Cablevision 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-58

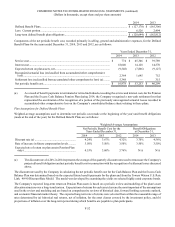

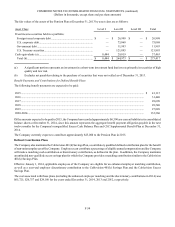

taxes 865,307 of these shares, with an aggregate value of $12,262 were surrendered to the Company. These acquired shares have

been classified as treasury stock.

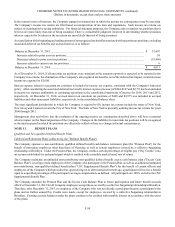

As of December 31, 2014, there was $55,529 of total unrecognized compensation cost related to Cablevision's unvested options

and restricted shares granted under Cablevision's stock plans. The unrecognized compensation cost is expected to be recognized

over a weighted-average period of approximately 1 year.

Long-Term Incentive Plans

In April 2006, Cablevision's Board of Directors approved the Cablevision Systems Corporation 2006 Cash Incentive Plan, which

was approved by Cablevision's stockholders at its annual stockholders meeting in May 2006.

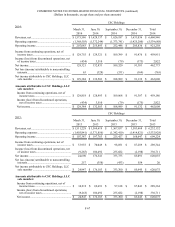

In connection with the long-term incentive awards outstanding, the Company has recorded expenses of $43,892, $24,596 and

$10,167 for the years ended December 31, 2014, 2013 and 2012, respectively. At December 31, 2014, the Company had accrued

$42,653 for performance based awards for which the performance criteria had not yet been met as of December 31, 2014 as such

awards are based on achievement of certain performance criteria through December 31, 2016. The Company has accrued the

amount that it currently believes will ultimately be paid based upon the performance criteria established for these performance

based awards. In 2012, the Company reversed certain accruals related to awards with performance criteria through 2013 that was

not expected to be achieved.

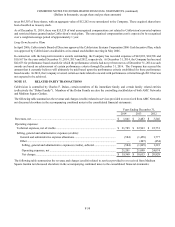

NOTE 15. RELATED PARTY TRANSACTIONS

Cablevision is controlled by Charles F. Dolan, certain members of his immediate family and certain family related entities

(collectively the “Dolan Family”). Members of the Dolan Family are also the controlling stockholders of both AMC Networks

and Madison Square Garden.

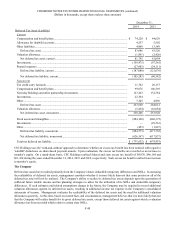

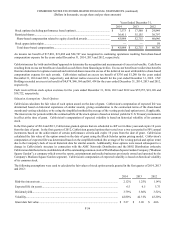

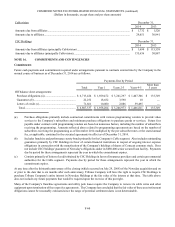

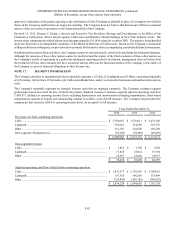

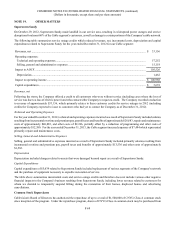

The following table summarizes the revenue and charges (credits) related to services provided to or received from AMC Networks

not discussed elsewhere in the accompanying combined notes to the consolidated financial statements:

Years Ending December 31,

2014 2013 2012

Revenues, net...................................................................................................................... $ 1,841 $ 2,483 $ 3,246

Operating expenses:

Technical expenses, net of credits.................................................................................... $ 21,785 $ 22,963 $ 22,751

Selling, general and administrative expenses (credits):

General and administrative expense allocations.......................................................... (584)(1,458) 1,777

Other............................................................................................................................ — (407)(454)

Selling, general and administrative expenses (credits), subtotal............................... (584)(1,865) 1,323

Operating expenses, net ............................................................................................ 21,201 21,098 24,074

Net charges................................................................................................................ $ 19,360 $ 18,615 $ 20,828

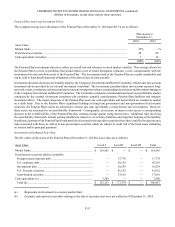

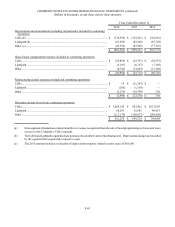

The following table summarizes the revenue and charges (credits) related to services provided to or received from Madison

Square Garden not discussed elsewhere in the accompanying combined notes to the consolidated financial statements: