Consolidated Financial Statements at 31 December... -

Page 156

... the following: (â,¬ millions) At 31 December 2008 At 31 December 2007 Retail financing Finance leases Dealer financing Supplier financing Current financial receivables from jointly controlled financial services entities Financial receivables from companies under joint control, associates and... -

Page 157

... sales of vehicles and are generally managed under dealer network financing programs as a component of the portfolio of the financial services companies. These receivables are interest bearing, with the exception of an initial limited, non-interest bearing period. The contractual terms governing the... -

Page 158

... binomial models and market parameters at the balance sheet date (in particular exchange rates, interest rates and volatility rates); I the fair value of interest rate swaps and forward rate agreements is determined by using the discounted cash flow method; I the fair value of derivative financial... -

Page 159

... sheet date; I the fair value of derivatives hedging commodity price risk is determined by using the discounted cash flow method, taking the market parameters at the balance sheet date (and in particular the future price of the underlying and interest rates). The overall increase in Other financial... -

Page 160

... in the quoted prices of the raw material. Cash flow hedges The economic effects mainly refer to the management of the currency risk and, to a lesser extent, to the hedges relating to the debt of the Group's financial companies and Group treasury. The policy of the Group for managing currency risk... -

Page 161

... from investments - Financial income (expenses) Taxes income (expenses) Total recognised in the income statement 138 115 50 9 9 (2) (24) 295 144 35 33 (4) 14 - (35) 187 The ineffectiveness of cash flow hedges was not material for the years 2008 and 2007. There was an overall positive economic... -

Page 162

...fair value at the balance sheet date. Cash with a pre-determined use consists of cash whose use is restricted to the repayment of the debt related to securitisations classified in the item Asset-backed financing. The credit risk associated with Cash and cash equivalents is limited, because it mainly... -

Page 163

... December 2008 At 31 December 2007 Other intangible assets Property, plant and equipment Investments and other financial assets Inventories Trade receivables Other current assets Cash and cash equivalents Total Assets Employee benefits Other provisions Trade payables Other current liabilities Total... -

Page 164

... to saving shares up to their par value, to the preference shares up to their par value, to the ordinary shares up to their par value; the remaining balance, if any, to shares of all three classes in an equal pro rata amount. Fiat Group Consolidated Financial Statements at 31 December 2008 163 -

Page 165

...; I an additional paid-in capital reserve is established if a company issues shares at a price exceeding their nominal value. This reserve may not be distributed until the legal reserve has reached one fifth of share capital; 164 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 166

... of cash from its industrial activities. In order to reach these objectives the Group aims at a continuous improvement in the profitability of the business in which it operates. Further, it may sell part of its assets to reduce the level of its debt, while the Board of Directors may make proposals... -

Page 167

... 2008 and at 31 December 2007, the following share-based compensation plans relating to managers of Group companies or members of the Board of Directors of Fiat S.p.A. were in place. Stock Option plans linked to Fiat S.p.A. ordinary shares The Board of Directors of Fiat S.p.A. approved certain stock... -

Page 168

...which was given on 5 April 2007) an eight year stock option plan, which provides certain managers of the Group and the Fiat S.p.A. Chief Executive Officer with the right to purchase a determined number of Fiat S.p.A. ordinary shares at the fixed price of â,¬13.37 per share. In particular, the 10,000... -

Page 169

... certain pre-determined profitability targets ( Non-Market Conditions or "NMC") in the reference period and which may be exercised from the date on which the 2010 Financial statements are approved. The contractual terms of the 2008 plan are as follows: Strike price (â,¬) Number of options granted... -

Page 170

... accounting policies, in the case of share-based payments the Group applies IFRS 2 to all those stock options granted after 7 November 2002 which had not yet vested at 1 January 2005, namely the July 2004, November 2006 and July 2008 stock option plans. More specifically, for the November 2006 plan... -

Page 171

... Plan ("CNH Directors' Plan") This plan, as amended on July 22, 2008, provides for the payment of the following to independent outside members of the CNH Global N.V. Board in the form of cash, and/or common shares of CNH, and/or options to purchase common shares of CNH. I an annual retainer... -

Page 172

... on specific performance targets for the Sector linked to the IFRS results of CNH, to officers and employees of CNH and its subsidiaries. As of 31 December 2008, CNH has reserved 15,900,000 shares for the CNH EIP (15,900,000 shares at December 31, 2007). The plan envisages stock option and share... -

Page 173

...18 21.20 37.16 68.85 Changes during the period in all CNH stock option plans are as follows: 2008 Average exercise price (in USD) 2007 Average exercise price (in USD) Number of shares Number of shares Outstanding at the beginning of the year Granted Forfeited Exercised Expired Outstanding at the... -

Page 174

...shares at 31 December 2007) available for issue under the CNH EIP. The Black-Scholes pricing model was used to calculate the fair value of stock options by CNH - Case New Holland Sector. The weighted-average assumptions used under the Black-Scholes pricing model were as follows: Directors' plan 2008... -

Page 175

... four cash-settled share-based payment schemes entitled Stock Appreciation Rights (SAR) plans. Under these plans, certain of the employees involved have the right to receive a payment corresponding to the increase in price between the grant date and the exercise date of General Motors $1 2/3 shares... -

Page 176

...liability arising from cash-settled share-based payment transactions at fair value at each reporting date and at the date of settlement; the changes in the fair value of these liabilities are recognised in the income statement for the period. At 31 December 2008 and 2007, the Group measured the fair... -

Page 177

...regulated markets in accordance with the following conditions: I the Programme will end on 30 September 2009, or once the maximum purchase value of â,¬1.8 billion (including the â,¬656.6 million in Fiat shares currently held by the Company) or a number of shares equivalent to 10% of share capital is... -

Page 178

... the employee has rendered his service and includes this cost by destination in Cost of sales, Selling, general and administrative costs and Research and development costs. In 2008, these expenses totalled â,¬1,366 million (â,¬1,243 million in 2007). Fiat Group Consolidated Financial Statements at... -

Page 179

... December 2006 these plans were fully unfunded; starting in 2007, the Group began making contributions on a voluntary basis to a separate and independently managed fund established to finance the North American health care plans. 178 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 180

... render the related service. The item Other long-term employee benefits consists of the Group's obligation for those benefits generally payable during employment on reaching a certain level of seniority in the company or when a specified event occurs, and reflects the probability of payment and the... -

Page 181

... changing mix of medical services. The change in the U.S. assumed health care trend rate from 2007 to 2008 is a result of recent health care cost experience. The expected long-term rate of return on plan assets reflects management's expectations on long-term average rates of return on funds invested... -

Page 182

... amounts recognised in the income statement for Post-employment benefits are as follows: Employee severance indemnity (â,¬ millions) 2008 2007 2008 Pension Plans 2007 Health care plans 2008 2007 2008 Other 2007 Current service cost Interest costs Expected return on plan assets Net actuarial losses... -

Page 183

... in the present value of Post-employment obligations are as follows: Employee severance indemnity (â,¬ millions) 2008 2007 2008 Pension Plans 2007 Health care plans 2008 2007 2008 Other 2007 Present value of obligation at the beginning of the year Current service cost Interest costs Contribution by... -

Page 184

... independently managed fund established to finance the North American health care plans. Plan assets for Post-employment benefits and Health-care benefits mainly consist of listed equity instruments and fixed income securities; plan assets do not include treasury shares of Fiat S.p.A. or properties... -

Page 185

...Commercial Vehicles 21 (23 at 31 December 2007); Metallurgical Products 16 (14 at 31 December 2007); Components 65 (8 at 31 December 2007); Production Systems 20 (28 at 31 December 2007); Other sectors 30 (22 at 31 December 2007). 184 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 186

... of the costs that are expected to be incurred in connection with product defects that could result in a larger recall of vehicles. This provision for risks is developed through an assessment of reported damages or returns on a case-by-case basis. Fiat Group Consolidated Financial Statements at 31... -

Page 187

... by Fiat S.p.A. The issuer taking part in the program is, among others, Fiat Finance & Trade Ltd. S.A. for an amount outstanding of â,¬3,768 million. As a part of this Program, a new bond having a nominal value of â,¬1 billion was issued in 2007 by Fiat Finance North America Inc. at a price of... -

Page 188

... website at www.fiatgroup.com under "Investor Relations - Financial Reports" . Most of the bonds issued by the Group impose covenants on the issuer and, in certain cases, on Fiat S.p.A. as guarantor, which is standard international practice for similar bonds issued by companies in the same industry... -

Page 189

... buy backs, if made, depend upon market conditions, the financial situation of the Group and other factors which could affect such decisions. Committed credit lines expiring after the end of 2009, amounting to approximately â,¬2 billion, were almost entirely used at 31 December 2008. 188 Fiat Group... -

Page 190

... 2007), determined using the quoted market price of financial instruments, if available, or the related future cash flows. The amount is calculated using the interest rates stated in Note 19, suitably adjusted to take account of the Group's current creditworthiness. At 31 December 2008 the Group... -

Page 191

... net debt as presented in the Report on Operations Less: Current financial receivables, excluding those due from jointly controlled financial services companies amounting to â,¬3 million at 31 December 2008 (amounting to â,¬81 million at 31 December 2007) Net financial position (17,954) (10... -

Page 192

... is considered in line with their fair value at the balance sheet date. 29. Other current liabilities An analysis of Other current liabilities is as follows: (â,¬ millions) At 31 December 2008 At 31 December 2007 Advances on buy-back agreements Indirect tax payables Accrued expenses and deferred... -

Page 193

... network, sold to jointly-controlled financial services companies (FAFS) for â,¬3,181 million (â,¬3,817 million at 31 December 2007) and associated financial service companies (Iveco Finance Holdings, controlled by Barclays) for â,¬752 million (â,¬869 million at 31 December 2007). 192 Fiat Group... -

Page 194

... lease contracts The Group enters into operating lease contracts for the right to use industrial buildings and equipments with an average term of 10-20 years and 3-5 years, respectively. The total future minimum lease payments under non-cancellable lease contracts are as follows: At 31 December 2008... -

Page 195

...Agricultural and Construction Equipment segment (CNH-Case New Holland) is active globally in the design, production and sale of agricultural and construction equipment. This segment also provides financial services to its end customers and dealers. I The Trucks and Commercial Vehicles segment (Iveco... -

Page 196

... cylinder heads. I The Production System segment (Comau) derives its revenues from the design and production of industrial automation systems and related products for the automotive sector. The Group assesses performance of its operating segments on the basis of Trading profit, Operating profit... -

Page 197

...items & adjustments FIAT Group (â,¬ millions) Maserati Ferrari CNH Iveco FPT Teksid Comau 2008 Segment revenues Revenues from transactions with other operating segments Revenues from external customers Trading profit Unusual income/(expense) Operating profit/(loss) Financial income/(expense... -

Page 198

... expense and other financial expense of the financial services entities, the operating assets of Fiat Group Automobiles, Ferrari, CNH-Case New Holland and Iveco also include the financial assets (predominantly the loan portfolio) of their financial services companies. Similarly, liabilities for... -

Page 199

... FIAT Group (â,¬ millions) Maserati Ferrari CNH Iveco FPT Teksid Comau At 31 December 2008 Segment assets Tax assets Receivables from financing activities, Non-current Other receivables and Securities of industrial companies Cash and cash equivalents, Current securities and Other financial... -

Page 200

... Other Operating Segments Unallocated items & adjustments FIAT Group At 31 December 2007 Segment assets Tax assets Receivables from financing activities, Non-current Other receivables and Securities of industrial companies Cash and cash equivalents, Current securities and Other financial assets... -

Page 201

...058 1,231 13,508 42,672 Total non-current Assets, excluding financial assets, deferred tax assets, defined benefit assets and rights arising under insurance contracts located in Italy totalled â,¬11,622 million at 31 December 2008 (â,¬10,391 million at 31 December 2007) and the total of such assets... -

Page 202

.... Dealers and final customers are subject to specific assessments of their creditworthiness under a detailed scoring system; in addition to carrying out this screening process, the Group also obtains financial and non-financial guarantees for credit granted for the sale of cars, commercial vehicles... -

Page 203

... and 2007, in support of the struggling agricultural sector, the Brazilian government granted a series of payment moratorium extending the loan payment terms and rescheduling, at the same time, the maturity of payments due on the credit lines provided to Banco CNH and all other financial services... -

Page 204

... trade receivables or payables denominated in a currency different from the money of account of the company itself. In addition, in a limited number of cases, it may be convenient from an economic point of view or it may be required under local market conditions, for companies to obtain finance or... -

Page 205

... the sale of receivables, or the return on investments, and the employment of funds, causing an impact on the level of net financial expenses incurred by the Group. In addition, the financial services companies provide loans (mainly to customers and dealers), financing themselves using various... -

Page 206

..., the Group holds certain derivative financial instruments whose value is linked to the price of listed shares and stock market indices (principally Equity swaps on Fiat shares). Although theses transactions were entered into for hedging purposes, they do not qualify for hedge accounting under IFRS... -

Page 207

... companies Other related parties Total related parties Effect on Total (â,¬ millions) Other investments and non current financial assets Inventories Trade receivables Current receivables from financing activities Current tax receivables Other current assets Current financial assets Cash and cash... -

Page 208

... of engines, other components and production systems Tofas-Turk Otomobil Fabrikasi Tofas A.S., for the sale of motor vehicles Fiat Group Automobiles Financial Services S.p.A. for the sale of motor vehicles Fiat India Automobiles Limited, for the provision of services, recharges of research costs and... -

Page 209

... operating or financial lease arrangements. In particular: (â,¬ millions) At 31 December 2008 At 31 December 2007 Fiat India Automobiles Limited Tofas-Turk Otomobil Fabrikasi Tofas A.S. Società Europea Veicoli Leggeri-Sevel S.p.A. Fiat Group Automobiles Financial Services S.p.A. Société Europ... -

Page 210

... sales of motor vehicles and components, including engines and gearboxes, production systems, and the provision of services, to the following companies: (â,¬ millions) 2008 2007 Iveco Finance Holdings Ltd. (a subsidiary of the Barclays group), for the sale of industrial vehicles leased out by the... -

Page 211

...be recognised in the balance sheet at 31 December 2008 since the acquired company is capable of achieving a high level of profitability and additional benefits will arise from the purchase. The IFRS book value of the acquiree's assets and liabilities at the acquisition date and immediately after the... -

Page 212

...be recognised in the balance sheet at 31 December 2007 since the acquired company is capable of achieving a high level of profitability and additional benefits will arise from the purchase. The IFRS book value of the acquiree's assets and liabilities at the acquisition date and immediately after the... -

Page 213

... to be recognised in the balance sheet at 31 December 2007 since the acquired company is capable of achieving a high level of profitability, synergies from the acquisition are expected to provide value and additional benefits will arise from the purchase. The IFRS book value of the acquiree's assets... -

Page 214

The book value at the disposal date of the net assets sold is summarised in the following table: (â,¬ millions) Total sales of consolidated subsidiaries Non-current assets Cash and cash equivalents Other current assets Total assets Debt Other liabilities Total liabilities - 1 12 13 - 8 8 The ... -

Page 215

... investments and the related net cash inflows in 2007 are provided as follows: (â,¬ millions) Total sales of other investments of which Mediobanca Total Consideration received Total Net cash inflows generated 251 251 225 225 214 Fiat Group Consolidated Financial Statements at 31 December 2008 -

Page 216

... countries, development and growth will be agreed with other operators in the automotive business and vehicles will be constructed on behalf of other manufacturers and/or the manufacturing know how will be sold. These agreements, which have by now become part of the Group's ordinary operations, had... -

Page 217

... (Chrysler) and Cerberus Capital Management L.P., the private investment majority owner of Chrysler LLC, announced the signing of a non-binding term sheet for the establishment of a global strategic alliance. According to the term sheet, the alliance, to be a key element of Chrysler's viability plan... -

Page 218

...Companies in the list are grouped according to type of control and consolidation method, and are further classified in accordance with IFRS 8 - Operating Segments. For each company, the following information is provided: name, location of registered office, country and share capital (in the original... -

Page 219

... SA Clickar Assistance S.R.L. Customer Services Centre S.r.l. Easy Drive S.r.l. Fiat Auto Argentina S.A. (business Fiat Group Automobiles) Fiat Auto Dealer Financing SA Fiat Auto Poland S.A. Fiat Auto S.A. de Ahorro para Fines Determinados Fiat Auto Var S.r.l. Fiat Automobil Vertriebs GmbH... -

Page 220

... a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Fiat Group Automobiles Maroc S.A. Fiat Group Automobiles Netherlands B.V. Fiat Group Automobiles Portugal, S.A. Fiat Group Automobiles... -

Page 221

... Services AG Ferrari Financial Services S.p.A. Ferrari Financial Services, Inc. Ferrari GB Limited Ferrari GE.D. S.p.A. Ferrari International S.A. Ferrari Japan KK Ferrari Management Consulting (Shanghai) CO., LTD Ferrari Maserati Cars International Trading (Shanghai) Co. Ltd. Ferrari Maserati Cars... -

Page 222

...Case Credit Holdings Limited Case Dealer Holding Company LLC Case Equipment Holdings Limited Case Equipment International Corporation Case Europe S.a.r.l. Case Harvesting Systems GmbH CASE IH Machinery Trading (Shanghai) Co. Ltd. Case India Limited Case International Marketing Inc. Case LBX Holdings... -

Page 223

...Capital Canada Ltd. Calgary CNH CNH CNH CNH CNH CNH CNH CNH CNH CNH CNH CNH CNH CNH Capital Insurance Agency Inc. Capital LLC Capital plc Capital RACES LLC Capital Receivables LLC Capital U.K. Ltd Componentes, S.A. de C.V. Danmark A/S Deutschland GmbH Engine Corporation Europe Holding S.A. Financial... -

Page 224

... Limited 51.000 Case Equipment Holdings Limited 51.000 New Holland Excavator Holdings LLC 65.000 CNH Global N.V. 100.000 CNH Australia Pty Limited 100.000 CNH Capital Australia Pty Limited 100.000 CNH Capital LLC 100.000 CNH America LLC 100.000 CNH Asian Holding Limited N.V. 96.407 Fiat Group... -

Page 225

...line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Afin Leasing... 70....Services Limited Iveco Czech Republic A.S. Iveco Danmark A/S Iveco España S.L. (business Trucks and Commercial Vehicles... -

Page 226

... on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Iveco France Iveco Iveco Iveco Iveco Holdings Limited Insurance Vostok LLC International Trade Finance S.A. Investitions... -

Page 227

... a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Mediterranea de Camiones S.L. Officine Brennero S.p.A. OOO Afin Leasing Vostok LLC OOO Iveco Russia S.A. Iveco Belgium N.V. S.C.I. La... -

Page 228

Subsidiaries consolidated on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Fiat Powertrain Technologies of North America, Inc. Fiat Powertrain Technologies Poland Sp. z o.o. FMA - ... -

Page 229

... line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Automotive Lighting S.R.O. Automotive Lighting UK Limited Ergom Automotive S.p.A. Ergom do Brasil Ltda Ergom France S.A.S. Ergom Holding... -

Page 230

... 99.99 99.99 Magneti Marelli Parts and Services S.p.A. Magneti Marelli Powertrain (Shanghai) Co. Ltd. Magneti Marelli Powertrain GmbH Magneti Marelli Powertrain India Private Limited Magneti Marelli Powertrain Slovakia s.r.o. Magneti Marelli Powertrain U.S.A. LLC Magneti Marelli Racing Ltd Magneti... -

Page 231

...on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Magneti Marelli Sistemas Electronicos Mexico S.A. Magneti Marelli Slovakia s.r.o. Magneti Marelli South Africa (Proprietary) Limited... -

Page 232

... consolidated on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights I Production Systems Comau S.p.A. Autodie International, Inc. Comau (Shanghai) Automotive Equipment Co. Ltd... -

Page 233

... on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights I Publishing and Communications Itedi-Italiana Edizioni S.p.A. BMI S.p.A. Editrice La Stampa S.p.A. La Stampa Europe SAS... -

Page 234

...Fiat Finance Canada Ltd. Fiat Finance et Services S.A. Fiat Finance North America Inc. Fiat Finance S.p.A. Fiat GmbH Fiat Group Marketing & Corporate Communication S.p.A. Fiat Group Purchasing France S.a.r.l. Fiat Group Purchasing Poland Sp. z o.o. Fiat Group Purchasing S.r.l. Fiat Iberica S.A. Fiat... -

Page 235

Subsidiaries consolidated on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Isvor Fiat Società consortile di sviluppo e addestramento industriale per Azioni Turin Italy 300,000 ... -

Page 236

... consolidated on a line-by-line basis (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights C.R.F . Società Consortile per Azioni 0.535 New Holland Kobelco Construction Machinery S.p.A. 0.535 Fiat Servizi per... -

Page 237

... CAPITAL RE Limited FGA Capital Services Spain S.A. FGA Capital Spain E.F .C. S.A. FGA Leasing GmbH Fiat Auto Contracts Ltd Fiat Auto Financial Services (Wholesale) Ltd. Fiat Auto Financial Services Limited Fiat Bank Polska S.A. Fiat Credit Belgio S.A. Fiat Credit Hellas Commercial S.A. of Vehicles... -

Page 238

... office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Fidis Finance (Suisse) S.A. Fidis Finance Polska Sp. z o.o. Fidis Insurance Consultants SA Fidis Leasing Polska Sp. z o.o. Fidis Nederland B.V. Fidis Retail Financial Services... -

Page 239

... L&T-Case Equipment Private Limited LBX Company LLC Megavolt L.P . L.L.L.P . New Holland HFT Japan Inc. Turk Traktor Ve Ziraat Makineleri A.S. I Trucks and Commercial Vehicles Iveco Fiat - Oto Melara Società consortile r.l. Naveco Ltd. SAIC IVECO Commercial Vehicle Investment Company Limited SAIC... -

Page 240

... Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Subsidiaries accounted for using the equity method I Fiat Group Automobiles Alfa Romeo Inc. F .A. Austria Commerz GmbH Fiat Auto Egypt Industrial Company SAE Fiat... -

Page 241

... Case Construction Equipment, Inc. Case Credit Wholesale Pty. Limited Case IH Agricultural Equipment, Inc. Fermec North America Inc. International Harvester Company J.I. Case Company Limited Limited Liability Company "CNH Parts and Service Operations" New Holland Agricultural Equipment S.p.A. New... -

Page 242

... office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights I Trucks and Commercial Vehicles Altra S.p.A. Genoa Consorzio per la Formazione Commerciale Iveco-Coforma in liquidation Turin Irisbus North America Limited Liability Company... -

Page 243

Subsidiaries valued at cost (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights I Holding companies and Other companies Fiat Common Investment Fund Limited Fiat Gra.De EEIG London Watford United Kingdom ... -

Page 244

... Ferrari Financial Services AG 49.000 I Agricultural and Construction Equipment Al-Ghazi Tractors Ltd CNH Capital Europe S.a.S. Employers Health Initiatives LLC Kobelco Construction Machinery Co. Ltd. Medicine Hat New Holland Ltd. New Holland Finance Ltd I Trucks and Commercial Vehicles Karachi... -

Page 245

Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Associated companies valued at cost I Fiat Group Automobiles Consorzio per la Reindustrializzazione Area di Arese S.r.l. in liquidation Arese Fidis Rent GmbH ... -

Page 246

Associated companies valued at cost (continued) Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights I Holding companies and Other companies Ascai Servizi S.r.l. in liquidation Ciosa S.p.A. in liquidation Consorzio Parco... -

Page 247

Name Registered office Country Share capital % of Group consoliCurrency dation Interest held by % interest held % of voting rights Other companies valued at cost I Agricultural and Construction Equipment Polagris S.A. I Trucks and Commercial Vehicles Pikieliszki Lithuania 1,133,400 LTL... -

Page 248

... of Fiat S.p.A. (2) Agreed upon procedures for certain aspects of the system of internal control over financial reporting. (3) Attestation of tax forms ('Modello Unico' and Form 770), and of accounting reports required for tax credits and other contributions for industrial research. (4) Sarbanes... -

Page 249

... conditions, results of operations and cash flows of the Company and its consolidated subsidiaries as of 31 December 2008 and for the year then ended. 3.2 the report on operations includes a reliable operating and financial review of the Company and of the Group as well as a description of the main... -

Page 250

-

Page 251

There are but two powers in the world: the sword and the mind. In the long run, the sword is always beaten by the mind. Napoleon -

Page 252

Statutory Financial Statements at 31 December 2008 252 Income Statement 253 Balance Sheet 254 Cash Flow Statement 255 Statement of Changes in Shareholders' Equity 256 Income Statement pursuant to Consob Resolution No. 15519 of 27 July 2006 257 Balance Sheet pursuant to Consob Resolution No. 15519 of... -

Page 253