Cablevision 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

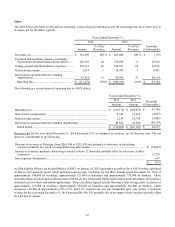

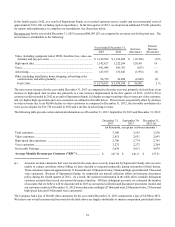

On October 15, 2014, Newsday's other publications, which include amNew York and Star Community Publishing and are distributed

for free, filed their most recent Publishers statements with the Certified Audit of Circulations, a subsidiary of the AAM. amNew

York averaged gross weekday circulation of approximately 324,000 for the six months ended September 28, 2014, which represents

a decline of approximately 5.9% over the comparable prior year period. Star Community Publishing distributed approximately

1,763,000 copies each week for the six months ended September 28, 2014, which represents a decline of approximately 2.0% over

the comparable prior year period.

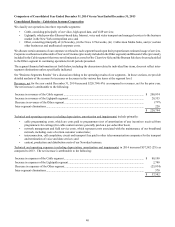

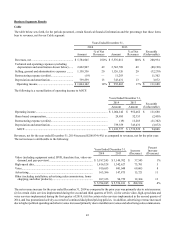

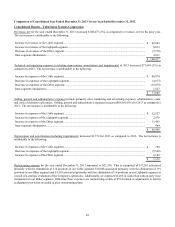

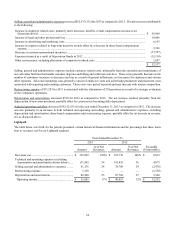

Technical and operating expenses (excluding depreciation and amortization shown below) for the year ended December 31, 2014

decreased $25,934 (10%) as compared to the prior year. The net decrease is attributable to the following:

Decrease in expenses due to reduced activities at certain businesses, including MSG Varsity (whose activities

have been significantly curtailed and which is no longer an operating segment).................................................... $(16,437)

Decrease in costs at Newsday (from $180,035 to $172,547) due primarily to lower newsprint and ink expenses as

well as lower employee related costs....................................................................................................................... (7,488)

Other net decreases ...................................................................................................................................................... (2,009)

$ (25,934)

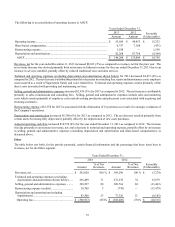

Selling, general, and administrative expenses for the year ended December 31, 2014 decreased $23,876 (7%) as compared to the

prior year. The net decrease is attributable to the following:

Decrease in expenses due to reduced activities at certain businesses, including MSG Varsity (whose activities

have been significantly curtailed and which is no longer an operating segment).................................................... $(17,937)

Decrease in expenses at Newsday (from $105,395 to $98,859) due primarily to lower employee related,

marketing, and property tax expenses...................................................................................................................... (6,536)

Decrease in corporate costs, primarily employee related costs, net of allocations to business units .......................... (1,735)

Other net increases....................................................................................................................................................... 1,685

Intra-segment eliminations........................................................................................................................................... 647

$ (23,876)

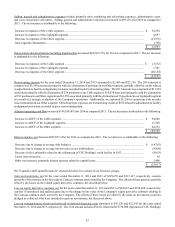

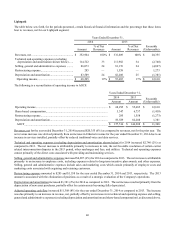

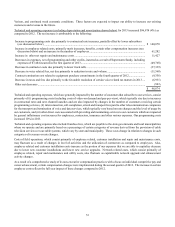

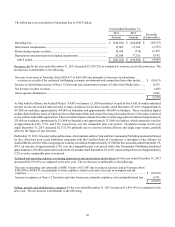

Prior to the Clearview Sale and the Bresnan Sale, we allocated certain corporate overhead, including share-based compensation

expense and expenses related to Cablevision's long-term incentive plans aggregating $9,117 for the year ended December 31,

2013, to Clearview Cinemas (previously included in the Other segment) and Bresnan Cable (previously included in the Cable

segment). Such expenses were not eliminated as a result of the Clearview Sale and the Bresnan Sale and have remained or have

been reclassified to the Other segment.

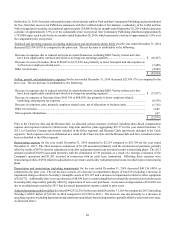

Restructuring expense for the year ended December 31, 2014 amounted to $2,214 compared to $10,709 for the year ended

December 31, 2013. The 2014 amount is comprised of $3,190 associated primarily with the elimination of positions, partially

offset by credits of $976 related to adjustments to facility realignment provisions recorded in prior restructuring plans. The 2013

amount included $10,038 associated primarily with the elimination of 191 positions as a result of a strategic evaluation of the

Company's operations and $1,205 recorded in connection with an early lease termination. Offsetting these expenses were

restructuring credits of $534 related to adjustments to severance and facility realignment provisions recorded in prior restructuring

plans.

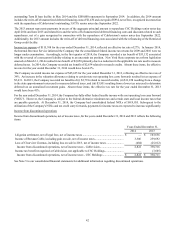

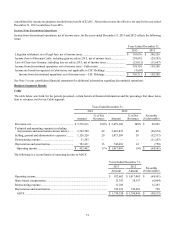

Depreciation and amortization (including impairments) for the year ended December 31, 2014 decreased $40,154 (48%) as

compared to the prior year. The net decrease consists of a decrease in impairment charges of $42,199 (including a decrease in

impairment charges related to Newsday's intangible assets of $31,627 and a decrease in impairments related to other equipment

of $10,572). Additionally there was a net decrease of $8,645 due to certain intangibles becoming fully amortized and certain assets

becoming fully depreciated, partially offset by depreciation of new asset purchases. An increase in depreciation of $10,690 was

due to an adjustment recorded in 2013 that decreased depreciation expense related to prior years.

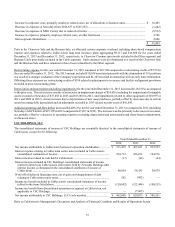

Adjusted operating cash flow deficit decreased $44,232 (22%) for the year ended December 31, 2014 as compared to 2013 (including

Newsday's AOCF deficit of $15,661 in 2014 compared to $15,399 in 2013). The decrease was due primarily to a decrease in

operating expenses excluding depreciation and amortization and share-based compensation, partially offset by a decrease in revenue,

as discussed above.