Cablevision 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-38

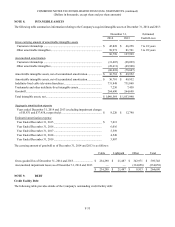

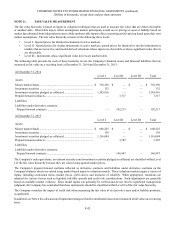

Senior Notes and Debentures

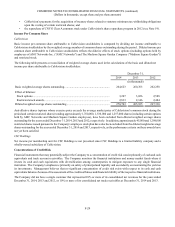

The following table summarizes the Company's senior notes and debentures:

Date Maturity Interest Issue Carrying Amount at

December 31,

Issuer Issued Date Rate Amount 2014 2013

CSC Holdings (a)(c) ... February 6, 1998 February 15, 2018 7.875% 300,000 $ 299,464 $ 299,293

CSC Holdings (a)(c) ... July 21, 1998 July 15, 2018 7.625% 500,000 499,912 499,887

CSC Holdings (b)(c)... February 12, 2009 February 15, 2019 8.625% 526,000 512,750 510,223

CSC Holdings (b) ....... November 15, 2011 November 15, 2021 6.750% 1,000,000 1,000,000 1,000,000

CSC Holdings (b) ....... May 23, 2014 June 1, 2024 5.250% 750,000 750,000 —

3,062,126 2,309,403

Cablevision (b)(c)....... September 23, 2009 September 15, 2017 8.625% 900,000 894,717 893,057

Cablevision (b)............ April 15, 2010 April 15, 2018 7.750% 750,000 750,000 750,000

Cablevision (b)............ April 15, 2010 April 15, 2020 8.000% 500,000 500,000 500,000

Cablevision (b)............ September 27, 2012 September 15, 2022 5.875% 750,000 649,024 686,055

$ 5,855,867 $ 5,138,515

(a) The debentures are not redeemable by the Company prior to maturity.

(b) The Company may redeem some or all of the notes at any time at a specified "make-whole" price plus accrued and unpaid

interest to the redemption date.

(c) The carrying amount of the senior notes is net of the unamortized original issue discount.

The table above also excludes the principal amount of Cablevision 7.75% senior notes due 2018 of $345,238 and the principal

amount of Cablevision 8.00% senior notes due 2020 of $266,217 held by Newsday at December 31, 2014 and 2013 which are

eliminated in the consolidated balance sheets of Cablevision.

The indentures under which the senior notes and debentures were issued contain various covenants, which are generally less

restrictive than those contained in the credit agreement of the issuer. The Company was in compliance with all of its financial

covenants under these indentures as of December 31, 2014.

Issuance of Debt Securities

CSC Holdings 5.25% Senior Notes Due 2024

In May 2014, CSC Holdings issued $750,000 aggregate principal amount of 5.25% senior notes due June 1, 2024 (the "2024

Notes"). The 2024 Notes are senior unsecured obligations and rank equally in right of payment with all of CSC Holdings' other

existing and future unsecured and unsubordinated indebtedness. CSC Holdings may redeem all or a portion of the 2024 Notes at

any time at a price equal to 100% of the principal amount of the 2024 Notes redeemed plus accrued and unpaid interest to the

redemption date plus a "make whole" premium. CSC Holdings used the net proceeds from the issuance of the 2024 Notes, as well

as cash on hand, to make a $750,000 repayment on its outstanding Term B loan facility. In connection with the issuance of the

2024 Notes, the Company incurred deferred financing costs of approximately $14,273, which are being amortized to interest

expense over the term of the 2024 Notes.

Cablevision 5.875% Senior Notes Due 2022

In September 2012, Cablevision issued $750,000 aggregate principal amount of 5.875% senior notes due September 15, 2022 (the

"2022 Notes") in a registered public offering. The 2022 Notes are senior unsecured obligations and rank equally in right of payment

with all of Cablevision's other existing and future unsecured and unsubordinated indebtedness. Cablevision may redeem all or a

portion of the 2022 Notes at any time at a price equal to 100% of the principal amount of the 2022 Notes redeemed plus accrued

and unpaid interest to the redemption date plus a "make whole" premium. Cablevision contributed the net proceeds of approximately

$735,000 from the issuance of the 2022 Notes to CSC Holdings, and CSC Holdings used those proceeds to (i) repurchase a portion