Cablevision 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

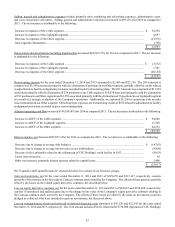

asset and valuation allowance were both reduced by $6,735 and $303 in 2014 and 2013, respectively. Pursuant to certain LLC

conversions during 2012, state NOLs for which the deferred tax asset had been offset by a valuation allowance were eliminated.

The associated deferred tax asset and valuation allowance were both reduced by $3,074 in 2012.

Plant and Equipment:

Costs incurred in the construction of the Company's cable systems, including line extensions to, and upgrade of, the Company's

hybrid fiber/coaxial infrastructure and headend facilities are capitalized. These costs consist of materials, subcontractor labor,

direct consulting fees, and internal labor and related costs associated with the construction activities. The internal costs that are

capitalized consist of salaries and benefits of the Company's employees and the portion of facility costs, including rent, taxes,

insurance and utilities, that supports the construction activities. These costs are depreciated over the estimated life of the plant

(10 to 25 years) and headend facilities (4 to 25 years). Costs of operating the plant and the technical facilities, including repairs

and maintenance, are expensed as incurred.

Costs incurred to connect businesses or residences that have not been previously connected to the infrastructure or digital platform

are also capitalized. These costs include materials, subcontractor labor, internal labor, and other related costs associated with the

connection activities. In addition, on-site and remote technical assistance during the provisioning process for new digital product

offerings are capitalized. The departmental activities supporting the connection process are tracked through specific metrics, and

the portion of departmental costs that is capitalized is determined through a time weighted activity allocation of costs incurred

based on time studies used to estimate the average time spent on each activity. New connections are amortized over the estimated

useful lives of 5 years or 12 years for residence wiring and feeder cable to the home, respectively. The portion of departmental

costs related to reconnection, programming service up- grade and down- grade, repair and maintenance, and disconnection activities

are expensed as incurred.

The estimated useful lives assigned to our property, plant and equipment are reviewed on an annual basis or more frequently if

circumstances warrant and such lives are revised to the extent necessary due to changing facts and circumstances. Any changes

in estimated useful lives are reflected prospectively.

Refer to Note 2 to our consolidated financial statements included in this Annual Report on Form 10-K for a discussion of our

accounting policies with respect to the policies discussed above and other items.

Legal Contingencies

The Company is party to various lawsuits and proceedings and is subject to other claims that arise in the ordinary course of business,

some involving claims for substantial damages. The Company records an estimated liability for these claims when management

believes the loss from such matters is probable and reasonably estimable. The Company reassesses the risk of loss as new

information becomes available and adjusts liabilities as necessary. The actual cost of resolving a claim may be substantially

different from the amount of the liability recorded. Refer to Note 16 to our consolidated financial statements included in this

Annual Report on Form 10-K for a discussion of our legal contingencies.

Certain Transactions

The following transactions occurred during the periods covered by this Management's Discussion and Analysis of Financial

Condition and Results of Operations:

2013 Transactions

On June 27, 2013, we completed the Clearview Sale and on July 1, 2013, we completed the Bresnan Sale. As a result, we no

longer consolidate the financial results of Clearview Cinemas and Bresnan Cable. Accordingly, the historical financial results of

Clearview Cinemas and Bresnan Cable have been reflected in our consolidated financial statements as discontinued operations

for all periods presented.

Litigation Settlement

In connection with the AMC Networks Distribution in June 2011, CSC Holdings and AMC Networks and its subsidiary, Rainbow

Programming Holdings, LLC (the "AMC Parties") entered into an agreement (the "VOOM Litigation Agreement") which provided

that CSC Holdings and the AMC Parties would share equally in the proceeds (including in the value of any non-cash consideration)

of any settlement or final judgment in the litigation with DISH Network, LLC ("DISH Network") that were received by subsidiaries

of AMC Networks from VOOM HD Holdings LLC.