Cablevision 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

pre-tax gain of approximately $5.8 million relating primarily to the settlement of a contingency related to Montana property taxes

associated with Bresnan Cable.

Clearview Cinemas

On June 27, 2013, the Company completed the sale of substantially all of its Clearview Cinemas' theaters pursuant to the asset

purchase agreement entered into in April 2013. The Company recognized a pretax loss in connection with the Clearview Sale of

approximately $19.3 million.

Competition

Cable

Our cable systems operate in an intensely competitive environment, competing with a variety of video, data and voice providers

and delivery systems, including telephone companies, wireless data and voice providers, satellite-delivered video signals, Internet-

delivered video content, and broadcast television signals available to homes within our market by over-the-air reception.

Telephone Companies. We face competition from two telephone companies. Verizon Communications, Inc. ("Verizon") and

Frontier Communications Corp. ("Frontier") (who recently acquired AT&T Inc.'s ("AT&T") Connecticut operation) offer video

programming in addition to their high-speed data and VoIP services to residential and business customers in our service area. The

attractive demographics of our service territory make this region a desirable location for investment in distribution technologies

by these companies.

We face intense competition from Verizon who has constructed a fiber to the home network plant that passes a significant number

of households in our service area. Verizon does not publicly report the extent of their build-out or penetration by area. Our estimate

of Verizon's build out and sales activity in our service area is difficult to assess because it is based upon visual inspections and

other limited estimating techniques, and therefore serves only as an approximation. We estimate that Verizon is currently able to

sell a fiber-based video service, as well as high-speed data and VoIP services, to at least half of the households in our service area.

In certain other portions of our service area, Verizon has also built its fiber network where we believe it is not currently able to

sell its fiber-based video service, but is able to sell its high-speed data and VoIP services. In these areas (as well as other parts of

our service area) Verizon markets direct broadcast satellite ("DBS") services along with its high-speed data and VoIP services.

Verizon’s fiber network also passes areas where we believe it is not currently able to sell its video, high-speed data or VoIP services.

Accordingly, Verizon may increase the number of customers in our service area to whom it is able to sell video, high speed data

and VoIP services in the future.

Frontier offers video service, as well as high-speed data and VoIP services, in competition with us in most of our Connecticut

service area. Frontier also markets DBS services in this service area. Verizon and Frontier have made and may continue to make

promotional offers at prices lower than ours. Verizon has significantly greater financial resources than we do.

This competition affects our ability to add or retain customers and creates pressure upon the pricing of our services. Competition,

particularly from Verizon, has negatively impacted our revenues and caused subscriber declines in our service areas. To the extent

Verizon and Frontier continue to offer competitive and promotional packages, our ability to maintain or increase our existing

customers and revenue will continue to be negatively impacted. See "Regulation" for a discussion of regulatory and legislative

issues.

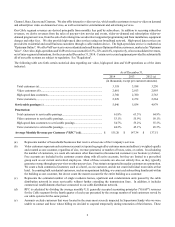

DBS. We also face competition from DBS service providers in our service area. The two major DBS services, DISH Network

and DIRECTV, are available to the vast majority of our customers. These companies each offer video programming that is

substantially similar to the video service that we offer, at competitive prices. Our ability to compete with these DBS services is

affected by the quality and quantity of programming available to us and to them. DIRECTV has exclusive arrangements with the

National Football League that gives it access to programming that we cannot offer. Each of these competitors has significantly

greater financial resources than we do. See "Regulation" for a discussion of regulatory and legislative issues. DBS providers have

tested the use of certain spectrum to offer satellite-based high-speed data services.

We compete in our service areas with DISH Network and DIRECTV by "bundling" our service offerings with products that these

companies cannot efficiently provide at this time, such as high-speed data, voice service and interactive services carried over the

cable distribution plant.

Other Competitors and Video Programming Sources. Another source of competition for our Cable segment is the delivery of video

content over the Internet directly to subscribers. This competition comes from a number of different sources, including companies

that deliver movies, television shows and other video programming over broadband Internet connections, such as Netflix, Google