Cablevision 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-44

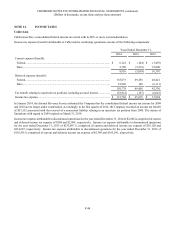

NOTE 12. INCOME TAXES

Cablevision

Cablevision files a consolidated federal income tax return with its 80% or more owned subsidiaries.

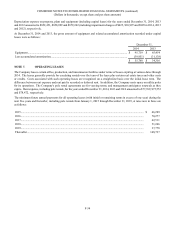

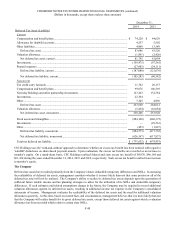

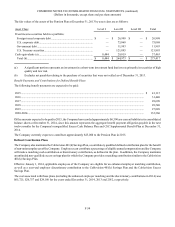

Income tax expense (benefit) attributable to Cablevision's continuing operations consists of the following components:

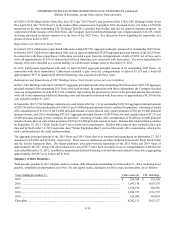

Years Ended December 31,

2014 2013 2012

Current expense (benefit):

Federal...................................................................................................................... $ 6,122 $ (144) $ (3,493)

State.......................................................................................................................... 2,788 (3,510) 19,800

8,910 (3,654) 16,307

Deferred expense (benefit):

Federal...................................................................................................................... 135,873 69,258 48,441

State.......................................................................................................................... 23,906 198 (6,111)

159,779 69,456 42,330

Tax benefit relating to uncertain tax positions, including accrued interest................ (52,921)(167)(6,643)

Income tax expense..................................................................................................... $ 115,768 $ 65,635 $ 51,994

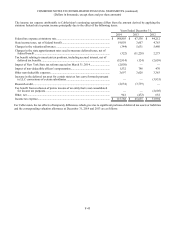

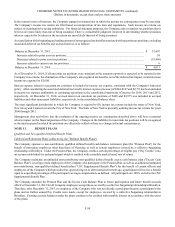

In January 2014, the Internal Revenue Service informed the Company that the consolidated federal income tax returns for 2009

and 2010 are no longer under examination. Accordingly, in the first quarter of 2014, the Company recorded an income tax benefit

of $53,132 associated with the reversal of a noncurrent liability relating to an uncertain tax position from 2009. The statute of

limitations with regard to 2009 expired on March 31, 2014.

Income tax expense attributable to discontinued operations for the year ended December 31, 2014 of $2,206 is comprised of current

and deferred income tax expense of $108 and $2,098, respectively. Income tax expense attributable to discontinued operations

for the year ended December 31, 2013 of $232,807 is comprised of current and deferred income tax expense of $18,120 and

$214,687, respectively. Income tax expense attributable to discontinued operations for the year ended December 31, 2012 of

$110,581 is comprised of current and deferred income tax expense of $5,340 and $105,241, respectively.