Cablevision 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-35

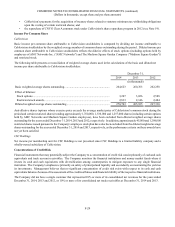

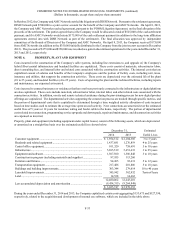

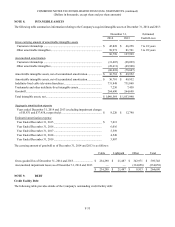

NOTE 8. INTANGIBLE ASSETS

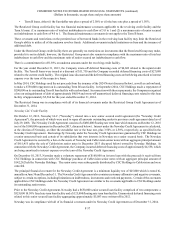

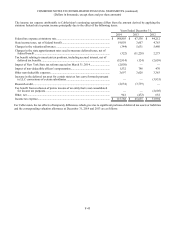

The following table summarizes information relating to the Company's acquired intangible assets at December 31, 2014 and 2013:

December 31, Estimated

2014 2013 Useful Lives

Gross carrying amount of amortizable intangible assets

Customer relationships ................................................................................. $ 45,828 $ 46,258 7 to 18 years

Other amortizable intangibles....................................................................... 50,971 81,741 3 to 28 years

96,799 127,999

Accumulated amortization

Customer relationships ................................................................................. (31,407)(28,099)

Other amortizable intangibles....................................................................... (28,611)(49,948)

(60,018)(78,047)

Amortizable intangible assets, net of accumulated amortization.................... $ 36,781 $ 49,952

Amortizable intangible assets, net of accumulated amortization.................... $ 36,781 $ 49,952

Indefinite-lived cable television franchises..................................................... 731,848 731,848

Trademarks and other indefinite-lived intangible assets................................. 7,250 7,450

Goodwill.......................................................................................................... 264,690 264,690

Total intangible assets, net.............................................................................. $ 1,040,569 $ 1,053,940

Aggregate amortization expense

Years ended December 31, 2014 and 2013 (excluding impairment charges

of $5,831 and $37,458, respectively)........................................................ $ 8,220 $ 12,790

Estimated amortization expense

Year Ended December 31, 2015................................................................... $ 7,013

Year Ended December 31, 2016................................................................... 6,016

Year Ended December 31, 2017................................................................... 5,559

Year Ended December 31, 2018................................................................... 4,549

Year Ended December 31, 2019................................................................... 3,907

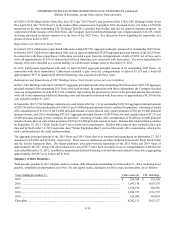

The carrying amount of goodwill as of December 31, 2014 and 2013 is as follows:

Cable Lightpath Other Total

Gross goodwill as of December 31, 2014 and 2013........................... $ 234,290 $ 21,487 $ 342,971 $ 598,748

Accumulated impairment losses as of December 31, 2014 and 2013 — — (334,058)(334,058)

$ 234,290 $ 21,487 $ 8,913 $ 264,690

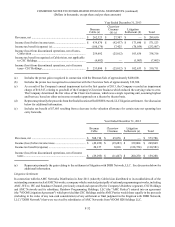

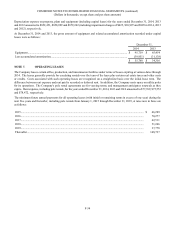

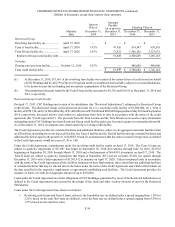

NOTE 9. DEBT

Credit Facility Debt

The following table provides details of the Company's outstanding credit facility debt: