Cablevision 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

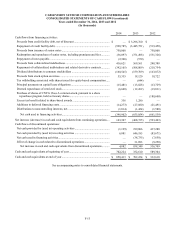

F-7

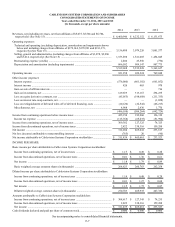

CABLEVISION SYSTEMS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

Years ended December 31, 2014, 2013 and 2012

(In thousands, except per share amounts)

2014 2013 2012

Revenues, net (including revenues, net from affiliates of $5,075, $5,586 and $5,784,

respectively) (See Note 15) ................................................................................................. $ 6,460,946 $ 6,232,152 $ 6,131,675

Operating expenses:

Technical and operating (excluding depreciation, amortization and impairments shown

below and including charges from affiliates of $179,144, $178,991 and $181,373,

respectively) (See Note 15) .............................................................................................. 3,136,808 3,079,226 3,001,577

Selling, general and administrative (including charges from affiliates of $3,878, $2,986

and $3,614, respectively) (See Note 15) .......................................................................... 1,533,898 1,521,005 1,454,045

Restructuring expense (credits) ............................................................................................ 2,480 23,550 (770)

Depreciation and amortization (including impairments) ...................................................... 866,502 909,147 907,775

5,539,688 5,532,928 5,362,627

Operating income ................................................................................................................... 921,258 699,224 769,048

Other income (expense):

Interest expense .................................................................................................................... (576,000) (601,102) (661,052)

Interest income ..................................................................................................................... 420 465 978

Gain on sale of affiliate interests .......................................................................................... — — 716

Gain on investments, net ...................................................................................................... 129,659 313,167 294,235

Loss on equity derivative contracts, net ............................................................................... (45,055) (198,688) (211,335)

Loss on interest rate swap contracts, net .............................................................................. — — (1,828)

Loss on extinguishment of debt and write-off of deferred financing costs .......................... (10,120) (22,542) (66,213)

Miscellaneous, net ............................................................................................................... 4,988 2,436 1,770

(496,108) (506,264) (642,729)

Income from continuing operations before income taxes ....................................................... 425,150 192,960 126,319

Income tax expense .............................................................................................................. (115,768) (65,635) (51,994)

Income from continuing operations, net of income taxes ....................................................... 309,382 127,325 74,325

Income from discontinued operations, net of income taxes.................................................... 2,822 338,316 159,288

Net income ............................................................................................................................. 312,204 465,641 233,613

Net loss (income) attributable to noncontrolling interests ...................................................... (765) 20 (90)

Net income attributable to Cablevision Systems Corporation stockholders ........................... $ 311,439 $ 465,661 $ 233,523

INCOME PER SHARE:

Basic income per share attributable to Cablevision Systems Corporation stockholders:

Income from continuing operations, net of income taxes .................................................... $ 1.17 $ 0.49 $ 0.28

Income from discontinued operations, net of income taxes ................................................. $ 0.01 $ 1.30 $ 0.61

Net income ........................................................................................................................... $ 1.18 $ 1.79 $ 0.89

Basic weighted average common shares (in thousands) ...................................................... 264,623 260,763 262,258

Diluted income per share attributable to Cablevision Systems Corporation stockholders:

Income from continuing operations, net of income taxes .................................................... $ 1.14 $ 0.48 $ 0.28

Income from discontinued operations, net of income taxes ................................................. $ 0.01 $ 1.27 $ 0.60

Net income ........................................................................................................................... $ 1.15 $ 1.75 $ 0.87

Diluted weighted average common shares (in thousands) ................................................... 270,703 265,935 267,330

Amounts attributable to Cablevision Systems Corporation stockholders:

Income from continuing operations, net of income taxes .................................................... $ 308,617 $ 127,345 $ 74,235

Income from discontinued operations, net of income taxes ................................................. 2,822 338,316 159,288

Net income ........................................................................................................................... $ 311,439 $ 465,661 $ 233,523

Cash dividends declared and paid per share of common stock............................................... $ 0.600 $ 0.600 $ 0.600

See accompanying notes to consolidated financial statements.