Cablevision 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-43

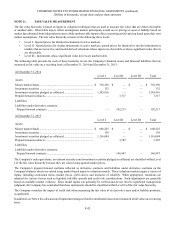

Fair Value of Financial Instruments

The following methods and assumptions were used to estimate fair value of each class of financial instruments for which it is

practicable to estimate:

Credit Facility Debt, Collateralized Indebtedness, Senior Notes and Debentures and Notes Payable

The fair values of each of the Company's debt instruments are based on quoted market prices for the same or similar issues or on

the current rates offered to the Company for instruments of the same remaining maturities. The fair value of notes payable is based

primarily on the present value of the remaining payments discounted at the borrowing cost.

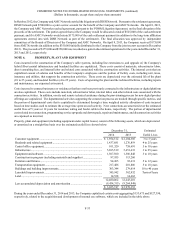

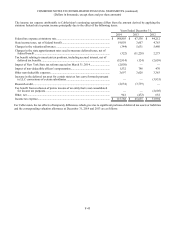

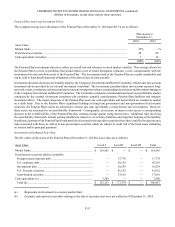

The carrying values, estimated fair values, and classification under the fair value hierarchy of the Company's financial instruments,

excluding those that are carried at fair value in the accompanying consolidated balance sheets, are summarized as follows:

December 31, 2014

Fair Value

Hierarchy Carrying

Amount Estimated

Fair Value

CSC Holdings notes receivable:

Cablevision senior notes held by Newsday Holdings (a)............................. Level II $ 611,455 $ 680,587

Debt instruments:

Credit facility debt (b) .................................................................................. Level II $ 2,780,649 $ 2,785,975

Collateralized indebtedness........................................................................... Level II 986,183 957,803

Senior notes and debentures.......................................................................... Level II 3,062,126 3,368,875

Notes payable................................................................................................ Level II 23,911 23,682

CSC Holdings total debt instruments .............................................................. 6,852,869 7,136,335

Cablevision senior notes ............................................................................... Level II 2,793,741 3,048,387

Cablevision total debt instruments .................................................................. $ 9,646,610 $ 10,184,722

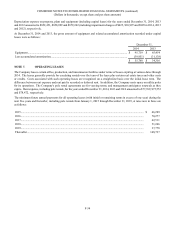

December 31, 2013

Fair Value

Hierarchy Carrying

Amount Estimated

Fair Value

CSC Holdings notes receivable:

Cablevision senior notes held by Newsday Holdings (a)............................. Level II $ 611,455 $ 682,887

Debt instruments:

Credit facility debt (b) .................................................................................. Level II $ 3,766,145 $ 3,776,760

Collateralized indebtedness........................................................................... Level II 817,950 809,105

Senior notes and debentures.......................................................................... Level II 2,309,403 2,608,885

Notes payable................................................................................................ Level II 5,334 5,334

CSC Holdings total debt instruments .............................................................. 6,898,832 7,200,084

Cablevision senior notes ............................................................................... Level II 2,829,112 3,101,373

Cablevision total debt instruments .................................................................. $ 9,727,944 $ 10,301,457

(a) These notes are eliminated at the consolidated Cablevision level.

(b) The principal amount of the Company's credit facility debt, which bears interest at variable rates, approximates its fair

value.

Fair value estimates related to the Company's debt instruments and senior notes receivable presented above are made at a specific

point in time, based on relevant market information and information about the financial instrument. These estimates are subjective

in nature and involve uncertainties and matters of significant judgments and therefore cannot be determined with precision. Changes

in assumptions could significantly affect the estimates.