Cablevision 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Other

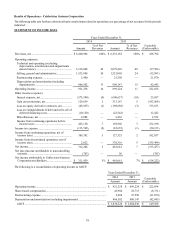

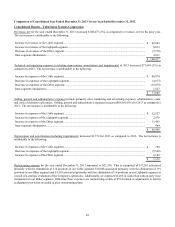

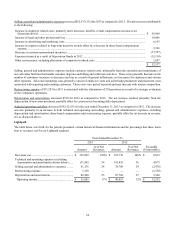

The table below sets forth, for the periods presented, certain financial information and the percentage that those items bear to

revenues, net for the Other segment.

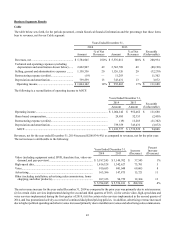

Years Ended December 31,

2014 2013

Amount % of Net

Revenues Amount % of Net

Revenues Favorable

(Unfavorable)

Revenues, net........................................................... $ 361,305 100 % $ 362,020 100 % $ (715)

Technical and operating expenses (excluding

depreciation and amortization shown below) ...... 230,565 64 256,499 71 25,934

Selling, general and administrative expenses.......... 296,351 82 320,227 88 23,876

Restructuring expense ............................................. 2,214 1 10,709 3 8,495

Depreciation and amortization (including

impairments) ........................................................ 43,354 12 83,508 23 40,154

Operating loss ....................................................... $(211,179) (58)% $ (308,923) (85)% $ 97,744

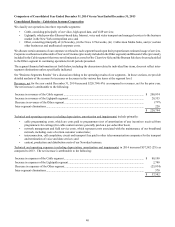

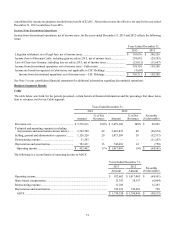

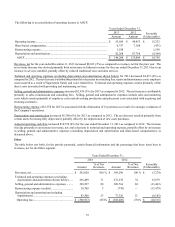

The following is a reconciliation of operating loss to AOCF deficit:

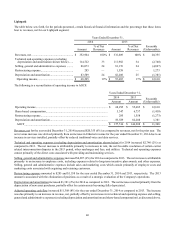

Years Ended December 31,

2014 2013 Favorable

(Unfavorable)

Amount Amount

Operating loss ......................................................................................................... $(211,179) $ (308,923)$ 97,744

Share-based compensation...................................................................................... 8,742 13,605 (4,863)

Restructuring expense............................................................................................. 2,214 10,709 (8,495)

Depreciation and amortization (including impairments) ........................................ 43,354 83,508 (40,154)

AOCF deficit ........................................................................................................ $(156,869) $ (201,101)$ 44,232

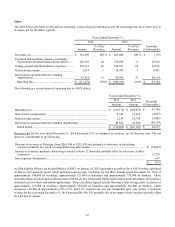

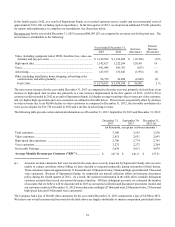

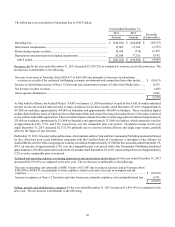

Revenues, net for the year ended December 31, 2014 decreased $715 as compared to revenues, net for the prior year. The net

decrease is attributable to the following:

Decrease in revenues at Newsday (from $265,504 to $251,439) due primarily to decreases in advertising

revenues primarily as a result of competition from other media.............................................................................. $(14,065)

Increase in revenues, primarily advertising revenues at News 12 Networks, partially offset by a decrease at other

businesses ................................................................................................................................................................. 12,703

Intra-segment eliminations........................................................................................................................................... 647

$ (715)

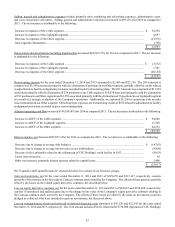

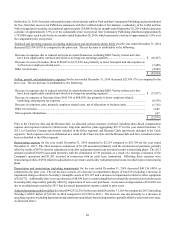

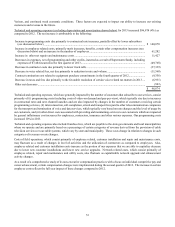

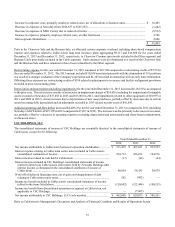

As filed with the Alliance for Audited Media (“AAM”) on January 19, 2015 and subject to audit by the AAM, Newsday submitted

its most recent quarterly report which indicated total average circulation for the three months ended December 28, 2014 of

approximately 340,000 on weekdays, approximately 321,000 on Saturdays and approximately 379,000 on Sundays. These

circulation figures include digital editions (most of which are free to Optimum Online and Newsday print subscribers) to Newsday's

restricted access website and mobile applications. These circulation figures include Newsday's total average print circulation of

approximately 237,000 on weekdays, approximately 228,000 on Saturdays and approximately 284,000 on Sundays, which

represents a decline of approximately 6.9%, 9.2%, and 9.1%, respectively, over the comparable prior year period. Circulation

revenue for the year ended December 31, 2014 increased $4,189 (5%) primarily due to the impact of rate increases partially offset

by a decline in volume.