Cablevision 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-51

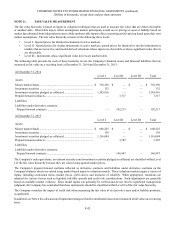

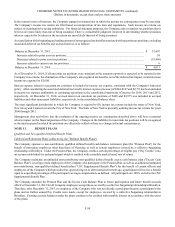

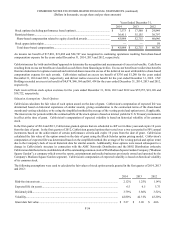

Plan Results for Defined Benefit Plans

Summarized below is the funded status and the amounts recorded on the Company's consolidated balance sheets for all of the

Company's Defined Benefit Plans at December 31, 2014 and 2013:

December 31,

2014 2013

Change in projected benefit obligation:

Projected benefit obligation at beginning of year ............................................................................ $ 433,916 $ 392,312

Service cost ...................................................................................................................................... 774 45,346

Interest cost ...................................................................................................................................... 18,040 14,128

Actuarial loss.................................................................................................................................... 9,006 5,282

Transfer of liabilities........................................................................................................................ — (208)

Benefits paid..................................................................................................................................... (30,890)(22,944)

Projected benefit obligation at end of year.................................................................................. 430,846 433,916

Change in plan assets:

Fair value of plan assets at beginning of year.................................................................................. 268,610 290,836

Actual return (loss) on plan assets, net............................................................................................. 11,687 (8,694)

Employer contributions.................................................................................................................... 54,269 9,620

Transfer of assets.............................................................................................................................. — (208)

Benefits paid..................................................................................................................................... (30,890)(22,944)

Fair value of plan assets at end of year........................................................................................ 303,676 268,610

Unfunded status at end of year ........................................................................................................... $ (127,170) $ (165,306)

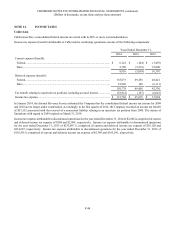

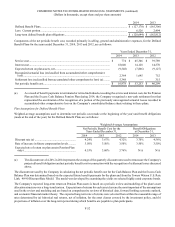

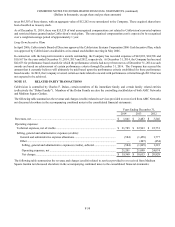

Other changes in plan assets and benefit obligations recorded in accumulated other comprehensive loss for the years ended

December 31, 2014 and 2013 are as follows:

Defined Benefit Plans

Changes in plan assets and benefit obligations, before taxes: 2014 2013 2012

Unrecognized actuarial loss.................................................................................................. $ 6,866 $21,842 $16,732

Tax expense (benefit)............................................................................................................ (2,815)(8,984)(6,848)

4,051 12,858 9,884

Amortization of actuarial losses, net included in net periodic benefit cost.......................... (2,364)(1,645)(1,067)

Tax expense (benefit)............................................................................................................ 969 677 437

(1,395)(968)(630)

Settlement loss included in net periodic benefit cost............................................................ (5,348) — —

Tax expense (benefit)............................................................................................................ 2,193 — —

(3,155) — —

Changes in plan assets and benefit obligations, net of taxes ...................................................... $(499) $11,890 $ 9,254

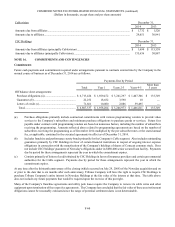

The accumulated benefit obligation for the Company's Defined Benefit Plans aggregated $430,846 and $433,916 at December 31,

2014 and 2013, respectively.

Approximately $2,239 of unrecognized actuarial losses recorded in accumulated other comprehensive loss is expected to be

recognized as a component of net periodic benefit cost during 2015 relating to the Defined Benefit Plans.

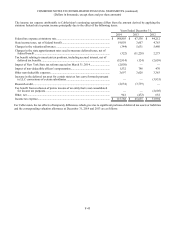

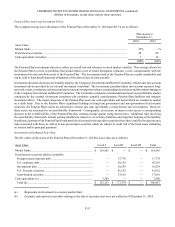

The Company's net funded status relating to its defined benefit plans at December 31, 2014 and 2013 are as follows: