Cablevision 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-46

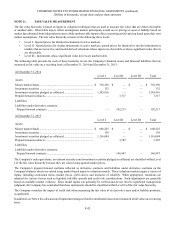

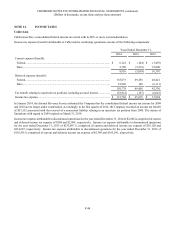

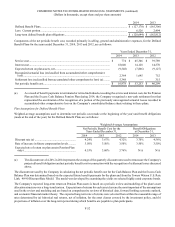

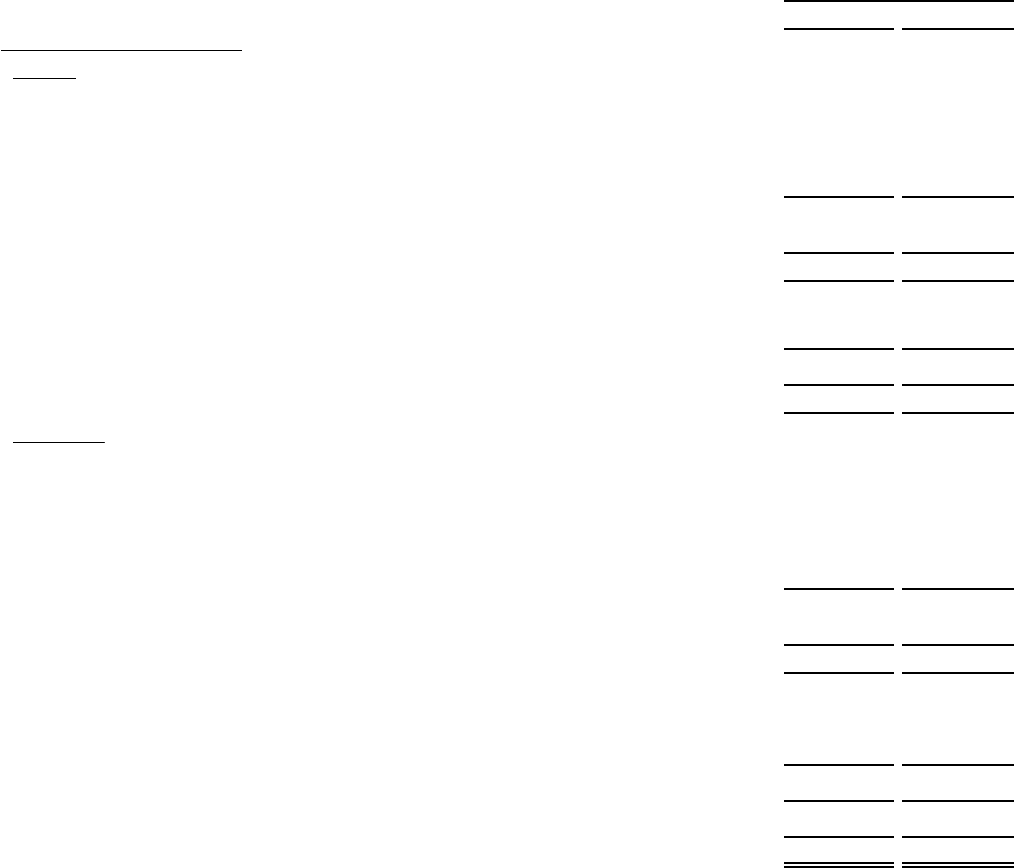

December 31,

2014 2013

Deferred Tax Asset (Liability)

Current

NOLs and tax credit carry forwards ............................................................................................... $ 144,833 $ 224,968

Compensation and benefit plans..................................................................................................... 74,220 44,629

Allowance for doubtful accounts.................................................................................................... 4,557 5,502

Other liabilities ............................................................................................................................... 4,909 13,389

Deferred tax asset....................................................................................................................... 228,519 288,488

Valuation allowance........................................................................................................................ (3,496)(6,988)

Net deferred tax asset, current ................................................................................................... 225,023 281,500

Investments..................................................................................................................................... (159,475)(97,565)

Prepaid expenses............................................................................................................................. (27,605)(24,111)

Deferred tax liability, current..................................................................................................... (187,080)(121,676)

Net deferred tax asset, current ........................................................................................................ 37,943 159,824

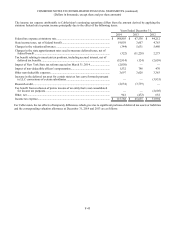

Noncurrent

NOLs and tax credit carry forwards ............................................................................................... 25,427 65,322

Compensation and benefit plans..................................................................................................... 99,076 106,595

Newsday Holdings and other partnership investments................................................................... 123,243 132,384

Investments..................................................................................................................................... 22,294 —

Other ............................................................................................................................................... 7,345 4,896

Deferred tax asset....................................................................................................................... 277,385 309,197

Valuation allowance........................................................................................................................ (3,901)(7,488)

Net deferred tax asset, noncurrent ............................................................................................. 273,484 301,709

Fixed assets and intangibles............................................................................................................ (884,120)(840,375)

Investments..................................................................................................................................... — (29,563)

Other ............................................................................................................................................... (452)(1,827)

Deferred tax liability, noncurrent............................................................................................... (884,572)(871,765)

Net deferred tax liability, noncurrent......................................................................................... (611,088)(570,056)

Total net deferred tax liability......................................................................................................... $ (573,145) $ (410,232)

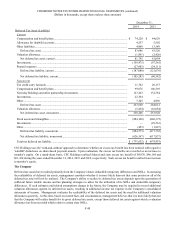

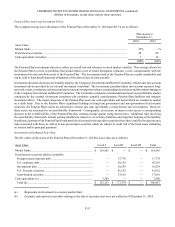

At December 31, 2014, Cablevision had consolidated federal net operating loss carry forwards ("NOLs") of $619,955 expiring on

various dates from 2024 through 2031. Cablevision has recorded a deferred tax asset related to $241,005 of such NOLs. A deferred

tax asset has not been recorded for the remaining NOL of $378,950 as this portion relates to 'windfall' deductions on share-based

awards that have not yet been realized. Cablevision uses the 'with-and-without' approach to determine whether an excess tax

benefit has been realized. Upon realization, such excess tax benefits are recorded as an increase to paid-in capital. Cablevision

realized excess tax benefit of $336 and $1,280 during the years ended December 31, 2014 and 2013, respectively, resulting in an

increase to paid-in capital.

As of December 31, 2014, Cablevision has $39,919 of federal alternative minimum tax credit carry forwards which do not expire.

As of December 31, 2014, Cablevision has $14,818 of research credits, expiring in varying amounts from 2023 through 2034.

Subsequent to the utilization of Cablevision's NOLs and tax credit carry forwards, payments for income taxes are expected to

increase significantly.