Cablevision 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-29

• Cablevision's payments for the acquisition of treasury shares related to statutory minimum tax withholding obligations

upon the vesting of certain restricted shares; and

• the repurchase of CNYG Class A common stock under Cablevision's share repurchase program in 2012 (see Note 19).

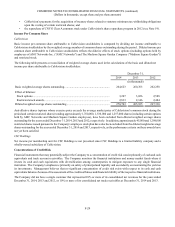

Income Per Common Share

Cablevision

Basic income per common share attributable to Cablevision stockholders is computed by dividing net income attributable to

Cablevision stockholders by the weighted average number of common shares outstanding during the period. Diluted income per

common share attributable to Cablevision stockholders reflects the dilutive effects of stock options (including options held by

employees of AMC Networks Inc. ("AMC Networks") and The Madison Square Garden Company ("Madison Square Garden"))

and restricted stock.

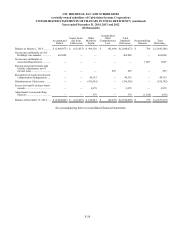

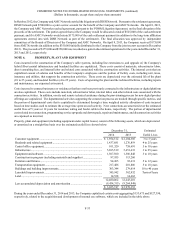

The following table presents a reconciliation of weighted average shares used in the calculations of the basic and diluted net

income per share attributable to Cablevision stockholders:

December 31,

2014 2013 2012

(in thousands)

Basic weighted average shares outstanding ............................................................... 264,623 260,763 262,258

Effect of dilution:

Stock options............................................................................................................ 3,247 3,026 2,588

Restricted stock awards............................................................................................ 2,833 2,146 2,484

Diluted weighted average shares outstanding............................................................ 270,703 265,935 267,330

Anti-dilutive shares (options whose exercise price exceeds the average market price of Cablevision's common stock during the

period and certain restricted shares) totaling approximately 1,760,000, 1,336,000 and 1,257,000 shares (including certain options

held by AMC Networks and Madison Square Garden employees), have been excluded from diluted weighted average shares

outstanding for the years ended December 31, 2014, 2013 and 2012, respectively. In addition, approximately 45,000 and 1,298,000

restricted shares issued pursuant to the Company's employee stock plan have also been excluded from the diluted weighted average

shares outstanding for the year ended December 31, 2014 and 2013, respectively, as the performance criteria on these awards have

not yet been satisfied.

CSC Holdings

Net income per membership unit for CSC Holdings is not presented since CSC Holdings is a limited liability company and a

wholly-owned subsidiary of Cablevision.

Concentrations of Credit Risk

Financial instruments that may potentially subject the Company to a concentration of credit risk consist primarily of cash and cash

equivalents and trade account receivables. The Company monitors the financial institutions and money market funds where it

invests its cash and cash equivalents with diversification among counterparties to mitigate exposure to any single financial

institution. The Company's emphasis is primarily on safety of principal and liquidity and secondarily on maximizing the yield on

its investments. Management believes that no significant concentration of credit risk exists with respect to its cash and cash

equivalents balances because of its assessment of the creditworthiness and financial viability of the respective financial institutions.

The Company did not have a single customer that represented 10% or more of its consolidated net revenues for the years ended

December 31, 2014, 2013 and 2012, or 10% or more of its consolidated net trade receivables at December 31, 2014 and 2013.