Cablevision 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

If we experience a significant data security breach or fail to detect and appropriately respond to a significant data security

breach, our results of operations and reputation could suffer.

The nature of our business involves the receipt and storage of information about our customers and employees. We have procedures

in place to detect and respond to data security incidents. However, because the techniques used to obtain unauthorized access,

disable or degrade service, or sabotage systems change frequently and may be difficult to detect for long periods of time, we may

be unable to anticipate these techniques or implement adequate preventive measures. In addition, hardware, software or applications

we develop or procure from third parties may contain defects in design or manufacture or other problems that could unexpectedly

compromise information security. Unauthorized parties may also attempt to gain access to our systems or facilities. If our efforts

to protect the security of information about our customers and employees are unsuccessful, a significant data security breach may

result in costly government enforcement actions, private litigation, and negative publicity resulting in reputation or brand damage

with customers, and our results of operations could suffer.

A portion of our workforce is represented by labor unions. Collective bargaining agreements can increase our expenses. Labor

disruptions could adversely affect our operations.

As of December 31, 2014, 486 of our full-time employees were covered by collective bargaining agreements. In February 2015,

the Company and the Communication Workers of America ("CWA") entered into a collective bargaining agreement which covers

approximately 262 of our workforce, primarily technicians in Brooklyn, New York. Collective bargaining agreements with the

CWA covering this group of employees or agreements with other unionized employees may increase our expenses. In addition,

any disruptions to our operations due to labor related problems could have an adverse effect on our business.

Our Newsday business has suffered operating losses historically and such losses are expected to continue in the future.

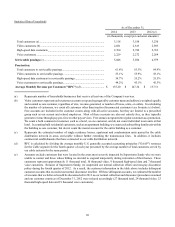

Newsday suffered operating losses of $37.7 million, $71.1 million, and $47.0 million for the years ended December 31, 2014,

2013, and 2012, respectively, which included impairments of intangible assets of $5.8 million, $37.5 million, and $13.0 million

in 2014, 2013 and 2012, respectively. Operating losses are expected to continue in the future. As of December 31, 2014, Newsday

had a credit facility outstanding which consisted of a $480 million floating rate term loan guaranteed by CSC Holdings. In addition,

at December 31, 2014, Newsday Holdings held approximately $611 million aggregate principal amount of senior notes issued by

Cablevision. Newsday has agreed that it will hold Cablevision or CSC Holdings senior notes or cash balances in excess of the

amount of borrowings outstanding under its senior secured credit facility until it matures.

Demand for advertising, increased competition and declines in circulation affect Newsday.

A majority of the revenues of our Newsday business are from advertising. Expenditures by advertisers generally reflect economic

conditions and declines in national and local economic conditions affect demand for advertising and the levels of advertising

revenue for Newsday.

Newsday operates in a highly competitive market which may adversely affect advertising and circulation revenues. Newsday

faces significant competition for advertising revenue from a variety of media sources, including other newspapers that reach a

similar audience, magazines, shopping guides, yellow pages, websites, mobile-device platforms, broadcast and cable television,

radio, and direct marketing; particularly if those media sources provide advertising services that could substitute for those provided

by Newsday within the same geographic area. Specialized websites for real estate, automobile and help wanted advertising have

become increasingly competitive with our newspapers and websites for classified advertising and further development of additional

targeted websites is likely.

The newspaper industry generally has experienced significant declines in advertising and circulation revenue as circulation and

readership levels continue to be adversely affected by competition from new media news formats and less reliance on newspapers

by some consumers as a source of news, particularly younger consumers. Newsday has experienced similar advertising revenue

declines. A prolonged decline in circulation would have a material adverse effect on the rate and volume of advertising revenues.

A significant amount of our book value consists of intangible assets that may not generate cash in the event of a voluntary

or involuntary sale.

At December 31, 2014, we reported approximately $6.8 billion of consolidated total assets, of which approximately $1.0 billion

were intangible. Intangible assets include franchises from city and county governments to operate cable television systems and

goodwill. While we believe that the carrying values of our intangible assets are recoverable, you should not assume that we would

receive any cash from the voluntary or involuntary sale of these intangible assets, particularly if we were not continuing as an