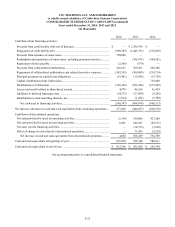

Cablevision 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

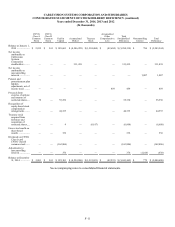

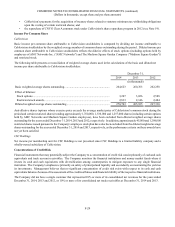

F-21

CSC HOLDINGS, LLC AND SUBSIDIARIES

(a wholly-owned subsidiary of Cablevision Systems Corporation)

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31, 2014, 2013 and 2012

(In thousands)

2014 2013 2012

Cash flows from operating activities:

Net Income............................................................................................................... $ 462,773 $ 620,055 $ 386,351

Adjustments to reconcile net income to net cash provided by operating

activities:

Income from discontinued operations, net of income taxes ............................. (2,822)(330,711)(159,288)

Depreciation and amortization (including impairments).................................. 866,502 909,147 907,775

Gain on sale of affiliate interests ...................................................................... — — (716)

Gain on investments, net................................................................................... (129,659)(313,167)(294,235)

Loss on equity derivative contracts, net ........................................................... 45,055 198,688 211,335

Loss on extinguishment of debt and write-off of deferred financing costs...... 9,618 23,144 66,213

Amortization of deferred financing costs and discounts on indebtedness........ 14,602 18,167 29,727

Share-based compensation expense related to Cablevision equity classified

awards............................................................................................................... 43,984 52,715 60,646

Settlement loss and amortization of actuarial losses related to pension and

postretirement plans...................................................................................... 7,643 1,575 997

Deferred income taxes...................................................................................... 53,189 99,867 72,379

Provision for doubtful accounts........................................................................ 47,611 55,231 49,002

Excess tax benefit related to share-based awards............................................. (4,978)(46,164)(61,434)

Change in assets and liabilities, net of effects of acquisitions and dispositions:

Accounts receivable, trade .................................................................................. (42,446)(25,673)(76,955)

Other receivables................................................................................................. 14,131 (13,905)(2,649)

Prepaid expenses and other assets....................................................................... 27,803 (2,176) 47,402

Advances/payables to affiliates........................................................................... 222,212 121,128 43,159

Accounts payable................................................................................................ 25,486 (1,715) 16,172

Accrued liabilities ............................................................................................... (29,608) 41,998 (25,487)

Deferred revenue................................................................................................. 5,169 (9,507)(2)

Liabilities related to interest rate swap contracts................................................ — — (55,383)

Net cash provided by operating activities................................................................ 1,636,265 1,398,697 1,215,009

Cash flows from investing activities:

Capital expenditures................................................................................................. (891,678)(951,679)(991,586)

Proceeds related to sale of equipment, including costs of disposal......................... 6,178 7,884 364

Proceeds from sale of affiliate interests................................................................... — — 750

Decrease (increase) in other investments................................................................. (1,369)(1,178) 955

Decrease in restricted cash....................................................................................... — — 1,149

Additions to other intangible assets......................................................................... (1,193)(3,685)(4,704)

Net cash used in investing activities ................................................................... (888,062)(948,658)(993,072)