Cablevision 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

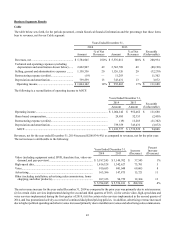

Business Segments Results

Cable

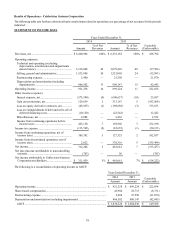

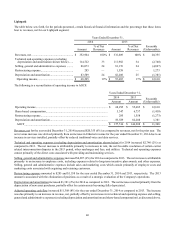

The table below sets forth, for the periods presented, certain historical financial information and the percentage that those items

bear to revenues, net for our Cable segment:

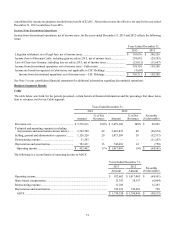

Years Ended December 31,

2014 2013

Amount % of Net

Revenues Amount % of Net

Revenues Favorable

(Unfavorable)

Revenues, net .......................................................... $ 5,784,945 100% $ 5,576,011 100% $ 208,934

Technical and operating expenses (excluding

depreciation and amortization shown below)...... 2,822,907 49 2,742,709 49 (80,198)

Selling, general and administrative expenses ......... 1,158,356 20 1,126,126 20 (32,230)

Restructuring expense (credits)............................... (19) — 11,283 — 11,302

Depreciation and amortization................................ 739,559 13 743,431 13 3,872

Operating income.................................................. $ 1,064,142 18% $ 952,462 17% $ 111,680

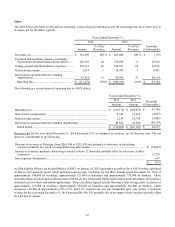

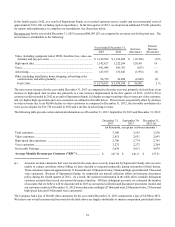

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2014 2013 Favorable

(Unfavorable)

Amount Amount

Operating income.................................................................................................... $ 1,064,142 $ 952,462 $ 111,680

Share-based compensation...................................................................................... 29,895 32,353 (2,458)

Restructuring expense (credits)............................................................................... (19) 11,283 (11,302)

Depreciation and amortization................................................................................ 739,559 743,431 (3,872)

AOCF.................................................................................................................... $ 1,833,577 $ 1,739,529 $ 94,048

Revenues, net for the year ended December 31, 2014 increased $208,934 (4%) as compared to revenues, net for the prior year.

The net increase is attributable to the following:

Years Ended December 31, Increase

(Decrease)

Percent

Increase

(Decrease)

2014 2013

Video (including equipment rental, DVR, franchise fees, video-on-

demand, and pay-per-view) ............................................................ $ 3,187,245 $ 3,149,702 $ 37,543 1%

High-speed data.................................................................................. 1,416,328 1,342,627 73,701 5

Voice................................................................................................... 910,653 841,048 69,605 8

Advertising......................................................................................... 163,596 147,875 15,721 11

Other (including installation, advertising sales commissions, home

shopping, and other products)......................................................... 107,123 94,759 12,364 13

$ 5,784,945 $ 5,576,011 $ 208,934 4%

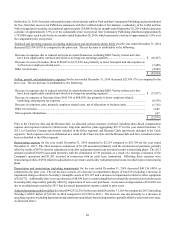

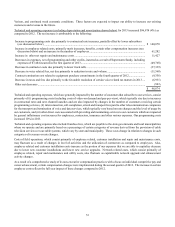

The net revenue increase for the year ended December 31, 2014 as compared to the prior year was primarily due to rate increases:

(i) for certain video services implemented during the second and third quarters of 2013, (ii) for certain video, high-speed data and

voice services implemented during the first quarter of 2014, (iii) for certain video services implemented in the second quarter of

2014, and less promotional activity as a result of continued disciplined pricing policies. In addition, advertising revenue increased

due to higher political spending and other revenue increased primarily due to installation revenue and advertising sales commissions.