Cablevision 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-30

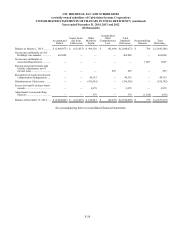

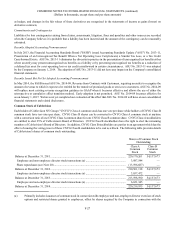

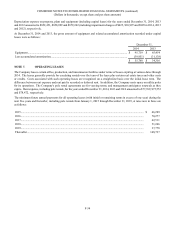

NOTE 3. SUPPLEMENTAL CASH FLOW INFORMATION

During 2014, 2013 and 2012, the Company's non-cash investing and financing activities and other supplemental data were as

follows:

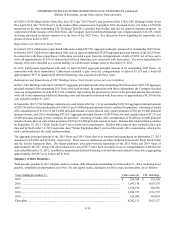

Years Ended December 31,

2014 2013 2012

Non-Cash Investing and Financing Activities of Cablevision and CSC Holdings:

Continuing Operations:

Property and equipment accrued but unpaid............................................................ $ 48,824 $ 65,391 $ 93,760

Capital lease obligations........................................................................................... 30,603 11,499 27,535

Intangible asset obligations...................................................................................... 525 2,498 1,435

Notes payable to vendor........................................................................................... 34,522 1,202 —

Reduction in capital lease obligation as a result of not exercising a bargain

purchase option..................................................................................................... — 22,950 —

Non-Cash Investing and Financing Activities of Cablevision:

Dividends payable on unvested restricted share awards.......................................... 3,809 3,466 3,119

Non-Cash Investing and Financing Activities of CSC Holdings:

Distribution of Cablevision senior notes to Cablevision.......................................... — 142,262 —

Supplemental Data:

Continuing Operations - Cablevision:

Cash interest paid ..................................................................................................... 550,241 580,906 646,346

Income taxes paid, net.............................................................................................. 10,598 16,470 13,418

Continuing Operations - CSC Holdings:

Cash interest paid ..................................................................................................... 335,175 362,365 469,502

Income taxes paid, net.............................................................................................. 10,598 16,470 13,437

Discontinued operations - Cablevision and CSC Holdings:

Cash interest paid ..................................................................................................... — 26,606 61,927

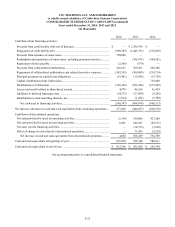

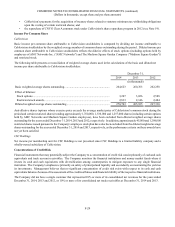

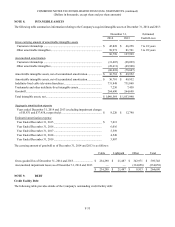

NOTE 4. RESTRUCTURING AND IMPAIRMENT CHARGES

Restructuring

In the fourth quarter of 2013, as a result of a strategic evaluation of the Company's operations, the Company recorded restructuring

charges associated primarily with the elimination of 234 positions in the Cable segment, 191 positions in the Other segment, and

16 positions in the Lightpath segment. Additionally, the Company expensed $1,205 in connection with an early lease termination

in the Other segment. The following table summarizes the restructuring charges and accrued restructuring liability related to the

2013 restructuring plan:

Cable

Segment Lightpath

Segment Other

Segment Total

Restructuring charges relating to severance, net ................................ $ 11,283 $ 1,558 $ 10,038 $ 22,879

Restructuring charges relating to an early lease termination.............. — — 1,205 1,205

Total restructuring expense................................................................. 11,283 1,558 11,243 24,084

Payments and other .......................................................................... (8,556)(628)(158)(9,342)

Accrual balance at December 31, 2013.............................................. 2,727 930 11,085 14,742

Payments and other, net.................................................................... (2,722)(311)(10,415)(13,448)

Accrued balance at December 31, 2014 ............................................. $ 5 $ 619 $ 670 $ 1,294

In addition to the charges included in the table above, the Company recorded net restructuring charges (credits) of $1,984, $(534),

and $(770), in 2014, 2013 and 2012, respectively. The 2014 restructuring expense included a $3,280 charge relating to the