Cablevision 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

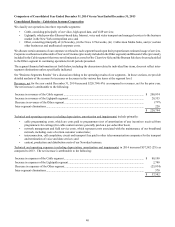

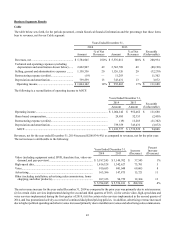

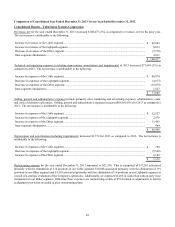

Selling, general and administrative expenses include primarily sales, marketing and advertising expenses, administrative costs,

and costs of customer call centers. Selling, general and administrative expenses increased $12,893 (1%) for 2014 as compared to

2013. The net increase is attributable to the following:

Increase in expenses of the Cable segment................................................................................................................ $ 32,230

Increase in expenses of the Lightpath segment.......................................................................................................... 4,897

Decrease in expenses of the Other segment............................................................................................................... (23,876)

Inter-segment eliminations......................................................................................................................................... (358)

$ 12,893

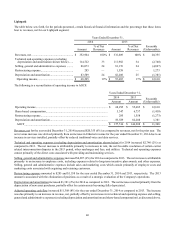

Depreciation and amortization (including impairments) decreased $42,645 (5%) for 2014 as compared to 2013. The net decrease

is attributable to the following:

Decrease in expenses of the Cable segment.............................................................................................................. $ (3,872)

Increase in expenses of the Lightpath segment......................................................................................................... 1,381

Decrease in expenses of the Other segment .............................................................................................................. (40,154)

$ (42,645)

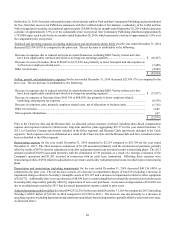

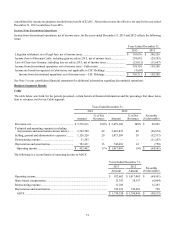

Restructuring expense for the year ended December 31, 2014 and 2013 amounted to $2,480 and $23,550. The 2014 amount is

comprised of $3,190 associated primarily with the elimination of positions in our Other segment, partially offset by credits related

to adjustments to facility realignment provisions recorded in prior restructuring plans. The 2013 amount was comprised of $11,283

associated primarily with the elimination of 234 positions in our Cable segment, $10,038 associated primarily with the elimination

of 191 positions in our Other segment and $1,558 associated primarily with the elimination of 16 positions in our Lightpath segment

as a result of a strategic evaluation of the Company's operations. Additionally, we expensed $1,205 in connection with an early

lease termination in our Other segment. Offsetting these expenses are restructuring credits of $534 related to adjustments to facility

realignment provisions recorded in prior restructuring plans.

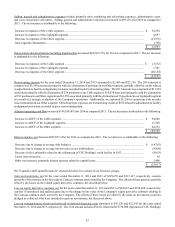

Adjusted operating cash flow increased $149,588 (9%) for 2014 as compared 2013. The net increase is attributable to the following:

Increase in AOCF of the Cable segment.................................................................................................................... $ 94,048

Increase in AOCF of the Lightpath segment.............................................................................................................. 11,308

Increase in AOCF of the Other segment.................................................................................................................... 44,232

$ 149,588

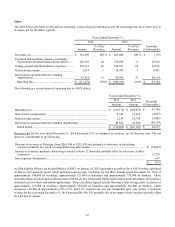

Interest expense, net decreased $25,057 (4%) for 2014 as compared to 2013. The net decrease is attributable to the following:

Decrease due to change in average debt balances ...................................................................................................... $ (14,762)

Decrease due to change in average interest rates on our indebtedness....................................................................... (4,808)

Decrease in fees, primarily related to the refinancing of CSC Holdings' credit facility in 2013 ............................... (8,018)

Lower interest income ................................................................................................................................................ 45

Other net increases, primarily interest expense related to capital leases.................................................................... 2,486

$ (25,057)

See "Liquidity and Capital Resources" discussion below for a detail of our borrower groups.

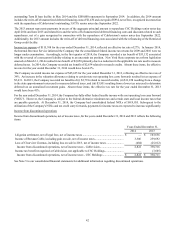

Gain on investments, net for the years ended December 31, 2014 and 2013 of $129,659 and $313,167, respectively, consists

primarily of the increase in the fair value of Comcast common stock owned by the Company. The effects of these gains are partially

offset by the losses on the related equity derivative contracts, net described below.

Loss on equity derivative contracts, net for the years ended December 31, 2014 and 2013 of $45,055 and $198,688, respectively,

consists of unrealized and realized gains due to the change in fair value of the Company's equity derivative contracts relating to

the Comcast common stock owned by the Company. The effects of these losses are offset by the gains on investment securities

pledged as collateral, which are included in gain on investments, net discussed above.

Loss on extinguishment of debt and write-off of deferred financing costs amounted to $10,120 and $22,542 for the years ended

December 31, 2014 and 2013, respectively. The 2014 amount includes $9,618, related to the $750,000 repayment of CSC Holdings'