Cablevision 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-34

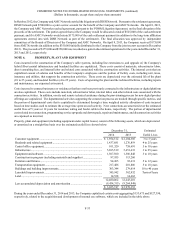

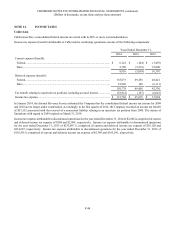

Depreciation expense on property, plant and equipment (including capital leases) for the years ended December 31, 2014, 2013

and 2012 amounted to $852,451, $858,899 and $879,242 (including impairment charges of $425, $10,997 and $829 in 2014, 2013

and 2012), respectively.

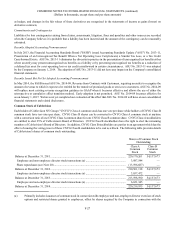

At December 31, 2014 and 2013, the gross amount of equipment and related accumulated amortization recorded under capital

leases were as follows:

December 31,

2014 2013

Equipment........................................................................................................................................... $ 95,719 $ 65,454

Less accumulated amortization........................................................................................................... (39,951)(31,138)

$ 55,768 $ 34,316

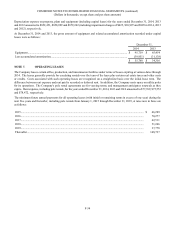

NOTE 7. OPERATING LEASES

The Company leases certain office, production, and transmission facilities under terms of leases expiring at various dates through

2034. The leases generally provide for escalating rentals over the term of the lease plus certain real estate taxes and other costs

or credits. Costs associated with such operating leases are recognized on a straight-line basis over the initial lease term. The

difference between rent expense and rent paid is recorded as deferred rent. In addition, the Company rents space on utility poles

for its operations. The Company's pole rental agreements are for varying terms, and management anticipates renewals as they

expire. Rent expense, including pole rentals, for the years ended December 31, 2014, 2013 and 2012 amounted to $77,769, $75,553

and $78,472, respectively.

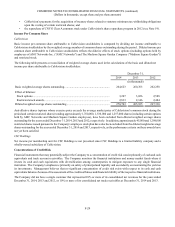

The minimum future annual payments for all operating leases (with initial or remaining terms in excess of one year) during the

next five years and thereafter, including pole rentals from January 1, 2015 through December 31, 2019, at rates now in force are

as follows:

2015............................................................................................................................................................................ $ 66,289

2016............................................................................................................................................................................ 70,277

2017............................................................................................................................................................................ 62,511

2018............................................................................................................................................................................ 51,246

2019............................................................................................................................................................................ 37,778

Thereafter................................................................................................................................................................... 168,737