Cablevision 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-62

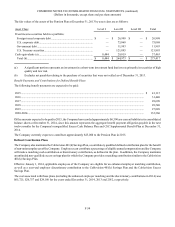

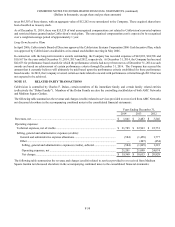

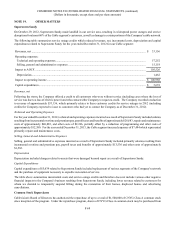

approved a stipulation of the parties agreeing to the substitution of Julie Friedman as plaintiff in place of Livingston who sold his

shares in the Company and therefore no longer has standing. The Company does not believe that this lawsuit will have a material

adverse effect on results of operations or the financial position of the Company.

On April 15, 2011, Thomas C. Dolan, a director and Executive Vice President, Strategy and Development, in the Office of the

Chairman at Cablevision, filed a lawsuit against Cablevision and Rainbow Media Holdings in New York Supreme Court. The

lawsuit raises compensation-related claims (seeking approximately $11,000) related to events in 2005. The matter is being handled

under the direction of an independent committee of the Board of Directors of Cablevision. Based on the Company's assessment

of this possible loss contingency, no provision has been made for this matter in the accompanying consolidated financial statements.

In addition to the matters discussed above, the Company is party to various lawsuits, some involving claims for substantial damages.

Although the outcome of these other matters cannot be predicted and the impact of the final resolution of these other matters on

the Company's results of operations in a particular subsequent reporting period is not known, management does not believe that

the resolution of these other lawsuits will have a material adverse effect on the financial position of the Company or the ability of

the Company to meet its financial obligations as they become due.

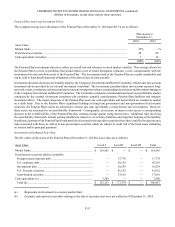

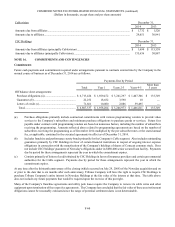

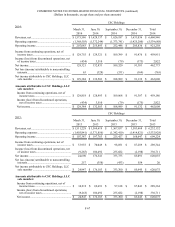

NOTE 17. SEGMENT INFORMATION

The Company classifies its operations into three reportable segments: (1) Cable, (2) Lightpath, and (3) Other, consisting principally

of (i) Newsday, (ii) the News 12 Networks, (iii) Cablevision Media Sales, and (iv) certain other businesses and unallocated corporate

costs.

The Company's reportable segments are strategic business units that are managed separately. The Company evaluates segment

performance based on several factors, of which the primary financial measure is business segment adjusted operating cash flow

("AOCF") (defined as operating income (loss) excluding depreciation and amortization (including impairments), share-based

compensation expense or benefit and restructuring expense or credits), a non-GAAP measure. The Company has presented the

components that reconcile AOCF to operating income (loss), an accepted GAAP measure.

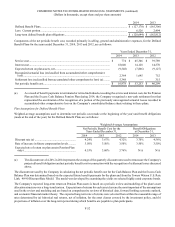

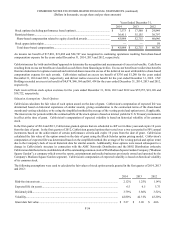

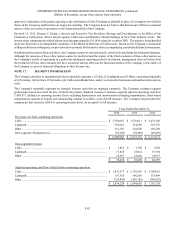

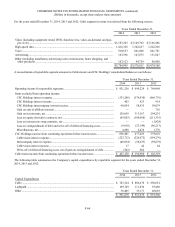

Years Ended December 31,

2014 2013 2012

Revenues, net from continuing operations

Cable....................................................................................................................... $ 5,784,945 $ 5,576,011 $ 5,479,108

Lightpath................................................................................................................. 352,964 332,609 323,776

Other ....................................................................................................................... 361,305 362,020 369,290

Inter-segment eliminations (a)................................................................................ (38,268)(38,488)(40,499)

$ 6,460,946 $ 6,232,152 $ 6,131,675

Inter-segment revenues

Cable....................................................................................................................... $ 1,883 $ 1,788 $ 1,728

Lightpath................................................................................................................. 17,818 18,014 19,794

Other ....................................................................................................................... 18,567 18,686 18,977

$ 38,268 $ 38,488 $ 40,499

Adjusted operating cash flow (deficit) from continuing operations

Cable....................................................................................................................... $ 1,833,577 $ 1,739,529 $ 1,798,041

Lightpath................................................................................................................. 157,516 146,208 135,409

Other ....................................................................................................................... (156,869)(201,101)(196,692)

$ 1,834,224 $ 1,684,636 $ 1,736,758