Cablevision 2014 Annual Report Download - page 113

Download and view the complete annual report

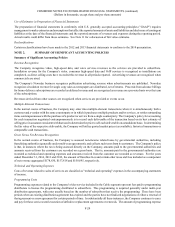

Please find page 113 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

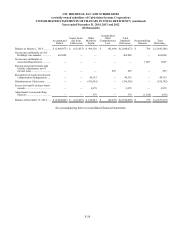

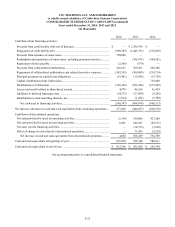

(Dollars in thousands, except share and per share amounts)

F-24

Use of Estimates in Preparation of Financial Statements

The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("GAAP") requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates. See Note 11 for a discussion of fair value estimates.

Reclassifications

Certain reclassifications have been made to the 2012 and 2013 financial statements to conform to the 2014 presentation.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Summary of Significant Accounting Policies

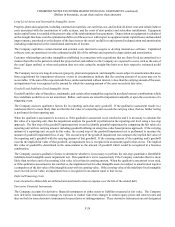

Revenue Recognition

The Company recognizes video, high-speed data, and voice services revenues as the services are provided to subscribers.

Installation revenue for the Company's video, consumer high-speed data and VoIP services is recognized as installations are

completed, as direct selling costs have exceeded this revenue in all periods reported. Advertising revenues are recognized when

commercials are aired.

The Company's Newsday business recognizes publication advertising revenue when advertisements are published. Newsday

recognizes circulation revenue for single copy sales as newspapers are distributed, net of returns. Proceeds from advance billings

for home-delivery subscriptions are recorded as deferred revenue and are recognized as revenue on a pro-rata basis over the term

of the subscriptions.

Revenues derived from other sources are recognized when services are provided or events occur.

Multiple-Element Transactions

In the normal course of business, the Company may enter into multiple-element transactions where it is simultaneously both a

customer and a vendor with the same counterparty or in which it purchases multiple products and/or services, or settles outstanding

items contemporaneous with the purchase of a product or service from a single counterparty. The Company's policy for accounting

for each transaction negotiated contemporaneously is to record each deliverable of the transaction based on its best estimate of

selling price in a manner consistent with that used to determine the price to sell each deliverable on a standalone basis. In determining

the fair value of the respective deliverable, the Company will utilize quoted market prices (as available), historical transactions or

comparable cash transactions.

Gross Versus Net Revenue Recognition

In the normal course of business, the Company is assessed non-income related taxes by governmental authorities, including

franchising authorities (generally under multi-year agreements), and collects such taxes from its customers. The Company's policy

is that, in instances where the tax is being assessed directly on the Company, amounts paid to the governmental authorities and

amounts received from the customers are recorded on a gross basis. That is, amounts paid to the governmental authorities are

recorded as technical and operating expenses and amounts received from the customer are recorded as revenues. For the years

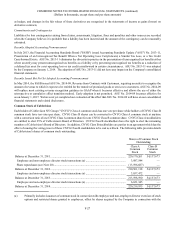

ended December 31, 2014, 2013 and 2012, the amount of franchise fees and certain other taxes and fees included as a component

of net revenue aggregated $178,630, $157,818 and $150,695, respectively.

Technical and Operating Expenses

Costs of revenue related to sales of services are classified as "technical and operating" expenses in the accompanying statements

of income.

Programming Costs

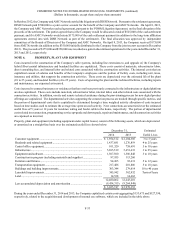

Programming expenses related to the Company's video service included in the Cable segment represent fees paid to programming

distributors to license the programming distributed to subscribers. This programming is acquired generally under multi-year

distribution agreements, with rates usually based on the number of subscribers that receive the programming. There have been

periods when an existing distribution agreement has expired and the parties have not finalized negotiations of either a renewal of

that agreement or a new agreement for certain periods of time. In substantially all these instances, the Company continues to carry

and pay for these services until execution of definitive replacement agreements or renewals. The amount of programming expense