Cablevision 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-39

of 8.50% CSC Holdings Senior Notes Due June 2015 (the "2015 Notes") and a portion of the 8.50% CSC Holdings Senior Notes

Due April 2014 (the "2014 Notes") in the tender offers commenced in September 2012 discussed below, (ii) make a $150,000

repayment on the then outstanding CSC Holdings Term B-2 extended loan facility, and (iii) for general corporate purposes. In

connection with the issuance of the 2022 Notes, the Company incurred deferred financing costs of approximately $16,195, which

are being amortized to interest expense over the term of the 2022 Notes. See discussion below regarding the repurchase of a

portion of these notes in 2013.

Repurchases of Cablevision Senior Notes

In January 2014, Cablevision repurchased with cash on hand $27,831 aggregate principal amount of its outstanding 2022 Notes.

In October 2014, Cablevision repurchased with cash on hand an additional $9,200 aggregate principal amount of the 2022 Notes.

In connection with these repurchases, Cablevision recorded a gain from the extinguishment of debt of $934, net of fees, and a

write-off approximately $1,436 of unamortized deferred financing costs associated with these notes. The notes repurchased in

January 2014 were classified as a current liability on Cablevision's balance sheet at December 31, 2013.

In 2013, Cablevision repurchased with cash on hand $63,945 aggregate principal amount of its outstanding 2022 Notes. In

connection with these repurchases, Cablevision recorded a gain from the extinguishment of debt of $1,119 and a write-off

approximately $517 of unamortized deferred financing costs associated with these notes.

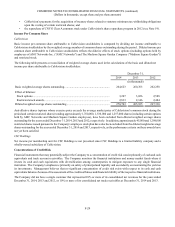

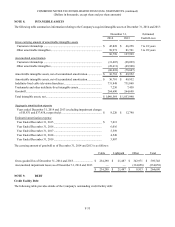

Redemptions and Repurchases of CSC Holdings Senior Notes (tender prices per note in dollars)

In 2013, CSC Holdings redeemed (1) $204,937 aggregate principal amount of its outstanding 2014 Notes and (2) $91,543 aggregate

principal amount of its outstanding 2015 Notes with cash on hand. In connection with these redemptions, the Company recorded

a loss on extinguishment of debt of $12,192, primarily representing the payments in excess of the principal amount thereof and a

write-off of the unamortized deferred financing costs and discounts associated with these notes of approximately $4,350 for the

year ended December 31, 2013.

In September 2012, CSC Holdings commenced a cash tender offer for: (1) its outstanding $120,543 aggregate principal amount

of 2015 Notes for total consideration of $1,046.25 per $1,000 principal amount of notes tendered for purchase, consisting of tender

offer consideration of $1,016.25 per $1,000 principal amount of notes plus an early tender premium of $30 per $1,000 principal

amount of notes, and (2) its outstanding $575,633 aggregate principal amount of 2014 Notes for total consideration of $1,113 per

$1,000 principal amount of notes tendered for purchase, consisting of tender offer consideration of $1,083 per $1,000 principal

amount of notes plus an early tender premium of $30 per $1,000 principal amount of notes. Holders that tendered their securities

by September 26, 2012 ("Early Tender Date") received the total consideration. Holders who tendered their securities after such

time and by the October 11, 2012 expiration date ("Tender Expiration Date") received the tender offer consideration, which is the

total consideration less the early tender premium.

The aggregate principal amount of the 2015 Notes and 2014 Notes that were tendered and repurchased on September 27, 2012

amounted to $29,000 and $370,696, respectively. There were no additional securities tendered between the Early Tender Date

and the Tender Expiration Date. The tender premiums associated with the repurchase of the 2015 Notes and 2014 Notes of

approximately $43,231, along with other transaction costs of $577, have been recorded in loss on extinguishment of debt for the

year ended December 31, 2012. In addition, unamortized deferred financing costs and discounts related to these notes aggregating

approximately $16,997 were written-off in 2012.

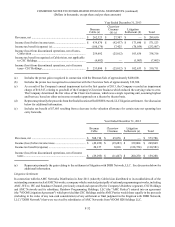

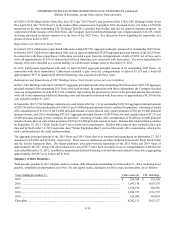

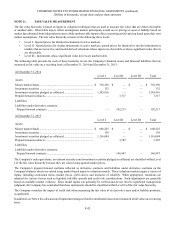

Summary of Debt Maturities

Total amounts payable by the Company under its various debt obligations outstanding as of December 31, 2014, including notes

payable, collateralized indebtedness (see Note 10), and capital leases, during the next five years and thereafter, are as follows:

Years Ending December 31, Cablevision (a) CSC Holdings

2015 .......................................................................................................................................... $ 558,368 $ 558,368

2016 .......................................................................................................................................... 1,007,576 1,007,576

2017 .......................................................................................................................................... 1,120,556 220,556

2018 .......................................................................................................................................... 2,286,755 1,536,755

2019 .......................................................................................................................................... 542,099 542,099

Thereafter.................................................................................................................................. 4,202,151 3,053,127