Cablevision 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-41

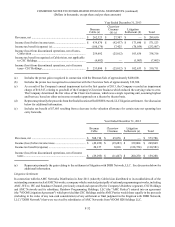

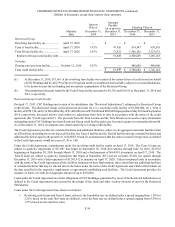

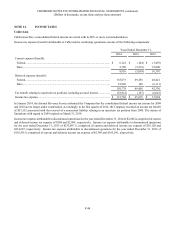

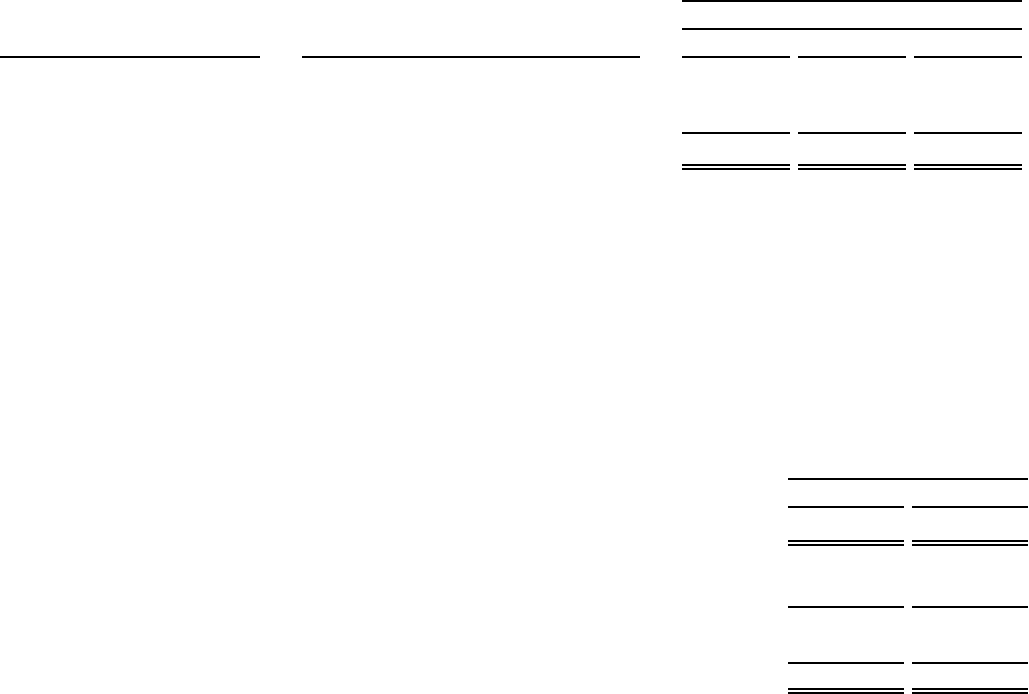

Derivatives Not Amount of Loss Recognized

Designated as Hedging Location of Loss Years Ended December 31,

Instruments Recognized 2014 2013 2012

Interest rate swap contracts ..... Loss on interest rate swap contracts, net $ — $ — $ (1,828)

Prepaid forward contracts........ Loss on equity derivative contracts, net (45,055)(198,688)(211,335)

$(45,055) $ (198,688) $ (213,163)

For the years ended December 31, 2014, 2013 and 2012, the Company recorded a gain on investments of $129,832, $313,251 and

$293,599, respectively, representing the net increase in the fair values of all investment securities pledged as collateral for the

period.

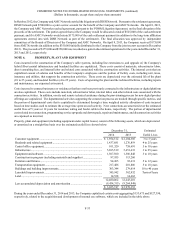

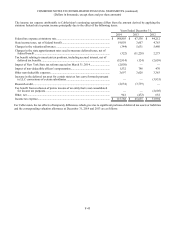

Settlements of Collateralized Indebtedness

The following table summarizes the settlement of the Company's collateralized indebtedness relating to Comcast shares that were

settled by delivering cash equal to the collateralized loan value, net of the value of the related equity derivative contracts for the

years ended December 31, 2014 and 2013. The cash was obtained from the proceeds of new monetization contracts covering an

equivalent number of Comcast shares. The terms of the new contracts allow the Company to retain upside participation in Comcast

shares up to each respective contract's upside appreciation limit with downside exposure limited to the respective hedge price.

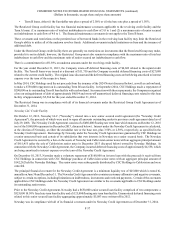

Years Ended December 31,

2014 2013

Number of shares .............................................................................................................................. 8,069,934 13,407,684

Collateralized indebtedness settled................................................................................................... $ (248,388) $ (307,763)

Derivative contracts settled............................................................................................................... (93,717)(200,246)

(342,105)(508,009)

Proceeds from new monetization contracts....................................................................................... 416,621 569,561

Net cash receipt................................................................................................................................. $ 74,516 $ 61,552

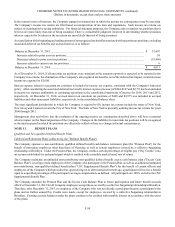

In January 2015, the Company settled collateralized indebtedness relating to 2,668,875 Comcast shares by delivering cash equal

to the collateralized loan value obtained from the proceeds of a new monetization contract covering an equivalent number of

Comcast shares. Accordingly, the consolidated balance sheets of Cablevision and CSC Holdings as of December 31, 2014 reflect

the reclassification of $154,821 of investment securities pledged as collateral from a current asset to a long-term asset and $103,227

of collateralized indebtedness from a current liability to a long-term liability.