Cablevision 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-27

as hedges, and changes in the fair values of these derivatives are recognized in the statements of income as gains (losses) on

derivative contracts.

Commitments and Contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded

when the Company believes it is probable that a liability has been incurred and the amount of the contingency can be reasonably

estimated.

Recently Adopted Accounting Pronouncement

In July 2013, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2013-11,

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists. ASU No. 2013-11 eliminates the diversity in practice in the presentation of unrecognized tax benefits either

where an entity may present unrecognized tax benefits as a liability or by presenting unrecognized tax benefits as a reduction of

a deferred tax asset for a net operating loss or tax credit carryforward in certain circumstances. ASU No. 2013-11 was adopted

by the Company on January 1, 2014. The adoption of ASU No. 2013-11 did not have any impact on the Company's consolidated

financial statements.

Recently Issued But Not Yet Adopted Accounting Pronouncement

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers, requiring an entity to recognize the

amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. ASU No. 2014-09

will replace most existing revenue recognition guidance in GAAP when it becomes effective and allows the use of either the

retrospective or cumulative effect transition method. Early adoption is not permitted. ASU No. 2014-09 becomes effective for

us on January 1, 2017. We have not yet completed our evaluation of the effect that ASU No. 2014-09 will have on our consolidated

financial statements and related disclosures.

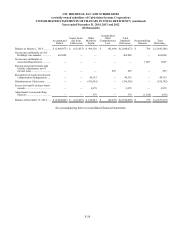

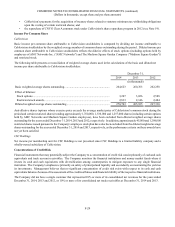

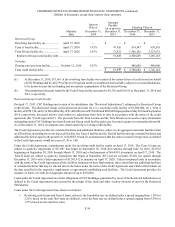

Common Stock of Cablevision

Each holder of Cablevision NY Group ("CNYG") Class A common stock has one vote per share while holders of CNYG Class B

common stock have ten votes per share. CNYG Class B shares can be converted to CNYG Class A common stock at anytime

with a conversion ratio of one CNYG Class A common share for one CNYG Class B common share. CNYG Class A stockholders

are entitled to elect 25% of Cablevision's Board of Directors. CNYG Class B stockholders have the right to elect the remaining

members of Cablevision's Board of Directors. In addition, CNYG Class B stockholders are parties to an agreement which has the

effect of causing the voting power of these CNYG Class B stockholders to be cast as a block. The following table provides details

of Cablevision's shares of common stock outstanding:

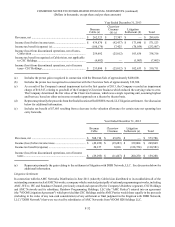

Shares of Common Stock

Outstanding

Class A

Common

Stock

Class B

Common

Stock

Balance at December 31, 2011......................................................................................................... 220,170,261 54,137,673

Employee and non-employee director stock transactions (a) ........................................................ 3,987,544 —

Share repurchases (see Note 20) .................................................................................................... (13,596,687) —

Balance at December 31, 2012......................................................................................................... 210,561,118 54,137,673

Employee and non-employee director stock transactions (a) ........................................................ 3,037,472 —

Balance at December 31, 2013......................................................................................................... 213,598,590 54,137,673

Employee and non-employee director stock transactions (a) ........................................................ 6,621,345 —

Balance at December 31, 2014......................................................................................................... 220,219,935 54,137,673

(a) Primarily includes issuances of common stock in connection with employee and non-employee director exercises of stock

options and restricted shares granted to employees, offset by shares acquired by the Company in connection with the