Cablevision 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-25

recorded during the interim period is based on the Company's estimates of the ultimate contractual agreement expected to be

reached, which is based on several factors, including previous contractual rates, customary rate increases and the current status of

negotiations. Such estimates are adjusted as negotiations progress until new programming terms are finalized.

In addition, the Company has received, or may receive, incentives from programming distributors for carriage of the distributors'

programming. The Company generally recognizes these incentives as a reduction of programming costs in technical and operating

expense, generally over the term of the distribution agreement.

Advertising Expenses

Advertising costs are charged to expense when incurred and are recorded to "selling, general and administrative" expenses in the

accompanying statements of income. Advertising costs amounted to $156,228, $140,779, and $157,783 for the years ended

December 31, 2014, 2013 and 2012, respectively.

Share-Based Compensation

Share-based compensation expense is based on the fair value of the portion of share-based payment awards that are ultimately

expected to vest.

For options and performance based option awards, Cablevision recognizes compensation expense based on the estimated grant

date fair value using the Black-Scholes valuation model. For options not subject to performance based vesting conditions,

Cablevision recognizes the compensation expense using a straight-line amortization method. For options subject to performance

based vesting conditions, Cablevision recognizes compensation expense based on the probable outcome of the performance criteria

and requisite service period for each tranche of awards subject to performance based vesting conditions. For restricted shares and

restricted stock units, Cablevision recognizes compensation expense using a straight-line amortization method based on the grant

date price of CNYG Class A common stock over the vesting period, except for restricted stock units granted to non-employee

directors which vest 100% and are expensed at the date of grant. For stock appreciation rights, Cablevision recognizes compensation

expense based on the estimated fair value at each reporting period using the Black-Scholes valuation model.

For CSC Holdings, share-based compensation expense is recognized in its statements of income based on allocations from

Cablevision.

Income Taxes

The Company's provision for income taxes is based on current period income, changes in deferred tax assets and liabilities and

changes in estimates with regard to uncertain tax positions. Deferred tax assets are subject to an ongoing assessment of realizability.

The Company provides deferred taxes for the outside basis difference of its investment in partnerships. Interest and penalties, if

any, associated with uncertain tax positions are included in income tax expense.

Cash and Cash Equivalents

The Company's cash investments are placed with money market funds and financial institutions that are investment grade as rated

by Standard & Poor's and Moody's Investors Service. The Company selects money market funds that predominantly invest in

marketable, direct obligations issued or guaranteed by the United States government or its agencies, commercial paper, fully

collateralized repurchase agreements, certificates of deposit, and time deposits.

The Company considers the balance of its investment in funds that substantially hold securities that mature within three months

or less from the date the fund purchases these securities to be cash equivalents. The carrying amount of cash and cash equivalents

either approximates fair value due to the short-term maturity of these instruments or are at fair value.

Accounts Receivable

Accounts receivable are recorded at net realizable value. The Company periodically assesses the adequacy of valuation allowances

for uncollectible accounts receivable by evaluating the collectability of outstanding receivables and general factors such as historical

collection experience, length of time individual receivables are past due, and the economic and competitive environment.

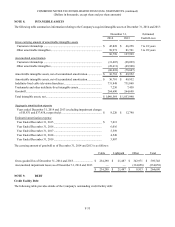

Investments

Investment securities and investment securities pledged as collateral are classified as trading securities and are stated at fair value

with realized and unrealized holding gains and losses included in net income.