Cablevision 2014 Annual Report Download - page 112

Download and view the complete annual report

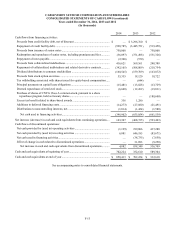

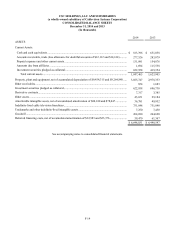

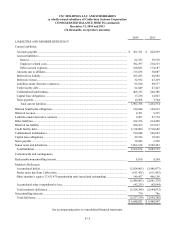

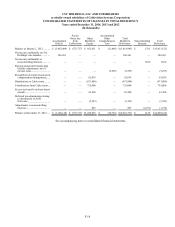

Please find page 112 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

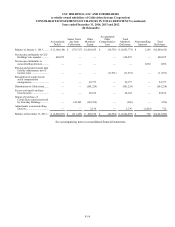

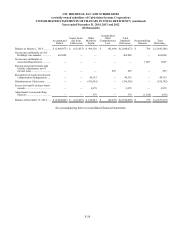

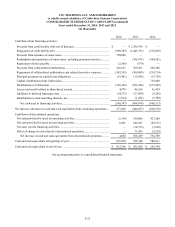

(Dollars in thousands, except per share amounts)

F-23

NOTE 1. DESCRIPTION OF BUSINESS, RELATED MATTERS AND BASIS OF PRESENTATION

The Company and Related Matters

Cablevision Systems Corporation ("Cablevision"), through its wholly-owned subsidiary CSC Holdings, LLC ("CSC Holdings,"

and collectively with Cablevision, the "Company"), owns and operates cable systems and owns companies that provide regional

news, local programming and advertising sales services for the cable television industry, provide Ethernet-based data, Internet,

voice and video transport and managed services to the business market, and operate a newspaper publishing business. The Company

classifies its operations into three reportable segments: (1) Cable, consisting principally of its video, high-speed data, and Voice

over Internet Protocol ("VoIP") operations, (2) Lightpath, which provides Ethernet-based data, Internet, voice and video transport

and managed services to the business market in the New York metropolitan area; and (3) Other, consisting principally of (i)

Newsday, which includes the Newsday daily newspaper, amNew York, Star Community Publishing Group, and online websites,

(ii) the News 12 Networks, which provide regional news programming services, (iii) Cablevision Media Sales Corporation

("Cablevision Media Sales"), a cable television advertising company, and (iv) certain other businesses and unallocated corporate

costs.

On June 27, 2013, the Company completed the sale of substantially all of its Clearview Cinemas' theaters ("Clearview Cinemas")

pursuant to the asset purchase agreement entered into in April 2013 (the "Clearview Sale"). On July 1, 2013, the Company

completed the sale of its Bresnan Broadband Holdings, LLC subsidiary ("Bresnan Cable") pursuant to the purchase agreement

entered into in February 2013, for $1,625,000 (the "Bresnan Sale"). The Company received net cash of approximately $675,000,

which reflects certain adjustments, including an approximate $962,000 reduction for certain funded indebtedness of Bresnan Cable,

and transaction costs. The Company recorded a pre-tax gain of approximately $408,000 for the year ended December 31, 2013

relating to the Bresnan Sale. During 2014, the Company recorded a pre-tax gain of $5,848 relating primarily to the settlement of

a contingency related to Montana property taxes associated with Bresnan Cable.

Effective as of the closing dates of the Clearview Sale and the Bresnan Sale, the Company no longer consolidates the financial

results of Clearview Cinemas and Bresnan Cable. Accordingly, the historical financial results of Clearview Cinemas and Bresnan

Cable have been reflected in the Company's consolidated financial statements as discontinued operations for all periods presented.

Basis of Presentation

Principles of Consolidation

The accompanying consolidated financial statements of Cablevision include the accounts of Cablevision and its majority-owned

subsidiaries and the accompanying consolidated financial statements of CSC Holdings include the accounts of CSC Holdings and

its majority-owned subsidiaries. Cablevision has no business operations independent of its CSC Holdings subsidiary, whose

operating results and financial position are consolidated into Cablevision. The consolidated balance sheets and statements of

income of Cablevision are essentially identical to the consolidated balance sheets and statements of income of CSC Holdings,

with the following significant exceptions: Cablevision has $2,793,741 of senior notes outstanding at December 31, 2014 (excluding

the $611,455 aggregate principal amount of Cablevision notes held by its subsidiary Newsday Holdings LLC ("Newsday

Holdings")) that were issued to third party investors, cash, deferred financing costs and accrued interest related to its senior notes,

deferred taxes and accrued dividends on its balance sheet. In addition, CSC Holdings and its subsidiaries have certain intercompany

receivables from and payables to Cablevision. Differences between Cablevision's results of operations and those of CSC Holdings

primarily include incremental interest expense, interest income, the write-off of deferred financing costs, net of gain on

extinguishment of debt, and income tax expense or benefit. CSC Holdings' results of operations include incremental interest

income from the Cablevision senior notes held by Newsday Holdings, which is eliminated in Cablevision's results of operations.

The combined notes to the consolidated financial statements relate to the Company, which, except as noted, are essentially identical

for Cablevision and CSC Holdings. All significant intercompany transactions and balances between Cablevision and CSC Holdings

and their respective consolidated subsidiaries are eliminated in both sets of consolidated financial statements. Intercompany

transactions between Cablevision and CSC Holdings are not eliminated in the CSC Holdings consolidated financial statements,

but are eliminated in the Cablevision consolidated financial statements.