Cablevision 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

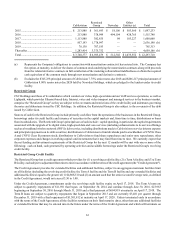

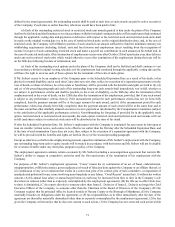

Fair Value of Equity Derivative Contracts

Fair value as of December 31, 2013, net liability position ...................................................................................... $(143,562)

Change in fair value, net .......................................................................................................................................... (45,055)

Settlement of contracts............................................................................................................................................. 93,717

Fair value as of December 31, 2014, net liability position ...................................................................................... $(94,900)

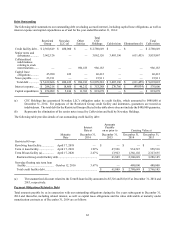

The maturity, number of shares deliverable at the relevant maturity, hedge price per share, and the lowest and highest cap prices

received for the Comcast common stock monetized via an equity derivative prepaid forward contract are summarized in the

following table:

Cap Price (b)

Number of Shares Deliverable Maturity Hedge Price per Share (a) Low High

13,407,684 2015 $38.68 - $49.01 $ 49.57 $ 58.81

8,069,934 2016 $48.93 - $53.62 $ 58.72 $ 69.70

(a) Represents the price below which we are provided with downside protection and above which we retain upside

appreciation. Also represents the price used in determining the cash proceeds payable to us at inception of the contracts.

(b) Represents the price up to which we receive the benefit of stock price appreciation.

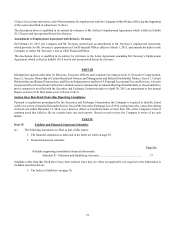

Fair Value of Debt: Based on the level of interest rates prevailing at December 31, 2014, the fair value of our fixed rate debt of

$7,398,747 was more than its carrying value of $6,865,961 by $532,786. The fair value of these financial instruments is estimated

based on reference to quoted market prices for these or comparable securities. Our floating rate borrowings bear interest in reference

to current LIBOR-based market rates and thus their carrying values approximate fair value. The effect of a hypothetical 100 basis

point decrease in interest rates prevailing at December 31, 2014 would increase the estimated fair value of our fixed rate debt by

$298,690 to $7,697,437. This estimate is based on the assumption of an immediate and parallel shift in interest rates across all

maturities.

Item 8. Financial Statements and Supplementary Data.

For information required by Item 8, refer to the Index to Financial Statements on page 83.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

An evaluation was carried out under the supervision and with the participation of Cablevision's management, including our Chief

Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and

procedures (as defined under SEC rules). Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer

concluded that the design and operation of these disclosure controls and procedures were effective as of December 31, 2014.

Management's Annual Report on Internal Control Over Financial Reporting

The Company's management is responsible for establishing and maintaining effective internal control over financial reporting as

defined in Rules 13a-15(f) under the Securities Exchange Act of 1934, as amended. The Company's internal control over financial

reporting is a process designed under the supervision of the Company's Chief Executive Officer and Chief Financial Officer to

provide reasonable assurance to the Company's management and Board of Directors regarding the reliability of financial reporting

and the preparation of the Company's external financial statements, including estimates and judgments, in accordance with

accounting principles generally accepted in the United States of America.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore,

even those internal controls determined to be effective can provide only reasonable assurance with respect to financial statement

preparation and presentation. Also, the evaluation of the effectiveness of internal control over financial reporting was made as of