Cablevision 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

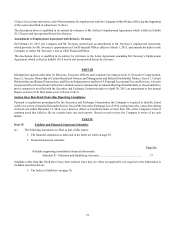

66

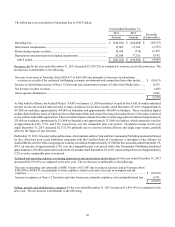

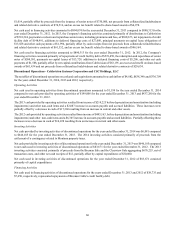

Payments Due by Period

Total Year

1Years

2-3 Years

4-5 More than

5 years Other

Off balance sheet arrangements:

Purchase obligations (a)........................ $ 6,713,424 $ 1,929,472 $ 3,241,297 $ 1,407,306 $ 135,349 $ —

Operating lease obligations (b) ............. 456,838 66,289 132,788 89,024 168,737 —

Guarantees (c) ....................................... 22,252 18,652 3,590 10 — —

Letters of credit (d) ............................... 71,661 10,080 2,086 59,495 — —

7,264,175 2,024,493 3,379,761 1,555,835 304,086 —

Contractual obligations reflected on

the balance sheet:

Debt obligations (e)............................... 12,245,492 1,079,180 3,093,303 3,415,171 4,657,838 —

Capital lease obligations (f) .................. 48,218 18,053 22,505 6,332 1,328 —

Taxes (g)................................................ 7,254 486 — — — 6,768

12,300,964 1,097,719 3,115,808 3,421,503 4,659,166 6,768

Total....................................................... $19,565,139 $ 3,122,212 $ 6,495,569 $ 4,977,338 $ 4,963,252 $ 6,768

(a) Purchase obligations primarily include contractual commitments with various programming vendors to provide video

services to our subscribers and minimum purchase obligations to purchase goods or services. Future fees payable under

contracts with programming vendors are based on numerous factors, including the number of subscribers receiving the

programming. Amounts reflected above related to programming agreements are based on the number of subscribers

receiving the programming as of December 2014 multiplied by the per subscriber rates or the stated annual fee, as

applicable, contained in the executed agreements in effect as of December 31, 2014. See Note 2 to our consolidated

financial statements for a discussion of our program rights obligations.

(b) Operating lease obligations represent primarily future minimum payment commitments on various long-term,

noncancelable leases for office, production and storage space, and rental space on utility poles used for our Cable segment.

See Note 7 to our consolidated financial statements for a discussion of our operating leases.

(c) Includes franchise and performance surety bonds primarily for the Company's Cable segment. Also includes outstanding

guarantees primarily by CSC Holdings in favor of certain financial institutions in respect of ongoing interest expense

obligations in connection with the monetization of our holdings of shares of Comcast common stock. Does not include

CSC Holdings' guarantee of Newsday's obligations under its senior secured loan facility, which amounted to $480,000

at December 31, 2014. Payments due by period for these arrangements represent the year in which the commitment

expires.

(d) Consists primarily of letters of credit obtained by CSC Holdings in favor of insurance providers and certain governmental

authorities for the Cable segment. Payments due by period for these arrangements represent the year in which the

commitment expires.

(e) Includes interest payments and future payments due on our (i) credit facility debt, (ii) senior notes and debentures, (iii)

notes payable and (iv) collateralized indebtedness. See Notes 9 and 10 to our consolidated financial statements for a

discussion of our long-term debt.

(f) Reflects the principal amount of capital lease obligations, including related interest.

(g) Represents tax liabilities, including accrued interest, relating to uncertain tax positions. See Note 12 to our consolidated

financial statements for a discussion of our income taxes.

At any time after the thirteenth anniversary of the closing of the Newsday Transaction (which occurred on July 29, 2008) and on

or prior to the date that is six months after such anniversary, Tribune Company will have the right to require CSC Holdings to

purchase Tribune Company's entire interest in Newsday Holdings at the fair value of the interest at that time. The table above

does not include any future payments that would be required upon the exercise of this put right.